“`html

Bitcoin is currently trading just beneath the $120,000 threshold after achieving a record high of $123,200 on Monday. The modest retracement is interpreted by many investors as a healthy consolidation above significant demand levels, rather than an indicator of weakness. Positive momentum remains solid, with robust technical frameworks reinforcing expectations for a continued surge in the near future.

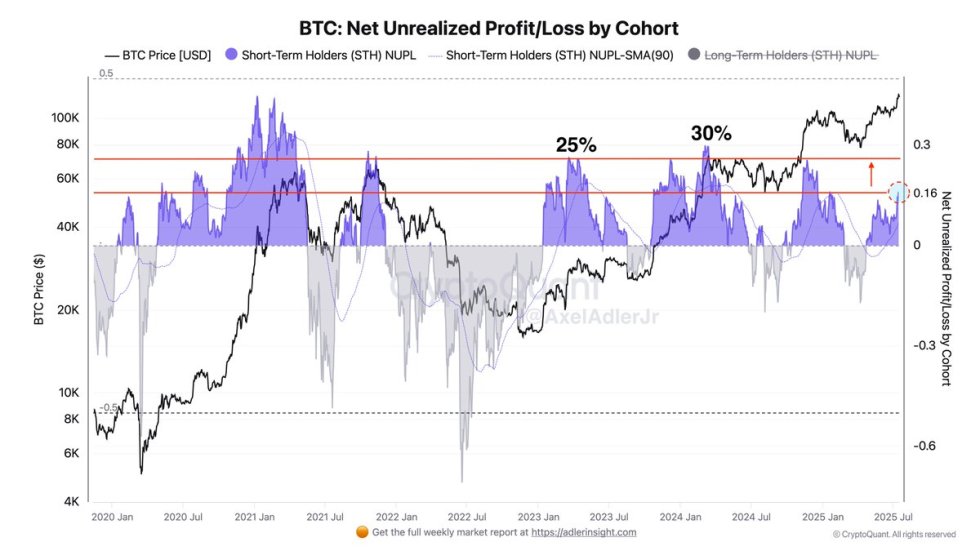

On-chain insights from CryptoQuant bolster the optimistic perspective. As of July 17, 2025, the Short-Term Holder Net Unrealized Profit/Loss (STH NUPL) metric is reported at 13%, a slight decrease from 16% when Bitcoin last reached its peak. This signifies that most short-term holders are enjoying moderate gains, yet not to extreme extents that typically herald speculative exuberance or impending market overheating.

The blend of stable price structure and robust on-chain behavior indicates a market still in the phase of advancing higher, rather than reaching a peak. With Ethereum and altcoins also strengthening and overall sentiment shifting positively, Bitcoin seems well-positioned for its next significant move.

Bitcoin Data Indicates Potential for Further Upside

Noted analyst Axel Adler points out that Bitcoin still has substantial potential to move upwards before experiencing a phase of speculative overheating. In earlier macro cycles, Adler observes that the STH NUPL metric reaching 25% has consistently indicated the peak of euphoria among short-term holders. At that juncture, many investors began to significantly take profits, often instigating a loss of momentum or a broader market correction.

As of July 17, 2025, STH NUPL is at 13%, illustrating that unrealized gains among short-term holders remain moderate. Based on current dynamics, Adler estimates that for this group to achieve a 25% unrealized profit level, Bitcoin would need to surpass $137,000. This price point now signifies a potential trigger point for widespread selling—a psychological and on-chain threshold that could lead to increased volatility or a pause in the cycle.

Until that happens, the data implies there is space for ongoing bullish price movements without the concern of immediate profit-taking pressure. This scenario arises at a critical moment, as the US Congress continues to discuss three significant cryptocurrency bills during what has been a fraught and uncertain “Crypto Week.” Following the rejection of the proposals over the last two days, the upcoming sessions may either alleviate regulatory uncertainty or prolong it.

Bitcoin Maintains Crucial Support Amid Rising Volume Surge

The 12-hour chart indicates Bitcoin consolidating just below $120,000 after achieving a new all-time high at $123,200 recently. Despite the brief retracement, BTC remains in a robust bullish structure, trading well above all key moving averages: the 50 SMA at $110,602, the 100 SMA at $108,105, and the 200 SMA at $102,178. These levels now function as dynamic support zones, emphasizing the strength of the prevailing trend.

Importantly, volume has surged significantly over the last few sessions, with consecutive high-volume candles accompanying both the confirmation of new highs and the subsequent correction. This rise in volume suggests heightened market activity, likely reflecting a combination of profit-taking and fresh inflows from traders positioning for further upward movements.

So far, the consolidation appears to be sound. As long as Bitcoin remains above the short-term moving averages and $109,300, the market structure supports the bulls. A clear recovery of $120K would pave the way for another attempt at new highs, potentially aiming for the $130K–$137K region.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist focuses on providing thoroughly researched, precise, and impartial content. We adhere to strict sourcing criteria, and each page undergoes meticulous review by our team of leading technology specialists and seasoned editors. This process ensures the integrity, relevance, and value of our content for our audience.

Source link

“`