“`html

Approach, Michael Saylor and MSTR have dominated Wall Street. To the dismay of many, the suitcoiners and corporations are present: Bitcoin held by firms in the guise of bitcoin treasury companies is mesmerizing to observe. It has captivated nearly everyone’s attention — including mine.

It’s the newest trend in global capital markets, acclaimed by a select group of astute Bitcoiners and insiders, yet loathed by tradfi individuals who can’t fathom why anyone, let alone an enterprise, would desire bitcoin at all. Every quirky Bitcoin podcaster has joined one or several bitcoin treasury companies as investors or advisors… or, to clarify their role more straightforwardly: as elevated marketers masquerading as retail-delivery systems.

In recent months, I’ve contributed hundreds of hours exploring bitcoin treasury entities. I’ve perused reports and explanations, bullish puff pieces and detailed descriptions. I’ve pondered the financial-market rationale behind them. I’ve refined outstanding articles advocating the justification for treasury firms, and overseen equally impressive counterarguments against them.

In some minor ways, I’ve even succumbed to them; I’m not as staunchly opposed to them as I expressed in the June 2025 piece (“Are Bitcoin Treasury Companies Ponzi Schemes?”) that was, coincidentally, presented before Michael Saylor on Fox Business last week.

Here’s what I’ve gleaned from all of this.

What Should a Rational, Ordinary Bitcoiner Do?

The simplest approach to bitcoin treasuries and financialized bitcoin is to merely disregard everything. Before Enlightenment: chop wood, hodl self-custody bitcoin; after Enlightenment: chop wood, hodl self-custody bitcoin. Only time will reveal whether these financial instruments, brimming with corporate-enveloped bitcoin and softly-spoken CEOs, will thrive or dramatically implode.

However, in discussions of finances and economics (and more broadly, economic theory), there is seldom a pleasant, impartial choice, no inaction; my funds and savings must find a destination, my focus and efforts be directed towards something. New bitcoin treasury companies are established weekly; energetic fund raises or acquisitions are proclaimed daily. Being part of this domain, having an opinion is unavoidable; having a well-informed perspective looks almost like a moral responsibility.

Having spent years deep-diving into the intricacies of monetary economics and financial history and now the unpredictable financial frontier of Bitcoin, the intellectual path to follow here is rather limited. One side guarantees a quick route to the hyperbitcoinized future we all envision, with corporate charters merely amplifying my sats along the journey; the other, a quagmire of financial engineering and a nest of speculative frenzy quickly lining up Bitcoiners to transform their fiat contributions into bitcoin yield.

Why Would a Bitcoiner Engage with These Firms?

One factor is leverage. As a typical millennial, I lack a house and thus find no easy access to inexpensive debt (essentially the only justification to own a property).

I can leverage my coins via e.g., Firefish (with 6-9% APR), or utilize my credit cards (11% and 19%, respectively). These terms aren’t favorable; they carry a hefty cost, a fairly small capital pool, and are quite pricey. Even if bitcoin experiences a CAGR of 30-60%, that’s over more extended timeframes — not monthly or annually, which is the timeline I must adhere to for servicing these types of debt.

In contrast, Strategy and MARA provide convertible debt at 0%. These obligations mature in several years and are in the nine-figure range. Said Pierre Rochard during his debate with Jim Chanos last month:

“The ability to access the terms that Saylor has… is not available to individuals holding Bitcoin in cold storage.”

For the majority of Bitcoiners, engaging in this endeavor is proving too enticing to refuse… even if you have to relinquish control and ownership, and additionally pay a high premium over their existing bitcoin reserves for the opportunity to own some of these shares.

As a leverage mechanism, Saylor’s shift towards preferred shares appears significantly more costly — paying 8-10% interest is nearing my own borrowing capacities — but they are much safer.

The preferences protect the company itself, as they eliminate the risk of margin calls or debt-driven bankruptcy worries, and afford the company remarkable flexibility. Preferred shares act as a release valve, since Strategy can choose not to distribute dividends for instance, STRD; doing the same for STRF “only” incurs a 1% penalty moving forward. In a crunch, and without significant repercussions for the company itself, Strategy can even pause payments for the others (at the risk of zeroing out the bondholder bagholder, and undoubtedly leaving many disgruntled).

Here’s the contradiction: While this represents financial leverage for Strategy, allowing it to acquire increasing amounts of external capital to invest in bitcoin and augment their reserves, it isn’t leverage for (new) shareholders of MSTR.

To reference Jim Chanos’ reply to Rochard in that discussion: the purpose of leverage is to have more than $1 of exposure. If I purchase MSTR at a mNAV of 1.5, and Strategy itself has a leverage ratio around 20%, I’m not leveraging up! (1/1.5 x 1.2 = 0.8). Hence, for every $1 I invest in MSTR, I receive approximately 80 cents of bitcoin exposure. Moreover, the entity, of which that share is a fraction, still needs to compensate roughly what I pay my financiers for the advantage of leveraging other people’s finances.

The evaluations for the majority of other treasury firms are even worse, primarily due to their inflated mNAV. You are the yield that bitcoin treasury companies are pursuing. When we invest in these firms, we engage in fiat games. And we partake in them directly in proportion to the costliness of the mNAV. I’ve inquired numerous times:

“How can a bitcoin, encased in a corporate framework, suddenly be valued at double, triple, or tenfold the most liquid, observable, and undeniably accurate price on the globe?”

Indeed,

“What substantial value-added transformation does our orange token undergo the instant you take it under your financially leveraged wings and pledge to issue debt, preferred shares, and equity against it — in “waves of credit bubbles,” we hear Satoshi’s specter faintly murmur.“

Strategy’s remarkable revelation — which everyone is now eagerly emulating — is that enclosing a bitcoin in a corporate shell, applying some leverage on it, and marketing it on Wall Street somehow renders that same bitcoin worth multiples of its true market value.

A significant portion of the dialogue concludes there, with traditional finance journalists quick to dismiss this as a trend or a bubble; according to the efficient market hypothesis, or simply common sense, nothing should trade above the value of the singular asset it possesses.

Not sufficient. Let’s summarize some quite valid reasons as to why corporate stocks solely focused on acquiring bitcoin should carry a value greater than the bitcoin they retain:

- Storage. Self-custody is more straightforward than you might think, but many individuals still hesitate (see: ETFs). An additional peculiar reason is the high-profile wrench-attacks on Bitcoiners globally; it would be reasonable to pay some form of premium for allowing someone else to secure your coins. Can’t wrench-attack my MSTR shares. Saylor appears to understand what he’s doing (though custodying with Coinbase has raised some eyebrows), so let’s “store” our bitcoin with his company. 10%.

- Futures. Future bitcoin holds more value than present bitcoin. At any moment, there are undisclosed treasury firm acquisitions benefiting shareholders but not yet disclosed publicly. When you buy shares, you’re only aware of the deals or acquisitions that haven’t been made known… but we all recognize, and can forecast, that shares should trade slightly higher than they currently do: You’re perpetually trading shares on present information, fully aware that there are matters behind the scenes leading to more. That’s presumably deserving of some premium, thus: 5% for example, Strategy; considerably more for the smaller and more ambitious firms.

- Regulatory arbitrage. Look, say the bulls, there is vast money out there, eager to purchase bitcoin but prohibited from doing so. I don’t entirely accept this: Not that many people or institutions are particularly keen on orange, and even if they were, any premium we wish to associate with this taxation-mandate-401(k)–regulatory barrier will diminish over time and through acceptance. The same financial motivations and laws of gravity that justify the existence of bitcoin treasury firms also work to erode the very regulatory challenges that provide them value in the beginning. 20%.

(For some entities, such as Metaplanet in Japan, where bitcoin investors confront significant capital gains taxes, that arbitrage premium is even more valuable.) - Catch-all. I’m likely overlooking some additional rationale — some of these firms possess residual, real-world operations as well — for why a collection of bitcoin should be appraised at more than the bitcoin encapsulated within the collection… so let’s simply add another 20% here.

Total: 10+5+20+20 equals 55… and conveniently approximately where MSTR traded when I initially waved my hand to justify these premium rationales. At a bitcoin price of $122,500, the 628,791 BTC on Strategy’s balance sheet is valued at around $77 billion, while the firm’s market capitalization stands at $110 billion (~45% premium).

Strategy is a Bank: The Economic Vision

Not in the sense that accepts (bitcoin) deposits and offers (bitcoin) loans, but in a different, more profoundly economic manner.

You might regard banking as one of society’s methods for sharing risk. Society extends credit to various risky enterprises, and capital markets — a segment in which the banking system operates — allocate the associated risk levels. (Essentially, a financial “Who Gets What and Why.”)

A bank, from an economic perspective, is an organization that assumes that risk while possessing some non-public details about the parties involved; it offers a modest, guaranteed return to the lender, while it profits from any prosperous venture — albeit not as extensively as the equity owner. If the bank achieves this effectively, i.e., it typically selects successful projects and earns more in interest on creditworthy loans than it disburses in interest to depositors, it generates profit for itself.

This is the essence of what Strategy is executing, leveraging the unexplored territory between the bitcoin realm and the fiat realm.

Traditional finance entities, pension funds, or retirees represent the bank-financing aspect of this framework. They “deposit” funds in Strategy, with returns and terms defined by the particular tranche they select (STRK, STRD, STRF, STRC, or residual claimant in common stock, MSTR).

The bank allocates these resources into assets: Strategy occupies a central position, assuring payouts to these economic entities by forecasting that the assets will yield returns surpassing the stated interest on the “bank deposits.” Instead of a bank extending loans for mortgages and credit cards and to small enterprises, Strategy’s lending aspect comprises a singular client: the world’s most successful asset. What Strategy is undertaking is the (very logical) wager that bitcoin will appreciate in dollar value faster than the 8-10% it must pay traditional fiat institutions for the privilege of utilizing their funds.

Any middle-schooler equipped with a calculator can ascertain that limitless wealth awaits if you’re borrowing at 10% annually to acquire an asset that grows by 40% each year.

Of course, bitcoin doesn’t provide a neat, cozy, 40% a year. If that were the case, per Michael Saylor’s own assertions, Warren Buffett would have snatched up all the bitcoin long before now:

“If bitcoin were not volatile, individuals with more wealth than you, more influence than you, would outbid you for the bitcoin; you couldn’t possess it… At the moment it becomes entirely predictable, Warren Buffet will announce ‘oh yes; we understand; we just acquired all the bitcoin’… and your chance is gone.”

All that Strategy needs to secure is that the financing won’t lead to its bankruptcy; that the issuance is firmly within its control and discretion; that dividend payouts are conservatively enough compared to the net capital it holds (i.e., bitcoin); and, most crucially, that the liabilities aren’t callable in a way that would compel the company to liquidate bitcoin at unfavorable times.

Essentially, Saylor devised a vehicle highly suited to navigate through extreme downturns. Even an 80% drop in bitcoin — the most severe of its kind, and it’s certainly debatable whether those will occur again, given the size and public accessibility of the asset — won’t hinder the company. The essence of a successful Ponzi is that the funds must continually flow in. More specifically, Strategy is conservatively Ponzi-like in its financing (unlike traditional — fraudulent — Ponzi schemes, Saylor isn’t perpetrating a fraud; the perception just coincides, and no one is defrauded… unwillingly, at least).

What neither traditional finance journalists nor treasury-skeptic Bitcoiners have articulated well is how precisely these schemes unravel. For “Economic Forces,” economist Josh Hendrickson succinctly outlines the pertinent stumbling blocks: “If markets are segmented and there is an anticipation that prices will continue to rise quickly, this makes the present discounted value of a future liquidation exceed the current liquidation value. If the stock is selling at its current liquidation value, it is undervalued.” And:

“what MicroStrategy has accomplished is transform itself into a bitcoin bank by issuing dollar-denominated liabilities and acquiring bitcoin. The company is explicitly engaged in financial engineering to take advantage of regulatory arbitrage.”

Strategy’s framework, but more importantly the other imitators given their respective jurisdictional advantages, can thus fail if:

- Investors misjudge the future direction of bitcoin

- Any mandates, tax regulations, and legal challenges that currently inhibit investors from purchasing bitcoin directly loosen up

The flywheel effect, so creatively coined by the Twitterati of the Bitcoin community, refers to the capacity to exploit regulatory arbitrage, which, in turn, “depends on investors sustaining this expectation that bitcoin will be significantly more valuable in the future,” in Hendrickson’s very academic and economic phrasing.

Shareholders and purchasers of the preferred shares won’t be pleased in the case of dividend nonpayment. Shareholders of MSTR itself will resent dilution merely to accommodate bondholders (or worse, and Ponzi-like) pay the interest to preferreds. But so what? It doesn’t dismantle Strategy.

What will dismantle the model is the removal of these traditional finance-to-bitcoin barriers. It’s the regulatory challenges that advanced many of these firms; transformed them into financial bridges between the new economy and the old; enabled them to absorb unproductive, low-yielding capital from across the globe and redirect it into bitcoin.

If fund managers or treasury departments or family offices consistently accumulate bitcoin instead of various Strategy offerings (or securities of Strategy imitators, as may be the case in different regions), the fundamental rationale for bitcoin treasury enterprises dissipates.

The continuity of bitcoin treasury firms, succinctly stated, rests on the inertia of the current system. It crucially relies on family offices and pension funds, sovereign wealth funds, and traditional investors not undertaking the effort to uncover

“““html

current bitcoin involvement (along with some secure, prudent leverage). If they opt against this, and instead choose to pay an additional 50% for the privilege, then… indeed, the bitcoin treasury enterprises’ business frameworks are perpetually viable.

What Else Could Go Awry?

There is certainly a custodian risk for Strategy, with its coins held by various custodians, and in solutions that are deliberately maintained rather opaque. What occurs to Strategy’s operations if, for instance, Coinbase files for bankruptcy? Or worse, if emerging political dynamics usher in confiscation and/or harsh taxation policies?

Fair enough, these are tail risks but nonetheless risks.

And — it’s almost mundane to mention this — if Bitcoin somehow falters, certainly Strategy falters with it. If bitcoin remains a $118,000 stablecoin indefinitely, the majority of Strategy’s opportunistic usage of abundant financial capital becomes rather irrelevant, and it’ll behave like the collection of bitcoin that numerous journalists and various analysts believe it to be, its remarkable growth (largely) vanished.

And I believe that’s what confounds so many journalists and analysts when examining this treasury company trend: If you cannot comprehend how or why bitcoin would ever hold value or applicability, especially in the future of finance and currency, then evidently a corporation dedicated to acquiring as much bitcoin as it can seems utterly nonsensical.

The Hedge and The FOMO: What If I’m Mistaken?

Intellectual modesty compels us to accept that perhaps, just perhaps, we miscalculated something.

Diamond hands are continuously formed… and mine remain quite fragile. It genuinely worries me when the bitcoin price plummets sharply. (It’s the abrupt extremity of it, I believe, that’s significant… and I find it challenging to rationalize even in retrospect). I act impulsively, lash out — and not infrequently take reckless risks with rent funds or other reserves of extra cash that really shouldn’t be allocated to bitcoin.

In bullish markets, that kind of conduct generally serves me well… but eventually, it won’t. Morgen Rochard, during one of these endless guest appearances on the Bitcoin podcast circuit, emphasized this point. (I sometimes say that Morgen has, paradoxically, encouraged me to own less bitcoin than I currently do… sleep peacefully at night, be composed in the face of price fluctuations, etc, etc.)

The more I discover regarding Strategy, the more I’m warming up to its numerous tailored offerings. It makes some degree of sense for me to possess e.g., STRC for short-term liquidity and STRK for limited bitcoin exposure coupled with cash flow. STRK, from a financial standpoint, resembles holding bitcoin twice removed; short-term variations in price would be significantly less volatile, and it would provide me with a bit of extra fiat side income.

Given that my net worth and professional roles are primarily linked to bitcoin and influenced by bitcoin price movements, having slightly less of my net worth in this all-in-one area is logical.

Why Not Simply Keep Cash in a High-Yield Savings Account?

Great inquiry. Two reasons: they don’t generate much… checks notes… 4.05% interest on my “high-yield” dollar account. Saylor’s analogous product, STRC, aims for a rate hundreds of basis points higher; and STRK, which in the medium term mirrors bitcoin itself, adjusted for changes in MSTR’s mNAV (since at MSTR = $1,000, ten STRK converts), currently yields over 7%. Secondly, knowing myself, I’m fairly certain I’ll just dive cash reserves held in a fiat bank account into bitcoin at the first indication of a notable price drop; maintaining STRC or STRK in a brokerage account would at least raise the barriers to that kind of reckless behavior.

Hedges… Hedges Everywhere

Since I’m already structurally short fiat — as per the original Speculative Attack, I carry debt and bitcoin, thus I’m leveraged long — it’s prudent to… deep breath… diversify, just a little bit!

I consistently maximally contribute to the pension fund that my jurisdiction local authority obligates me to pay into. The assets within that sanctioned wrapper invest broadly in stocks and bonds (approximately 75:25 ratio); compared to any bitcoin comparison, these naturally perform poorly, but in case I’m somehow — for some unfathomable reason — incorrect about this entire money-printing, central banking-ending situation, at least I won’t starve in my later years:

Additionally, contributing to it comes with substantial tax benefits: Maximizing the contribution grants me about 1.5x the funds immediately. While those supplementary resources will be eclipsed by bitcoin’s typical ~40% CAGR in less than a couple of years, they also come with tax-exempt mortgage advantages; should I wish to acquire a house real-world asset someday, I can utilize this pool of funds for that purpose.

The opportunity cost of bitcoin is significant, and over time quite burdensome, but this isn’t a matter of conviction. Real-life considerations prevail: It makes a world of difference for how you

“““html

live your life whether hyperbitcoinization occurs in a week or in a century.

What relevance does any of this have with bitcoin treasury companies?!

A lot: since the protective mindset of “what if I’m mistaken about this” prevails here too.

Despite all the hype and sophisticated jargon, along with new metrics and futuristic aspirations, I still struggle to understand why a bitcoin, when encased in a corporate framework, should hold greater value than a standalone bitcoin. Yes, yes, net-present-value of projected growth, yield, capital arbitrage, speculative challenges, and a wager on hyperbitcoinized banking but… seriously?!

Alright, what if I’m mistaken? Numerous individuals I trust within the Bitcoin ecosystem endorse these points — more frequently, it seems — and there is some rationale behind them. Cheap leverage, speculative attacks, enticing (read: deceiving) fiat reserves to flow into bitcoin.

…so I FOMO’d into two treasury companies lately: Two Strategy products (MSTR and STRK) and the Swedish newcomer H100.

It’s Great to Have Stocks Again…

A decade plus ago, I used to possess a significant number of stocks — large, well-diversified portfolios, meticulously monitored. For years now, and for apparent reasons, I haven’t owned any.

I opted for Strategy’s offerings because they are the least financially reckless in this domain; the second one due to my easy access via my traditional Nordic bank accounts — and I wasn’t about to go through the trouble of locating a suitable brokerage, signing documents, and transferring funds just to possibly engage with a few hundred bucks of bitcoin treasury money. There’s already plenty of frustrating paperwork out there.

In the unlikely event that these assets yield anything, Strategy will be involved, managing the operations: MSTR is “amplified bitcoin,” as their marketing puts it. Given that most of my savings are orange-themed and my professional existence is deeply orange, this kind of diversification resonates. (Moreover, the mNAV for MSTR is swiftly nearing one… 1.42 as I write this.)

With Emil Sandstedt’s words echoing in my mind — I grasp that I am the BTC yield they’re pursuing — but with a BTC yield around 25% and a safe 20% leverage through the prefs and convertibles, I’ll find myself even at this time next year: My ~150 dollars’ worth of MSTR shares currently delivers about 120 dollars’ worth of bitcoin exposure; I’m content to invest the extra $30 for the financial empire Mr. Saylor is building (and the potential growth in bitcoin-per-share).

Secondly, H100. The mNAV here was also reasonably acceptable for a small, agile, fast-moving and jurisdictionally strong player — at 2.73, ugh — but its low days-to-cover rate reassures me that I won’t get too trapped.

My initial realization after purchasing some: I’d forgotten how enjoyable it is!

Suddenly, I’m monitoring several different asset prices instead of merely one. Suddenly, I’m financially linked with actual companies engaged in real activities (…sort of, anyway), rather than just the most portable, global, and easily accessible currency that has ever existed. Psychologically, I felt part of something — invested in the endeavor, the speculative challenge, and the bitcoin yield curve structure encapsulated in treasury companies. How thrilling!

Second realization: Bitcoin has messed with clarified the definition of ownership.

None of these assets are mine; they’re mired in layers of sanctioned custody. I can liquidate them with a click (from nine to five, Mondays through Fridays…), but I only ever perceive any of that value if

a) the brokerage cooperates

b) the bank facilitating the payout complies, and

c) the government doesn’t obstruct the transactions.

It is one step worse than what Knut Svanholm elegantly notes in Bitcoin: The Inverse of Clown World:

“A bank resembles a 2-of-3 multi-sig wallet where you, the bank, and the government each possess one key. In essence, money within the bank is not genuinely yours. Nor is it, in truth, real money.”

…Or Not So Great to Have Stocks

I promptly received a few reminders of the opaque, utterly absurd, and bureaucratic nightmare that stock “ownership” entails. After I had transferred funds to the brokerage last month, located STRK and pressed “buy,” I encountered an error message: “This security is unavailable to you.”

It turns out I wasn’t qualified to own American securities via that brokerage.

Traditional finance assets are so opaque and so incredibly controlled. And the reminders of this outdated value technology kept coming. Naturally, it took a day or two for that “investment” to plummet by -11%, reminding me that I still know nothing about fair valuation or timing the market. (On the other hand, bitcoin dropped by 5% from its then 2-week 118,000 stablecoin pattern, so the opportunity cost was somewhat mitigated.)

It escalated when navigating through the murky depths of bitcoin treasury companies: the two Swedish penny stocks that have gained attention (H100, and K33; I had to purchase something with the funds intended for STRK) instantly declined by 10% and 20% respectively — essentially from the moment I touched them. What an experiment.

To rephrase an old Wall Street saying, a fool and his sats are soon parted… and the current fool doesn’t even have any new, shiny assets to display because — newsflash! — stocks are custodial and intangible! They exist in a brokerage firm’s database, and by extension, a corporate ledger somewhere. They aren’t physical… and they’re not even truly mine! I can’t utilize them, transfer them, back them up, or recover them to a different wallet. They’re trapped where they are, dead stock in Adam Smith’s famous wording regarding money.

Instead, I set aside some additional fiat funds in my regular banking application.

“““html

and impulsively acquired MARA (MSTR is accessible there, but no other Strategy tools); while MARA is issuing shares and convertible bonds to accumulate sats like yet another treasury entity, at least it’s an actual operational business (mining) — and their mNAV hovers around 1, so I’m not paying a premium for their financial-market, cost-of-capital arbitrage-style maneuver.

How, Just HOW, will Bitcoin Treasury Firms Encounter Failure?

“There’s a genuine chance we may experience a dot-com-esque boom-and-bust cycle in this public equity realm.”

Danny Knowles, May 28, “What Bitcoin Did”

Strategy is resilient.

As Lyn Alden’s query in the Strategy Q2 earnings call highlighted, even during an 80% bitcoin decline, Strategy will remain intact. The firm was in a considerably worse condition during the 2022 bear market when its bitcoin was directly linked to margin loans and collateral for bank debt. That’s not the situation in 2025, when preferreds are in charge.

When looking beyond the occasional traditional finance analyst or journalist fixation on mNAV, or why a firm should be valued above the bitcoin it possesses, and the hand-wringing, both inside and outside Bitcoin regarding the use of debt for acquiring additional bitcoin, Strategy is astonishingly conservatively financed. The firm owns bitcoin valued at approximately $77 billion; the convertible debt total is around $5 billion ($8 billion in total, but some of them are deeply in-the-money and transact as equity, not debt, at this stage). There’s slightly over $6 billion of preferred stock outstanding across STRK, STRD, STRF, and STRC. (This means the firm is about 15% leveraged, implying bitcoin would have to plummet by over 85% for the company to face any kind of solvency issues.)

Another potential issue arises if traditional finance money market capital diminishes. Strategy’s ability to outperform bitcoin by generating increasing bitcoin per share relies on a mix of lower/safer cost of capital (or improved conditions on its debt) or tapping the above-1 mNAV (instantly beneficial as it allows Saylor to buy bitcoin at a discount). Without that — for instance, if nobody acquires the treasury company issuances, and financial capital flows elsewhere; money printing halts; interest rates on (safer?) government securities escalate, etc — I don’t see how Strategy’s mNAV doesn’t simply crash back down to 1.

Lastly, there’s custodial risk for Strategy in particular. Being the largest player around, possessing some 3% of the total supply, honey-pot threats are significant. (This likely won’t pose an issue for the smaller firms, which are distributed across very diverse jurisdictions.) Strategy keeps its massive collection of coins with Coinbase custody — in solutions that are deliberately kept quite opaque.

What occurs with Strategy’s business if Coinbase faces bankruptcy? Or even worse, if new political shifts lead to confiscation and/or harsh taxation measures? These are valid questions, but very speculative tail risks nonetheless. Do we really need to be that concerned about them?

Whether bitcoin treasury companies are here to place bitcoin at the core of global capital markets, or if this ends in catastrophe, remains to be seen.

Final Reflections: Sold-Out? Ponzi Conspiracy in Your Head?

Have I intellectually compromised? Am I a corporate minion? Has David Bailey’s reflections — and the fact that Nakamoto, loosely tied to Bitcoin Magazine through mutual ownership and marketing services — influenced me, now that NAKA is merging with KindlyMD and can unleash its flywheel/“Ponzi” schemes in full?

Firstly, it would be a grave violation of journalistic ethics and — as told by our in-house legal advisor — unlawful to utilize a media platform to promote securities owned by its proprietor. (Though in the Trump era, who can say?). But I certainly wouldn’t be fulfilling my duty if I weren’t diligently analyzing the merits and drawbacks of these entities proliferating everywhere.

Secondly, and as an example of my extremely low confidence in all of this: I hold about as much in treasury company shares as I do in custodial Lightning wallets for effortless spending — thus, not much.

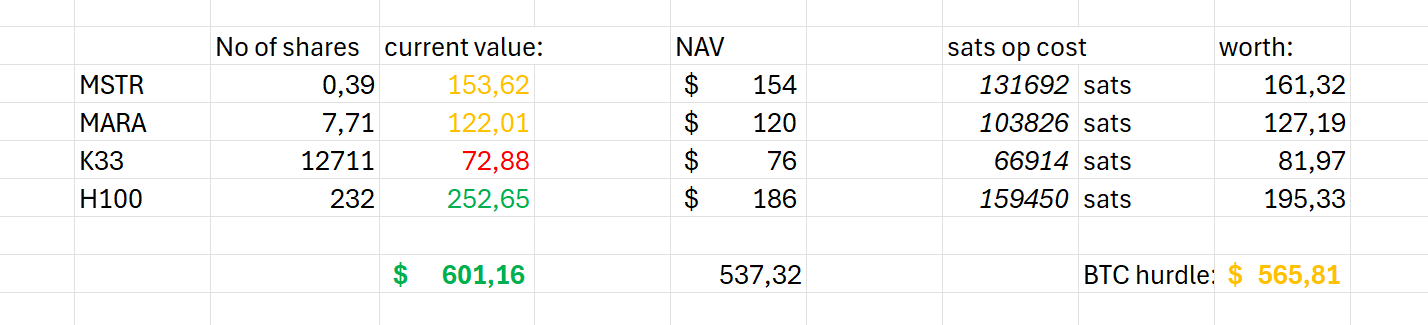

Thirdly, for complete transparency (again, based on legal counsel’s advice), here’s the experience outlined to date (note: calculated at values before Treasury Secretary Scott Bessent’s comments yesterday caused these prices to decline):

Several points are noteworthy.

- Select your bitcoin treasury firms wisely: H100 and Sander Andersen appear quite committed to the stacking initiative, and the firm continues to ascend the bitcoin treasuries list. Currently, financial markets reward such firms for their endeavors. Conversely, the K33 team operates much slower, and their stock price movement since their initial bitcoin launch months ago has followed a typical pattern of a short-term spike before gradually declining back to where the stock began. MARA and Strategy are lingering around their previous levels for months.

- My impressive ~5% excess return over bitcoin is too insignificant to warrant attention — it was a one-time stroke of luck. Over extended durations, this may alter… but to be honest, just don’t bother.

- I will probably grow weary of this latest fiat financial engineering trend quite soon. There’s only so much enjoyment in maintaining permissioned, brokerage-restricted, traditional assets.

Regardless of challenges or triumphs, celebration or calamity, glory or despair… it seems far simpler to continue chopping wood and piling sats into cold storage than to engage with any of these bitcoin securities.

Treasury enthusiasm is soaring on Wall Street and among energized Bitcoiners. Perhaps the financialization of bitcoin is upon us… yet honestly, I believe I’ll primarily sit this one out.

—

BM Big Reads are weekly, thorough articles on some current theme pertinent to Bitcoin and Bitcoiners. The views expressed belong to the authors and do not necessarily represent those of BTC Inc or Bitcoin Magazine. If you have a submission that aligns with this model, feel free to reach out at editor[at]bitcoinmagazine.com.

The views articulated in this article solely represent the author’s and do not necessarily reflect the opinions of BTC Inc, BTC Media, Bitcoin Magazine, or its staff. The piece is provided for informational objectives only and should not be regarded as financial, legal, or professional advice. No material confidential information was exploited in writing this article. Opinions, along with financial actions taken as a result of those opinions, are solely those of the author and do not inherently represent BTC Inc, BTC Media, or Bitcoin Magazine.

Nakamoto has a marketing partnership with Bitcoin Magazine’s parent entity BTC Inc to assist in constructing the first global network of Bitcoin treasury firms, where BTC Inc provides certain marketing services to Nakamoto. Further details on this can be found here.

Source link

“`