“`html

The Lightning Network stands out as one of the most thrilling and groundbreaking technologies developed on Bitcoin, yet it is also one of the most misinterpreted. From its infancy with grassroots movements like “PLEBNET,” to ambitious concepts of Lightning Applications (LApps), and the notion of generating passive income as a routing node operator, excitement surrounding Lightning often surpasses its tangible realities.

Numerous Bitcoin enthusiasts anticipated Lightning to be a smooth, plug-and-play addition to the Bitcoin network — just as sovereign, decentralized, and accessible as running a complete Bitcoin node. However, the truth is more intricate. Establishing and sustaining a well-connected Lightning node demands technical expertise and financial resources that most users are not equipped to handle. This isn’t a setback: It’s merely a reflection of Lightning’s architecture.

Consequently, many users have opted for custodial options to tap into the advantages of Lightning. Custodial wallets and neobanks such as Strike, Blink, Wallet of Satoshi, Cash App, and others provide functionalities like Lightning URLs, immediate low-cost transactions, and the type of reliability and user experience one expects from full-featured, banking-style applications. For some, this dependence on custodians seems like a trade-off, and in some ways, it indeed is. But more crucially, it highlights something often disregarded: Operating Lightning infrastructure isn’t intended for everyone.

Here’s the contentious aspect: That’s entirely acceptable.

Critics of Lightning, both within the Bitcoin community and among altcoin advocates, frequently present these compromises as evidence that Lightning has faltered, implying it ought to be substituted with something altogether different. However, that perspective is misguided. Instead of perceiving these constraints as critical deficiencies, it’s significantly more accurate and constructive to recognize the Lightning Network for what it genuinely represents: enterprise-grade infrastructure.

Within this context, “enterprise-grade” denotes robust, scalable, and reliable enough to facilitate real-time, low-cost payments for mission-critical services. It’s not something every casual user will operate themselves. Lightning is designed for professional participants — Bitcoin exchanges, payment processors, wallet developers, and technically adept community initiatives. For them, Lightning is not a drawback; it represents a competitive edge.

Furthermore, the Lightning Network acts as a complement to Bitcoin in numerous vital ways and is becoming more interoperable with adjacent technologies such as ecash mints and other layer-2 solutions. It operates as a global, open-source, and permissionless financial infrastructure that any serious operator, anywhere in the world, can utilize. Essentially, the Lightning Network is maturing into the interoperable glue linking external systems to the Bitcoin blockchain.

Not everyone will operate a Lightning node, and that’s fine. This truth does not lessen Lightning’s importance in Bitcoin’s scaling blueprint. On the contrary, Lightning serves as a foundational layer that enables an extensive range of tools and services. Rather than acting as a centralizing force, it actually promotes decentralization by opening up pathways for permissionless payments across the globe, fostering new types of economic participants that were previously inconceivable.

An excellent illustration of this is the Kenyan Bitcoin payments application Tando. This app empowers users to spend bitcoin at any merchant or service that accepts M-PESA utilizing the Lightning Network.

M-PESA is a mobile monetary platform inaugurated by Safaricom in Kenya, enabling users to send, receive, and hold money via smartphones without needing a conventional bank account. As of 2024, it caters to over 34 million users in Kenya, processes upwards of 30 billion transactions annually, and constitutes nearly 60% of the nation’s GDP.

Thanks to Lightning, Tando’s developers can create a fluid, programmatic payment experience that directly interconnects with the M-PESA system, significantly enhancing liquidity access for Bitcoin users in Kenya. Because virtually everyone in Kenya accepts M-PESA, now with Tando, anyone can use bitcoin anywhere in Kenya — even in the Maasai Mara.

Absent Lightning, on-chain Bitcoin payments would merely be too sluggish to provide a practical experience for daily M-PESA transactions. Transaction confirmation durations on-chain are not conducive to immediate payments, especially in rapid retail environments. However, by establishing a Lightning payment gateway that connects directly to M-PESA wallets, Tando has revolutionized the payment landscape for Bitcoin users in Kenya. Tando exemplifies that Lightning unlocks real-life applications for developers without the need to seek permission to create. The fact that Lightning enables this is remarkable.

Another outstanding example of the advantage Lightning provides businesses can be illustrated by comparing two global neobanks: PayPal and Strike.

PayPal, the original internet payment platform, debuted in 1998 and took over 17 years to expand to more than 200 nations. In contrast, Strike, a significantly more niche application built on Lightning and launched in 2020, has already rolled out to over 100 countries in just five years, reaching markets across Africa, Latin America, Europe, and the Asia-Pacific. Strike’s global footprint not only rivals PayPal’s in size but also vastly surpasses it in speed and convenience, underscoring the unique benefits of operating on modern, borderless infrastructure like the Lightning Network.

Strike CEO Jack Mallers and his team primarily circumvented direct collaborations with banks, opting instead to partner with Bitcoin exchanges worldwide that already had established local banking connections in the markets they serve. These collaborators utilize the Lightning Network to transmit value instantly across borders. When a user wishes to convert their Strike app balance into local currency, the partner facilitates the exchange on the back end. This approach enabled Strike to launch a global payments service propelled by universally accepted, instantaneous Lightning payments faster than ever.

Strike utilized Bitcoin and Lightning’s unrestricted capabilities to establish a genuinely global network, fusing this technical advantage with robust business development to secure fiat conversion alliances. While traditional entities continue to be constrained by conventional banking frameworks, Strike leverages Lightning to rapidly transfer value anywhere on Earth.

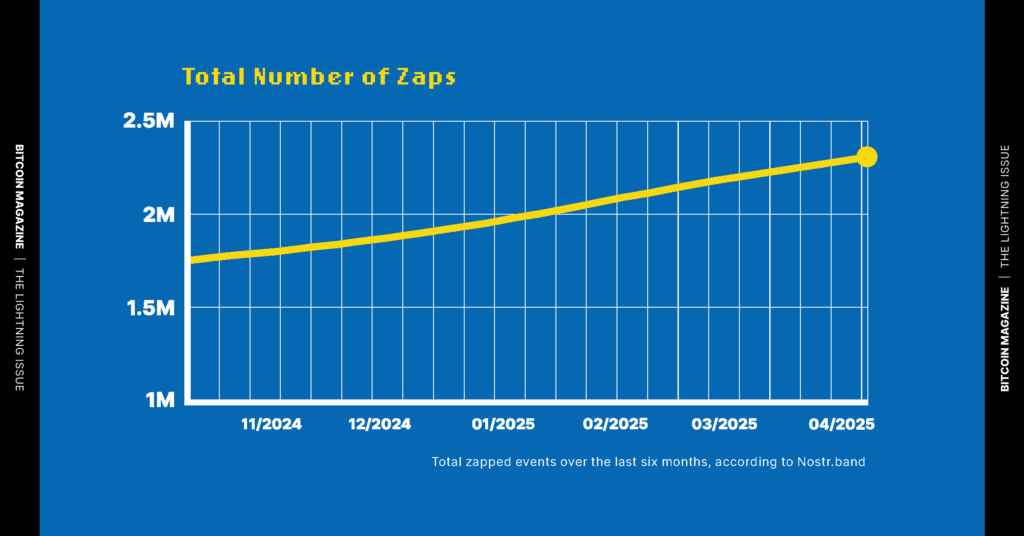

The Lightning Network not only creates fresh opportunities for enterprises but also facilitates unregulated payments, both substantial and minor, across other open protocols. A prime illustration of this is Nostr, a decentralized protocol aimed at enhancing social media experiences and beyond.

In a post on X, Jack Dorsey mentioned, “The most significant at-scale demonstration of Bitcoin for everyday transactions is Zaps on Nostr.” In a 2023 conversation with Politico, he elaborates on his grounded positivity for both Nostr and Lightning-powered zaps:

“He also contended that the user experience on NOSTR had already exceeded that of Twitter, referencing ‘Zaps,’ a feature that allows users to tip one another in Bitcoin — part of a vision where information and currency flow seamlessly across the internet without barriers.”

Zaps on Nostr developed from a basic Lightning invoice mechanism into a smooth micropayment function largely due to the contributions of William Casarin, recognized as jb55. Initially, users were required to manually append Bitcoin payment requests to notes. However, in early 2023, Casarin, the developer of the Damus client, proposed NIP-57, bringing event types 9734 (zap request) and 9735 (zap receipt) into formal use, which characterized zaps as immediate, Lightning-powered Bitcoin transfers.

Expanding on Nostr’s initial Lightning incorporation, Casarin’s ambition helped evolve zaps into an integrated, intuitive feature across all major Nostr clients. The advent of zaps triggered a rapid increase in Nostr engagement: By June 2023, Nostr users had dispatched over 1 million zaps among a user base of approximately half a million.

Needing only a Lightning

“““html

A wallet alongside a Nostr client, zaps removed intermediaries and enabled creators to obtain direct, low-cost payments for their posts, streams, or other material. This smooth amalgamation of social engagement and Bitcoin’s Lightning economy has reshaped the manner in which value is traded online, one minor or major transaction at a time.

Although casual users generally won’t oversee their own consistently online Lightning infrastructure, the network empowers small teams and proficient individuals to provide financial services that previously necessitated a bank. This trend is swiftly evolving into a larger phenomenon, propelling Lightning towards increased decentralization via community-driven infrastructure.

Picture if each local Bitcoin gathering had someone operating a Lightning node on behalf of their community. This could furnish a neighborhood or area with an accessible, reliable operator, akin to contemporary credit unions. In such a scenario, Lightning infrastructure wouldn’t be solely governed by large enterprise nodes. Instead, trust and routing would be dispersed among smaller, localized participants with varied incentives, builders who emphasize resilience, privacy, and accessibility rather than scale or profit.

This phenomenon is already unfolding today! I’ve witnessed this firsthand through initiatives such as Praia Bitcoin in Brazil and La Crypta in Argentina. Both ventures link grassroots communities with locally managed payment systems constructed on Lightning. Together, Bitcoin and the Lightning Network are facilitating a grassroots alternative to conventional banking — and it’s a magnificent development.

Finally, I would be remiss not to acknowledge the many remarkable projects like Zeus, Phoenix, Breez, Aqua, Muun, and other Lightning wallets that are innovating to produce diverse user experiences. These teams are developing feature-rich applications without compromising user custody while navigating the still-uncharted territory of Bitcoin payments in 2025. In a landscape where Bitcoin and Lightning continue to be niche, and speculative behavior is as prevalent as ever, providing outstanding noncustodial payment experiences is no insignificant task. While not flawless, many of these projects are accomplishing precisely that. The reality that so many builders are offering such a broad array of ways to engage with Lightning provides consumers genuine options and ultimately reinforces my central argument.

The Lightning Network was never intended to cater to every user in every capacity, and that’s exactly why it succeeds. It’s not faltering because casual users may favor custodial wallets. It’s thriving because developers, businesses, and organizers are employing it to tackle real-world challenges without needing authorization.

What Lightning presents isn’t universal ease, it’s targeted, high-impact software. It’s infrastructure that connects Bitcoin to individuals and delivers innovative solutions to the fringes of the global economy. When we cease to expect Lightning to be something it cannot be, we start to grasp its genuine purpose: a dynamic, foundational layer for those constructing the future of financial freedom.

Don’t miss your opportunity to possess The Lightning Issue — featuring an exclusive discussion with Lightning co-creator Tadge Dryja. It explores extensively Bitcoin’s most potent scaling layer. Limited release. Only available while supplies endure.

This article is featured in the latest Print edition of Bitcoin Magazine, The Lightning Issue. We share it here to highlight the concepts examined throughout the complete edition.

Source link

“`