Bitcoin is presently stabilizing just beneath the psychological $120,000 mark, easing after last week’s rise to a new historical peak. While bulls retain their grip, price movements have decelerated, granting Ethereum a chance to shine with a notable breakout above $3,600.

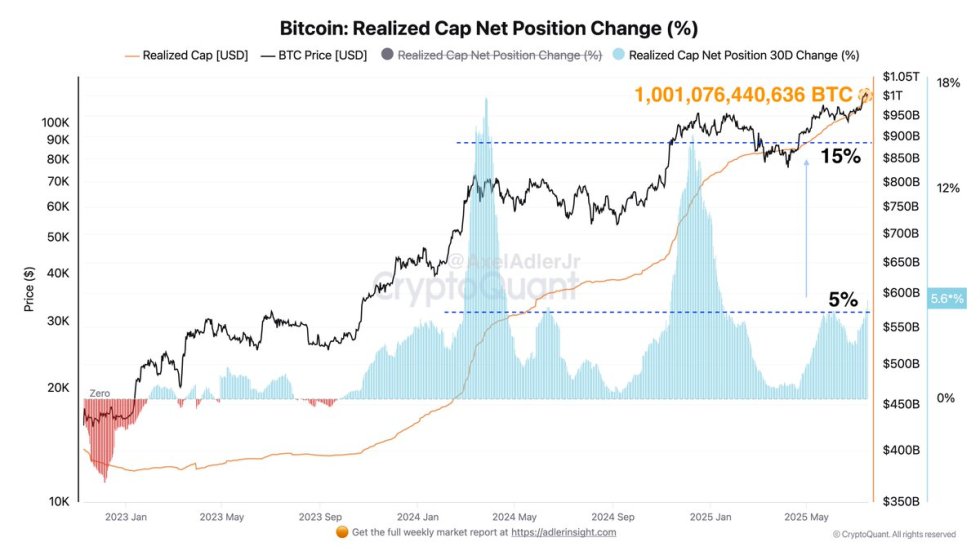

In this shifting landscape, new on-chain insights from CryptoQuant reveal a significant moment for Bitcoin. The network’s Realised Cap — a gauge that values each coin at the price it most recently transacted — has reached a new all-time high.

This achievement highlights the increasing robustness and sophistication of Bitcoin’s capital structure, particularly as institutional interest and long-term holding behaviors continue to grow. Adding a favorable note, this consolidation phase follows a pivotal regulatory event: the US House of Representatives has officially passed three crucial crypto legislations, including the GENIUS and Clarity Acts, bringing the long-awaited legal clarity for digital assets.

A Sign of Bitcoin’s Advancing Maturity

Leading analyst Axel Adler has pointed out a crucial milestone for Bitcoin: the network’s Realised Cap has officially exceeded $1 trillion for the first time, representing a new all-time high. Contrary to conventional market capitalization — which multiplies the current price by overall supply — Realised Cap assesses the worth of each coin based on the last price it transitioned. This approach delivers a clearer and more realistic perspective on the capital genuinely invested and retained within the Bitcoin network.

Adler explains that this gauge filters out speculative extremes and emphasizes coins genuinely held by market players, rendering it a more dependable indicator of Bitcoin’s fundamental strength. To illustrate the importance of this achievement, he notes: “If a company earned $1 every second, it would take 31,710 years to accrue one trillion dollars.” This analogy contextualizes the vast magnitude of value currently retained within the Bitcoin ecosystem.

With Bitcoin stabilizing beneath $120,000 after its recent record high, the increase in Realised Cap reaffirms the notion that this cycle is constructed on a sturdier foundation than in past rallies. Given the rising institutional adoption, clarity emerging in regulations within the US, and strengthening convictions among long-term holders, numerous analysts speculate that Bitcoin is poised for another extensive growth phase in the upcoming months.

BTC Price Stabilizes Following Breakout

Bitcoin (BTC) is currently stabilizing below the psychological $120,000 mark following a robust multi-week rally. The 12-hour chart indicates BTC trading within a clear range, with resistance at $123,230 and support at $115,730. This horizontal formation indicates a healthy pause after a significant movement, allowing the market to absorb gains and possibly set up for the next upward movement.

Despite slight retracements within the range, price activity remains above all vital moving averages: the 50 SMA ($111,306), the 100 SMA ($108,314), and the 200 SMA ($102,603), all trending upward. This alignment indicates that bullish momentum persists, with the 50 SMA serving as dynamic support during minor corrections.

Volume is elevated compared to earlier in July, signaling sustained engagement and strong interest from buyers. As long as BTC maintains its structure above the $115K–$116K zone, bulls are likely to hold the upper hand. A confirmed breakout above $123,230 could pave the way for new all-time peaks, while a drop below $115,730 might trigger short-term declines toward $111K.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist focuses on delivering comprehensively researched, precise, and impartial content. We observe strict sourcing standards, and each page undergoes thorough review by our team of leading technology experts and experienced editors. This procedure guarantees the integrity, relevance, and value of our material for our readers.