Grupo Murano, a $1 billion property firm located in Mexico, is spearheading an innovative strategy to incorporate bitcoin into its operations, with CEO Elías Sacal asserting that bitcoin is “demonetizing” the real estate sector. By transitioning from conventional asset-heavy frameworks to a bitcoin-focused treasury, the publicly listed enterprise intends to enhance its financial structure and take advantage of bitcoin’s prospective price growth, presenting a template for companies confronting fluctuating interest rates and currencies.

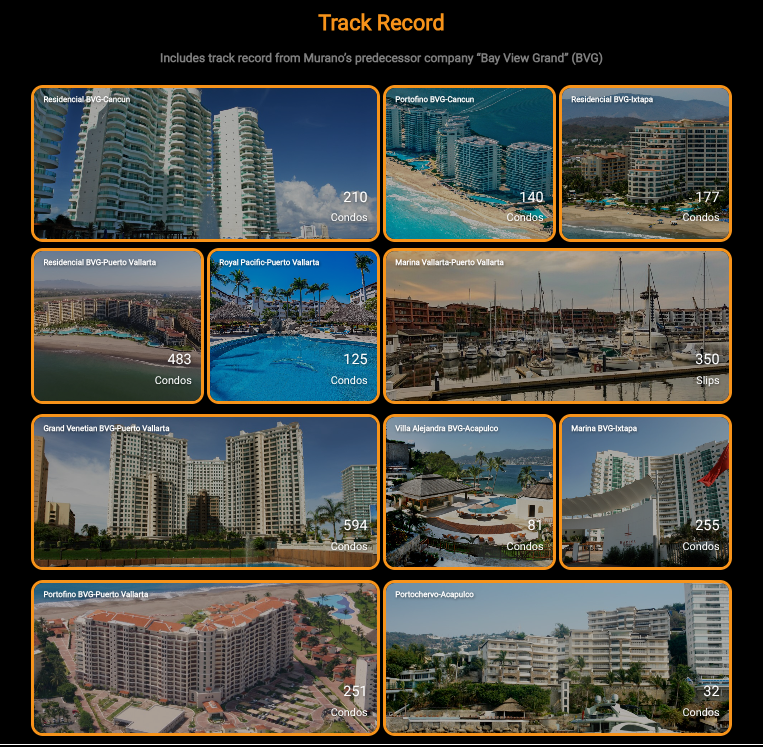

In a unique interview on the Bitcoin for Corporations show, Sacal, a seasoned real estate developer with 30 years of experience, detailed Grupo Murano’s ambitions. The company, which operates hotels under brands like Hyatt and Mondrian as well as residential and commercial spaces in locations like Cancun and Mexico City, aims to convert assets into bitcoin via refinancing and sale-leaseback agreements. This method lessens liabilities and equity on its balance sheet while preserving operational authority. “Rather than buildings awaiting minor appreciation, we believe bitcoin will appreciate more,” Sacal remarked, forecasting a potential 300% price surge in five years.

Sacal’s approach tackles the real estate sector’s dependency on debt financing, which has been challenged by rising interest rates—soaring from 4% to 9% in certain instances. “Real estate needs to be free from the rates of tomatoes or Walmart inflation,” he emphasized, highlighting bitcoin’s reliability for transactions involving global material procurement or hotel payment acceptance. By eliminating intermediaries like hedge funds and portfolio supervisors, bitcoin lowers costs incurred from commissions and currency exchange rates. A $100 transaction, as Sacal stated, tends to diminish to $85 after fees, yet bitcoin facilitates these transactions with greater ease.

Grupo Murano is also informing its stakeholders—including employees, investors, and guests—about the advantages of bitcoin. The company intends to install Bitcoin ATMs on its properties and is in the process of finalizing a collaboration with a prominent payment platform to ensure smooth transactions, especially for hotel visitors from the U.S. in Cancun and Mexico City. This aligns with Murano’s ambitious objective of developing a $10 billion bitcoin treasury within five years, taking inspiration from Strategy’s $100 billion valuation, primarily gained through bitcoin adoption. Murano is additionally seeking to accept bitcoin payments across its portfolio and will explore options to host Bitcoin conferences at its venues.

The firm’s emphasis continues to be on high-margin development initiatives, designating 20-30% of its business to real estate and 70-80% to bitcoin assets. Sacal dismissed alternative cryptocurrencies, labeling bitcoin as “the champion, akin to Formula One or the NFL.” He perceives Latin America, spearheaded by leaders like El Salvador, as fertile soil for Bitcoin adoption, though political uncertainties endure. Bitcoin has the potential to unify regional economies, lessening reliance on tourism or remittances.

For the audience of Bitcoin Magazine, Grupo Murano’s strategic shift illustrates bitcoin’s capacity to reshape capital-intensive sectors. By focusing on development rather than ownership and harnessing bitcoin’s appreciation, Murano provides a blueprint for firms aiming for resilience against economic fluctuations. As Sacal articulates, “Ultimately, real estate worldwide will be governed by Bitcoin transactions,” indicating a transition towards a more stable, decentralized future.

Bitcoin for Corporations is an initiative owned by BTC Inc., the parent entity of Bitcoin Magazine. BTC Inc. manages various subsidiaries that focus on the digital assets sector and maintains a business connection with Grupo Murano.