“`html

Reasons to rely on us

Rigorous editorial stance prioritizing precision, relevance, and neutrality

Developed by experts in the field and thoroughly vetted

The utmost standards in journalism and publication

Rigorous editorial stance prioritizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

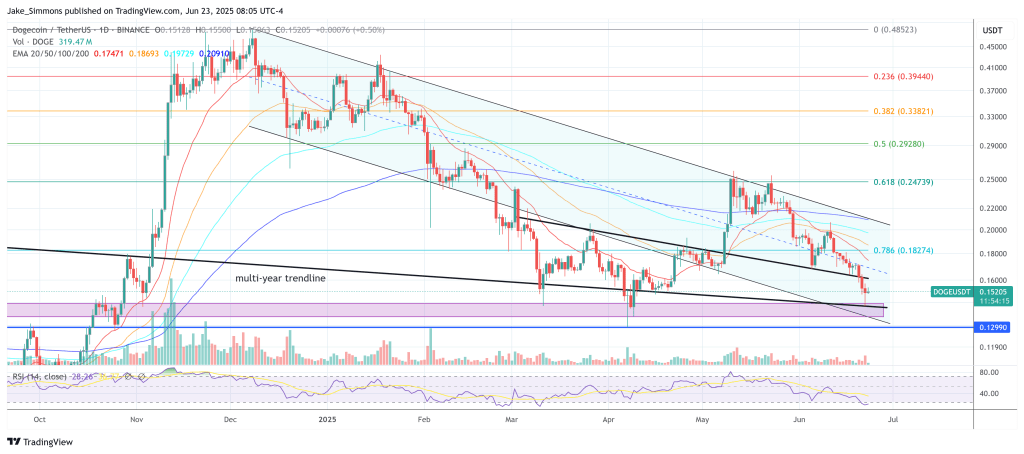

The price of Dogecoin continues to decline, and crypto analyst Kevin (@Kev_Capital_TA) cautions that the worst may still be impending. Highlighting a previous bearish trend, Kevin pointed out over the weekend that Dogecoin’s Head and Shoulders pattern—spotted nearly two weeks ago—is swiftly nearing its technical “measured move” target. However, he also indicated that the complete downside potential has yet to manifest.

Is the Dogecoin Collapse Far From Complete?

“I didn’t indicate that we are there just yet,” Kevin clarified in a follow-up post, “the orange circle signifies a range of where the measured move might extend, with a specific measured move target at the .786 fib level of .119.”

This $0.119 mark coincides with a wider convergence of technical supports that are rapidly becoming critical for DOGE’s formation. “The Head and Shoulders I highlighted in Dogecoin almost two weeks ago is nearing its measured move target area. Certain daily indicators are also beginning to reach triggering levels. Observing closely, along with BTC and USDT Dominance for additional confirmations,” he wrote.

Kevin also underscored the significance of the weekly 200 Simple Moving Average (SMA) and Exponential Moving Average (EMA), coupled with the macro .382 Fibonacci retracement and a long-term descending trendline.

Further Reading

Collectively, these levels constitute what he referred to as the “must-hold” area, specifically between $0.1434 and $0.1265. A sustained failure below that range would likely affirm a macro bearish transition for the meme asset.

What To Watch For Now

When zooming out, Kevin perceives Dogecoin’s destiny as intricately linked to Bitcoin and the broader altcoin market, which he notes is currently at its weakest point in years. “Thus far in 2025, altcoins have been much more bearish than in 2024 and 2023,” he remarked. “This has been the most challenging year for Alts since the bear market of 2022.” The remarkable strength of Bitcoin’s dominance has been a pivotal factor in this trend.

That dominance, Kevin contends, is not a fleeting spike. “New peaks for BTC Dominance arise from restrictive monetary policy and an unpredictable geopolitical landscape,” he wrote, referencing global macro conditions such as ongoing quantitative tightening (QT). He has consistently warned that without a shift in central bank policy, any discussions regarding a genuine “altseason” are premature.

Further Reading

“I’ve been stating since late 2023, early 2024—when AI coins were surging and people believed it was #Altseason—that until QT concludes and the terminal rate decreases, you will not witness genuine sustainable altcoin outperformance. This assertion remains valid.”

His caution extends well beyond Dogecoin. In previous observations, Kevin pinpointed crucial danger areas for Bitcoin and Ethereum, which he argues must be reclaimed to avert broader market decline. “As long as BTC cannot surpass the $106.8K mark and demonstrate real follow-through on 3D-1W time frames, then the market is in significant peril,” he wrote. “The same applies to ETH not being able to break the $2700-2800 range.”

“““html

level.”

For Dogecoin investors, the indication is unmistakable. The meme coin’s destiny depends not solely on its own technical condition, but also on a broader macro and intermarket framework that continues to be delicate. As long as Bitcoin finds it challenging to maintain an upward position above vital breakout thresholds and US monetary conditions remain restrictive, the likelihood of a more significant Dogecoin pullback stays elevated.

The focus will be on whether DOGE can secure a position above the $0.1265 mark in the upcoming days and weeks. A breach of that range, particularly alongside renewed Bitcoin weakness, could signal the onset of a more profound and distressing chapter for the once-adored meme coin.

At the time of writing, DOGE was trading at $0.152.

Featured image generated with DALL.E, chart from TradingView.com

Source link

“`