“`html

On-chain statistics reveal that every significant Bitcoin group is now consistent in behavior, with accumulation prevailing throughout the network.

Bitcoin Accumulation Trend Score Is Indicating Market-Wide Buying

In a recent post on X, the on-chain analytics company Glassnode has discussed how the conduct of the different Bitcoin groups has appeared from the viewpoint of the Accumulation Trend Score lately. The Accumulation Trend Score is a metric that indicates whether BTC investors are accumulating or distributing. This value incorporates two elements during its calculation: the changes in balances within the wallets of the holders and the magnitude of the wallets themselves. The latter factor implies that larger entities exert a greater impact on the score.

The metric’s value can range from 0 to 1, with the extremes reflecting perfect accumulation and distribution behaviors, respectively. The 0.5 mark serves as the threshold dividing these two behaviors.

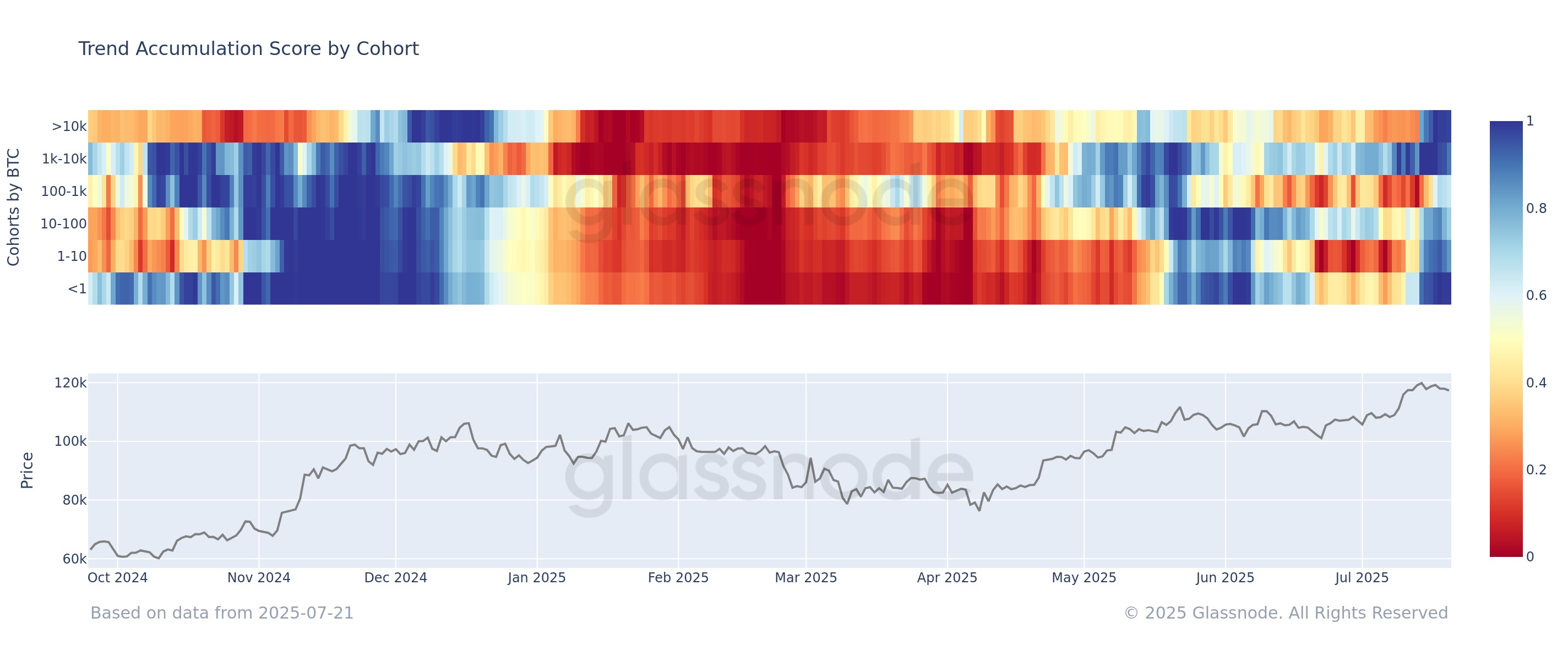

Here is a chart illustrating the trend in the Bitcoin Accumulation Trend Score for various segments of the network over the previous year:

The value of the metric seems to have been remarkably close to 1 in recent days | Source: Glassnode on X

As depicted in the graph above, the Bitcoin Accumulation Trend Score exhibited mixed behavior across the investor cohorts earlier, indicating that holders were divided on the cryptocurrency’s future. Recently, however, a change has taken place, with all investor categories displaying some level of accumulation. Three groups, in particular, stand out for their assertiveness: shrimps, whales, and mega whales.

The shrimps, or investors with less than 1 BTC, had exhibited slight distribution prior to the latest surge, but afterward, they shifted their stance to show aggressive accumulation. The whales, possessing between 1,000 and 10,000 BTC, were already acquiring with assurance when the remainder of the market was uncertain, and they have maintained this trend since the new all-time high (ATH) in the asset.

Finally, the largest holders on the network, those with over 10,000 BTC, have ended a distribution streak to exhibit buying levels not noted since December 2024. “The alignment across wallet sizes indicates widespread belief supporting the current BTC uptrend,” notes Glassnode.

While investors overall have been buying, it’s worth noting that there has been some selling recently. One group contributing to distribution in the latest phase of the rally has been the miners, according to data from analytics firm CryptoQuant.

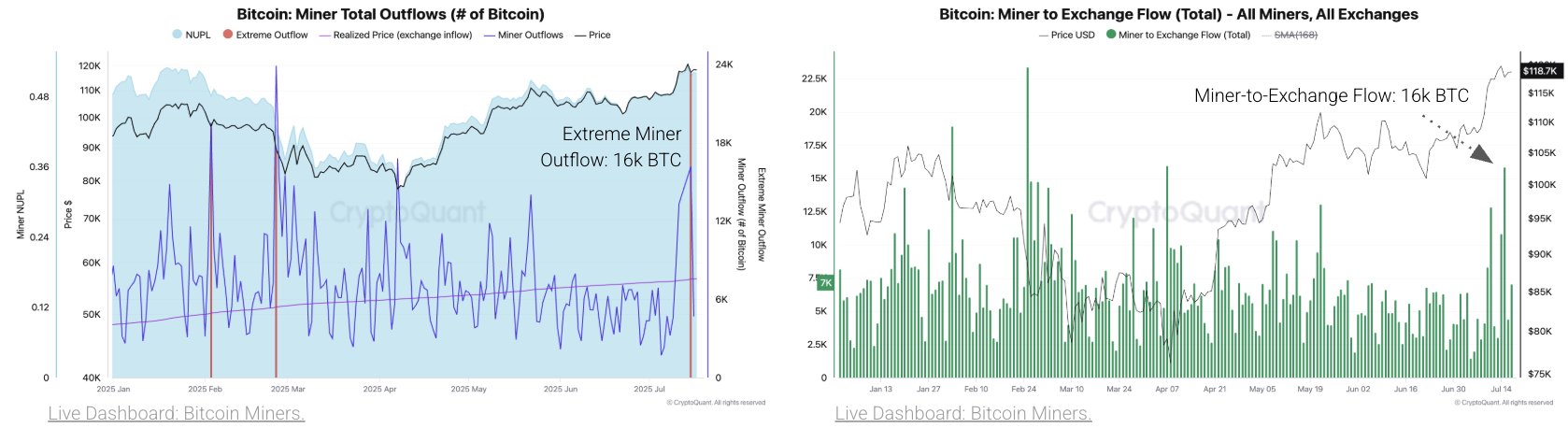

The trend in several miner-related indicators | Source: CryptoQuant on X

As visible in the left chart, Bitcoin miners made a considerable number of withdrawals from their wallets recently. What they aimed to do with these coins may be clarified by the second graph, which indicates that most of the 16,000 BTC outflow was directed to centralized exchanges.

Miners deposit to these platforms when they intend to sell, so this withdrawal surge might suggest that this group leveraged the rally to realize profits.

BTC Price

Bitcoin has moved sideways over the past week as its price continues to hover around the $118,000 mark.

It appears the price of the coin has stabilized in recent days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

Editorial Process for Bitcoinist is focused on providing thoroughly researched, precise, and impartial content. We adhere to strict sourcing standards, and each page is meticulously reviewed by our team of leading technology experts and experienced editors. This process guarantees the integrity, relevance, and value of our content for our audience.

Source link

“`