“`html

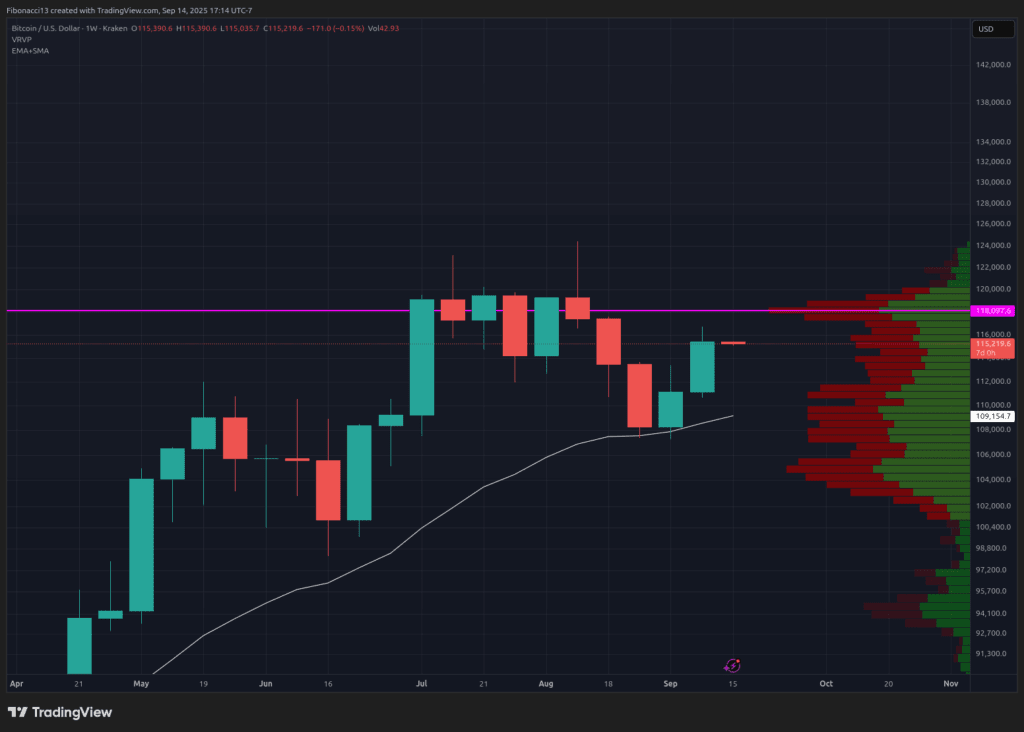

The Bitcoin Value concluded the previous week at $115,390, momentarily surpassing the $115,500 resistance point as it transitioned into the weekend, only to retract and finish the week just beneath it. A robust green candle was produced last week for the bulls, sustaining upward momentum into this week. On Wednesday morning of last week, the U.S. Producer Price Index was reported significantly lower than anticipated, instilling optimism in market bulls regarding the forthcoming rate cut decision by the Federal Reserve. However, the U.S. inflation data released the subsequent morning was tepid, recording at 2.9%, in line with expectations but exceeding the prior month’s figure of 2.7%. The Federal Reserve will have significant tasks at hand this week during Wednesday’s FOMC Meeting, where it needs to deliberate over the pros and cons of implementing a cut. The market is fully anticipating a 0.25% interest rate reduction (as observed in Polymarket), so any delay by the Fed is likely to induce a market correction.

Current Support and Resistance Levels

As we enter this week, the $115,500 mark represents the next resistance bitcoin aims to surpass. However, $118,000 will present a hurdle beyond this point. Should bitcoin experience another vigorous week, it’s feasible that the price exceeds the $118,000 threshold during the week only to close below it on Sunday. We should anticipate strong selling pressure there, compelling bulls to relinquish some ground.

In the event bitcoin shows any signs of weakness this week, or if it faces rejection at the $118,000 level, we should look towards the $113,800 mark for immediate support. Below that, we have weekly support positioned at $111,000. Closing beneath this point would likely put the $107,000 low under pressure.

Forecast for This Week

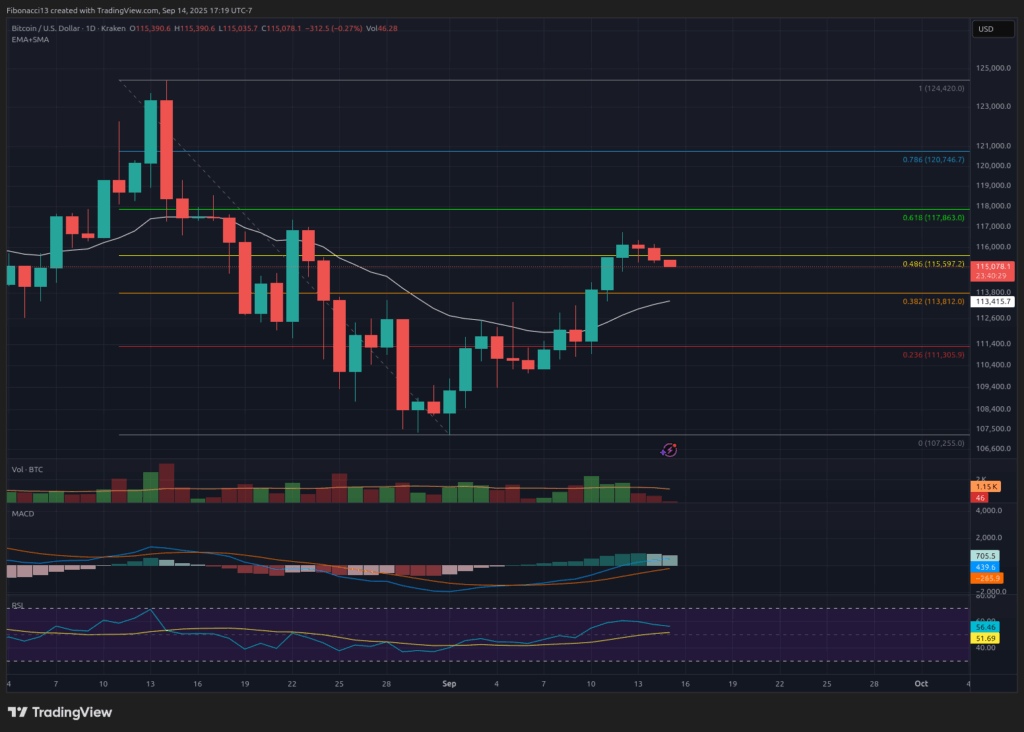

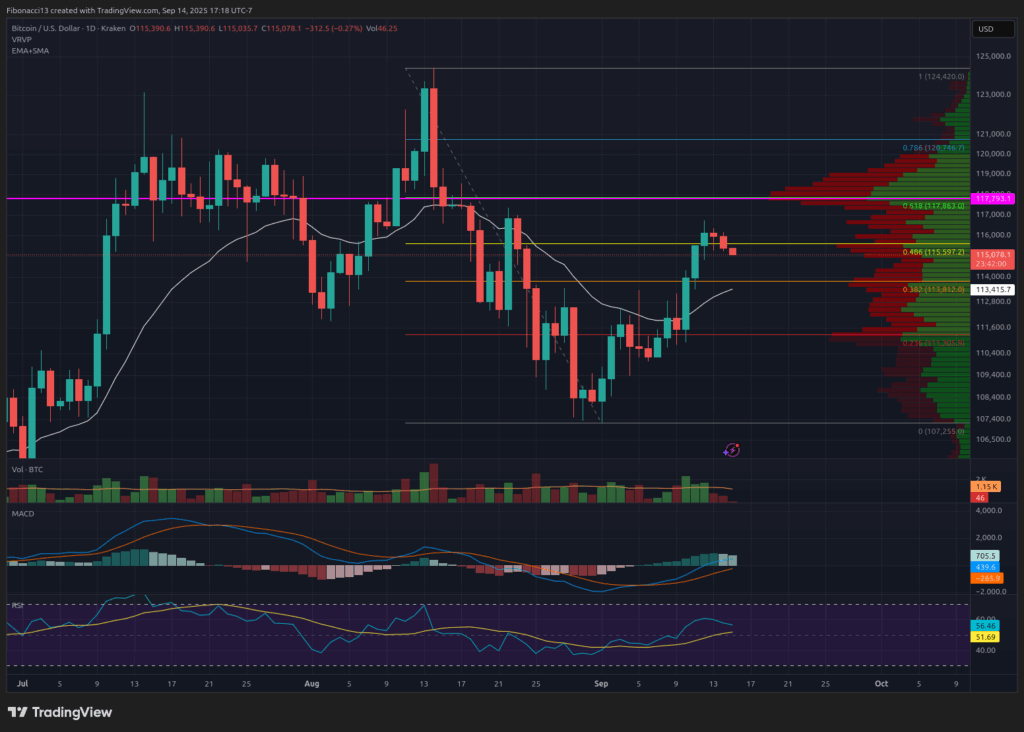

Focusing on the daily chart, the bias appears slightly bearish as of Sunday’s close, following a rejection from $116,700 last Friday. However, this could swiftly transition to a bullish sentiment if US stock market activity resumes its upward trend this Monday. The MACD is currently striving to maintain its position above the zero line and re-establish it as support for bullish momentum to continue. In the meantime, the RSI is declining yet remains in a favorable position. It will look towards the 13 SMA for support if selling accelerates into Tuesday.

All attention will be directed towards Chairman Powell and the Federal Reserve on Wednesday as he delivers a speech at 2:30 PM Eastern. Anything other than a 0.25% rate cut announcement at 2:00 PM is likely to trigger significant market fluctuations that would certainly affect bitcoin.

Market sentiment: Bullish, following two consecutive green weekly candles — anticipating the $118,000 level to be tested this week.

The Upcoming Weeks

Maintaining momentum above $118,000 will be crucial in the upcoming weeks if bitcoin can overcome this imminent obstacle shortly. I would anticipate bitcoin to advance into the $130,000s if it can re-establish $118,000 as support once more.

If the Fed decides to lower rates this week, the market will then anticipate October for another interest rate reduction. Thus, supportive market data and ongoing cuts will be vital to bitcoin’s price trajectory going forward, facilitating a bullish continuation to new heights.

Conversely, any substantial bearish developments, or the Fed surprising everyone with a decision not to cut on Wednesday, will undoubtedly push the bitcoin price back down to re-evaluate support levels.

Glossary:

Bulls/Bullish: Investors or purchasers anticipating an increase in price.

Bears/Bearish:Sell-side participants or investors expecting a decline in price.

Support or support level: A threshold at which the asset’s price is expected to hold, at least initially. The more times it touches support, the weaker it becomes, increasing the chances of a breakdown.

Resistance or resistance level: The antithesis of support. This threshold likely hinders the price from advancing, at least initially. An increased number of touches at resistance diminishes its strength and raises the probability of failure to contain the price.

SMA: Simple Moving Average. The average price calculated from closing prices over a designated time frame. In the context of RSI, it denotes the mean strength index value across the specified period.

Oscillators: Technical indicators that fluctuate over time but generally remain confined within a band formed by established levels. Consequently, they alternate between a low level (typically depicting oversold conditions) and a high level (usually indicating overbought conditions). Examples include the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD).

MACD Oscillator: Moving Average Convergence-Divergence serves as a momentum oscillator that calculates the difference between two moving averages to signify both trend and momentum.

RSI Oscillator: The Relative Strength Index is a momentum oscillator ranging between 0 and 100. It gauges the velocity of price changes and variations in that speed. When the RSI surpasses 70, it indicates overbought conditions. Conversely, when it falls below 30, it signifies oversold conditions.

Source link

“`