Yesterday, Bitcoin (BTC) encountered resistance once more around the $120,000 mark after briefly hitting a peak of $119,760. At the moment of writing, the leading cryptocurrency is trading marginally lower at $118,900. Nevertheless, a significant rise in whale inflows to Binance poses a risk of further downward pressure on the digital asset.

Binance Whales Intensify Bitcoin Deposits

As per a recent CryptoQuant Quicktake post by contributor BorisVest, Bitcoin whale activities on Binance have surged notably in recent days. Specifically, the Binance Whale Inflow metric reported a significant uptick on July 25, indicating increased institutional engagement in exchange deposits.

Related Reading

On that particular day, the 30-day total inflow to Binance soared by $1.2 billion, intensifying short-term selling pressure throughout the market. Data from CoinGlass reveals that between July 24 and July 25, around $141 million worth of BTC long positions were liquidated as a consequence.

It is important to highlight that alongside this upsurge in whale deposits, retail investors have also been transferring their holdings to exchanges. However, their involvement remains comparatively low, suggesting that the recent selling pressure is mainly driven by whales.

The following chart demonstrates that while retail inflows have been consistently rising for weeks, the abrupt spike in whale deposits has added extra instability to Bitcoin’s price structure.

The increase in Binance whale inflows occurred just prior to Bitcoin facing rejection at the pivotal $120,000 level. After this rejection, BTC retracted to the $115,000–$116,000 region, which has now become a short-term support level. The analyst remarked:

This zone is currently providing short-term support. Should it falter, a drop toward the $110K level becomes more probable. Conversely, if Bitcoin can rebound significantly from this area, there is still the potential to retest $121K and even aim for a new all-time high.

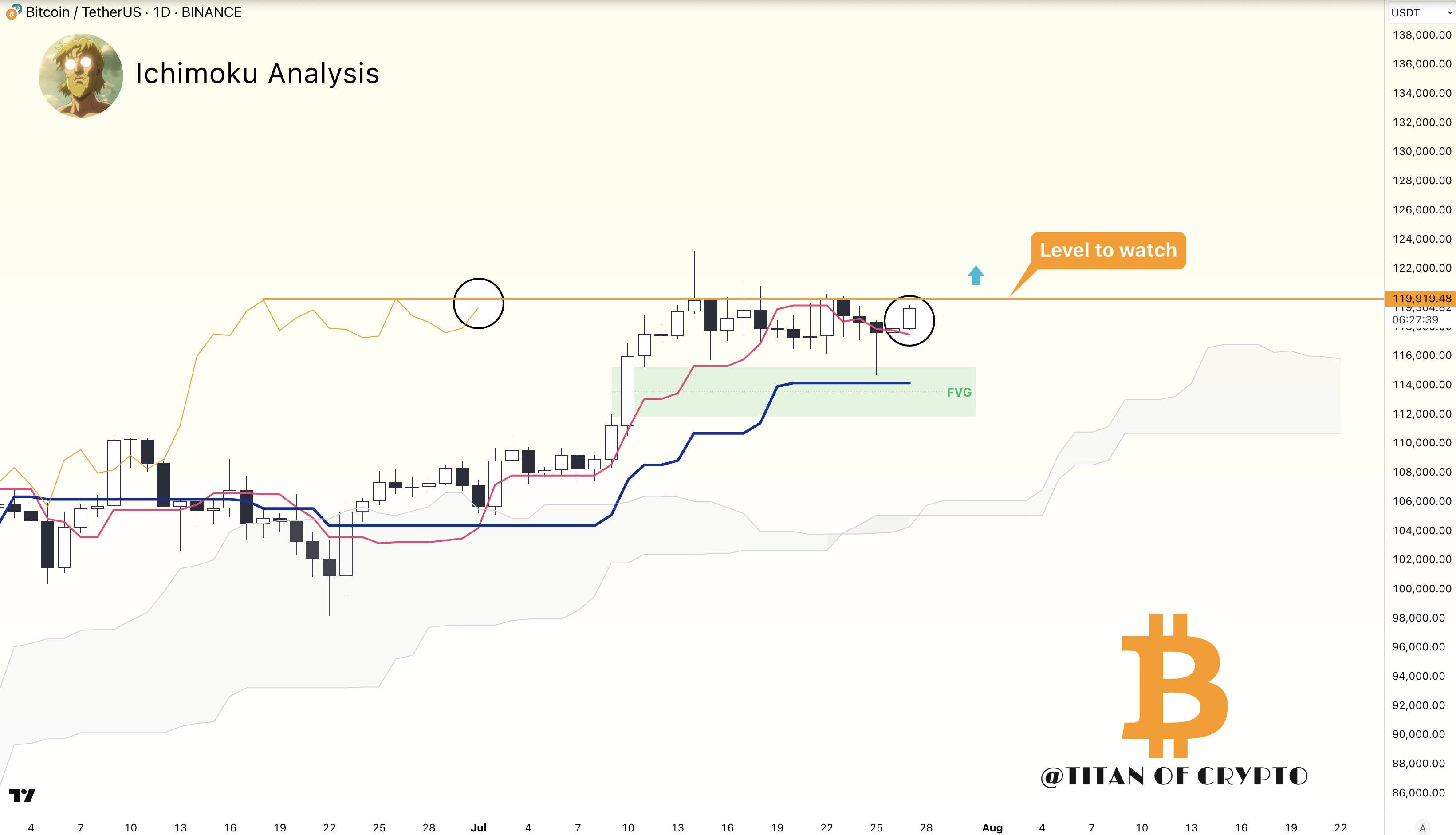

BorisVest concluded that BTC’s short-term price direction will be influenced by how effectively the market absorbs whale sell-offs. Meanwhile, fellow crypto analyst Titan of Crypto mentioned that if BTC decisively breaks the $119,900 barrier, then it may target new all-time highs (ATH).

What Else Does Exchange Data Indicate?

Whale inflows aren’t the only element unsettling investors. BTC reserves on centralized exchanges recently reached a one-month peak, implying that some holders may be bracing for a short-term retracement or consolidation phase before the upward trend resumes.

Related Reading

Nonetheless, Binance’s portion of BTC spot trading volume has recently experienced a sharp increase, indicating that a rally may be forthcoming for the world’s foremost cryptocurrency. As of this writing, BTC is priced at $118,926, up 0.4% over the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com