“`html

One of the prevalent stories this period is that “this time is distinct.” With institutional incorporation altering Bitcoin’s supply and demand relationships, many contend that we won’t witness the euphoric blowoff peaks that characterized earlier cycles. Instead, the concept suggests that informed investors and ETFs will mitigate volatility, substituting frenzy with sophistication. But is this truly the scenario?

Market Emotion Influences, Even for Institutions

Cynics frequently overlook instruments like the Fear and Greed Index as overly basic, asserting that they fail to encapsulate the intricacies of institutional movements. However, dismissing sentiment disregards a fundamental reality: institutions are still operated by humans, and humans remain susceptible to the same cognitive and emotional inclinations that influence market cycles, irrespective of the breadth of their wealth!

Although volatility has lessened in comparison to previous cycles, the ascent from $15,000 to above $120,000 is hardly unremarkable. Moreover, Bitcoin has attained this without the severe, prolonged drawdowns that characterized earlier bull runs. The ETF surge and corporate treasury accumulation have altered supply dynamics, yet the fundamental feedback loop of greed, fear, and speculation remains undisturbed.

Market Bubbles Are an Enduring Truth

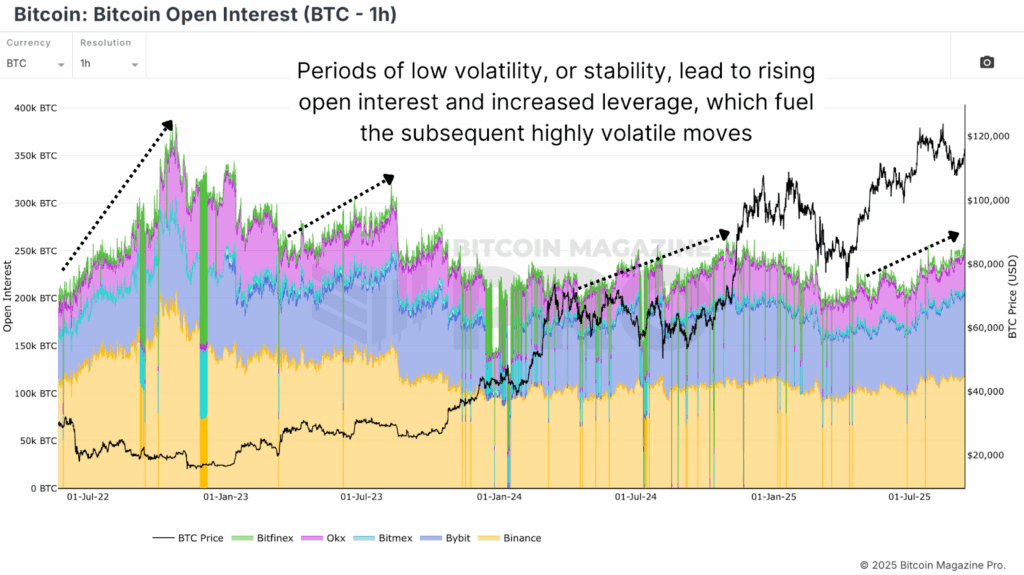

It’s not solely Bitcoin that is vulnerable to exponential surges; bubbles have been inherent in markets for centuries. Asset values have repeatedly soared beyond fundamental values, driven by human actions. Research consistently indicates that stability can often give rise to instability, and that tranquil times foster leverage, speculation, and ultimately runaway price movements. Bitcoin has mirrored this pattern. Phases of low volatility witness a rise in Open Interest, leverage accumulation, and an increase in speculative wagers.

In contrast to the notion that “sophisticated” traders are invulnerable, studies from the London School of Economics suggest the contrary. Professional capital can intensify bubbles by entering late, pursuing momentum, and magnifying movements. The 2008 real estate collapse and the dot-com crash were not fueled by retail, but rather by institutional forces.

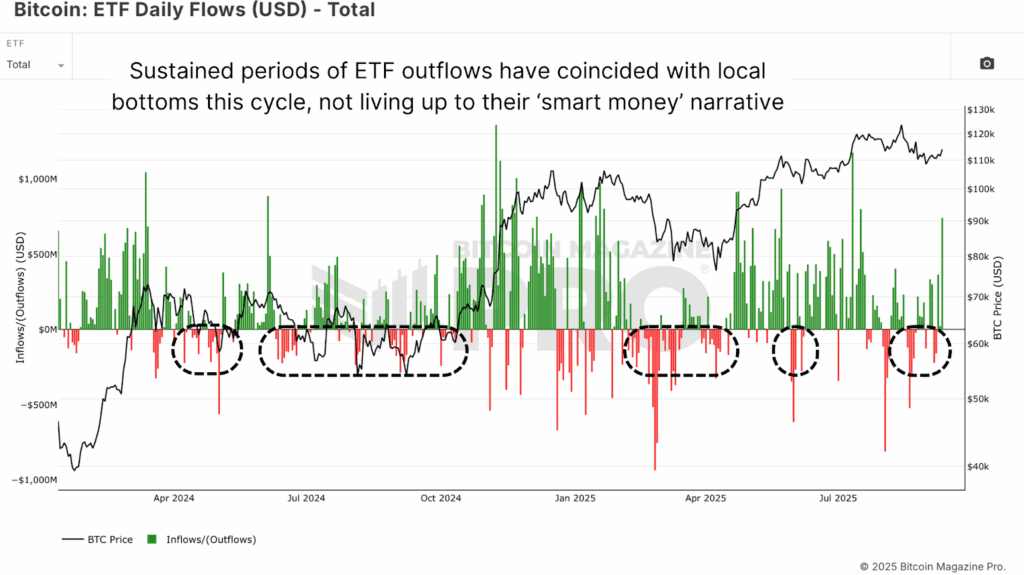

ETF flows in this period present another compelling instance. Phases of net withdrawals from spot ETFs have indeed correlated with local market bottoms. Rather than perfectly timing the cycle, these flows indicate that “smart money” is equally susceptible to herd mentality and trend-driven investments as retail participants.

Capital Movements Might Spark Bitcoin’s Next Surge

Meanwhile, an examination of global markets reveals how capital shifts could trigger another exponential phase. Since January 2024, Gold’s market capitalization has increased by over $10 trillion, escalating from $14T to $24T. For Bitcoin,

“““html

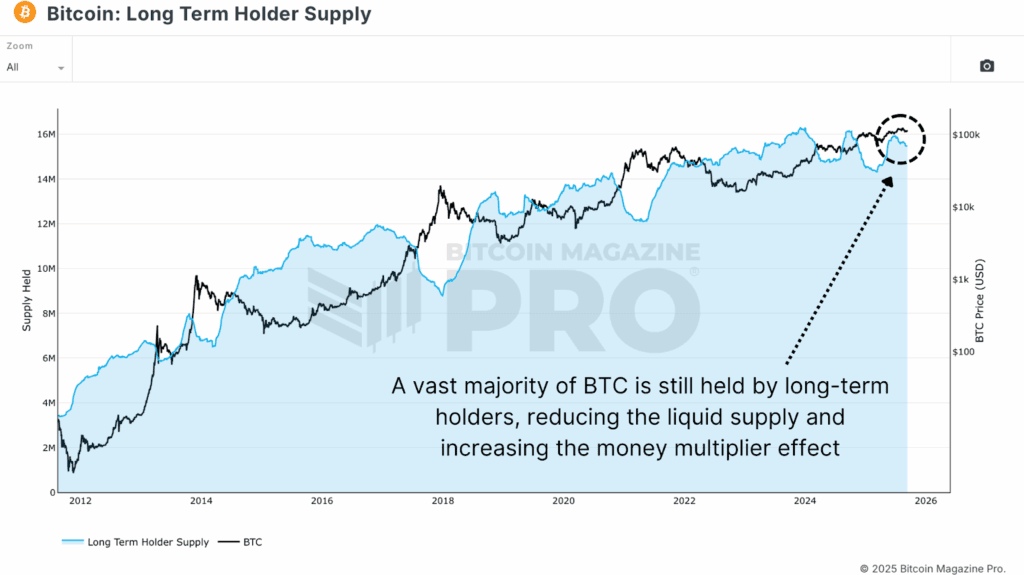

With a present market capitalization nearing $2 trillion, even a small portion of such an influx could yield a disproportionate impact due to the money multiplier effect. With approximately 77% of BTC owned by long-term investors, merely around 20–25% of the supply is instantly available, leading to a cautious money multiplier of 4x. This signifies that new influxes of $500 billion, merely 5% of gold’s recent growth, could convert into a $2 trillion upsurge in Bitcoin’s market valuation, suggesting prices significantly beyond $220,000.

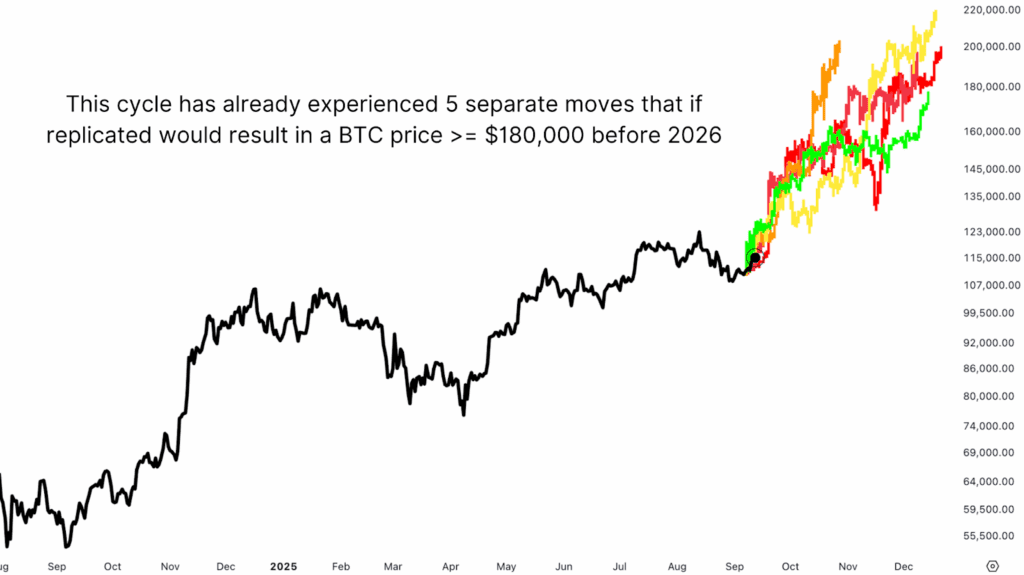

Perhaps the most compelling argument for a blowoff peak is that we’ve already witnessed parabolic surges in this particular cycle. Following the low of 2022, Bitcoin has executed several rallies of 60–100%+ in less than 100 days. Overlaying these fractals onto the current price activity provides plausible projections for how price might hit $180,000–$220,000 before the year’s end.

Bitcoin’s Parabolic Potential Remains Strong

The notion that institutional engagement has eradicated parabolic blowoff peaks undervalues both Bitcoin’s framework and human psychology. Bubbles aren’t simply the result of retail speculation; they are a consistent characteristic of markets throughout history, often expedited by intelligent capital.

This does not imply certainty, as markets do not operate in such a manner. However, disregarding the likelihood of a parabolic peak overlooks centuries of market activity and the distinct supply-demand dynamics that render Bitcoin one of the most reactive assets in existence. If anything, “this time is distinct” could just suggest that the rally might be larger, more rapid, and more intense than anticipated.

For more extensive data, visuals, and expert perspectives on bitcoin price trends, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for additional expert market insights and evaluations!

Disclaimer: This article serves informational purposes solely and should not be construed as financial guidance. Always conduct your own research prior to making any investment choices.

Source link

“`