“`html

Reasons to have confidence

Rigorous editorial standards that prioritize precision, significance, and neutrality

Developed by sector specialists and thoroughly examined

The utmost benchmarks in reporting and publishing

Rigorous editorial standards that prioritize precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tom Lee, head of research at Fundstrat, states that Bitcoin might rise to $250,000 before 2025 concludes. During an interview on CNBC’s Squawk Box today, Lee remarked that Bitcoin has recently fallen from its peak of $111,970 to roughly $104,000. He still believes the market is stabilizing around that figure.

Related Reading

Lee’s Near-Term Perspective

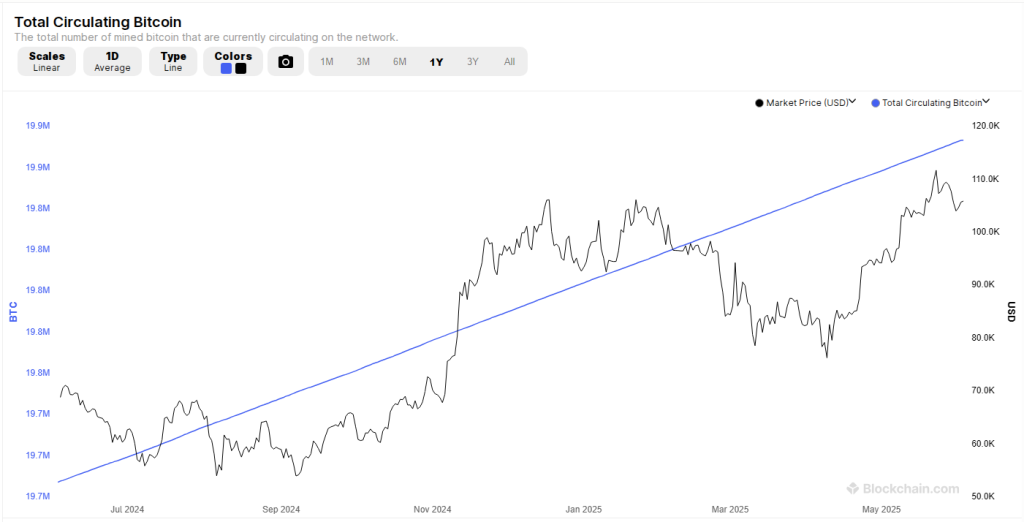

Lee informed Squawk Box’s host Joe Kernen that 95% of all Bitcoin—approximately 19.80 million coins—has already been extracted from a total of 21 million. This leaves about 1.13 million coins yet to be produced. He regards this as a constrained supply scenario.

He further mentioned that while almost all Bitcoin is in existence, 95% of the global population has not acquired any. According to reports, this disparity between supply and potential buyers might drive prices higher in the upcoming months.

For Bitcoin to ascend from approximately $104,000 to $250,000, it would need to surge by about 140%. Lee remains confident that it can reach $150,000 by December and may even approach $200,000 to $250,000 if demand intensifies.

Supply And Demand Disparity

Lee emphasized that a significant portion of the global population has yet to purchase Bitcoin. He noted this creates a discrepancy. On one end, there is a nearly static supply. Conversely, there could be millions of new purchasers in the next decade. He articulated that if merely a fraction of these individuals choose to invest in Bitcoin, the price could rise substantially.

Currently, only about 5% of all coins remain to be extracted. This indicates that new supply is diminishing rapidly. Simultaneously, additional wallets, applications, and accessible purchasing methods could attract new investments. Lee believes this imbalance plays a significant role in why Bitcoin could continue to escalate.

Long-Term Value Objectives

When queried about Bitcoin’s ultimate valuation—indicating its price when all coins are mined by 2140—Lee projected it would align with gold’s estimated $23 trillion market capitalization. This translates to at least $1.15 million per Bitcoin if there are 20 million coins in circulation.

He selected 20 million over 21 million due to assumed losses (lost keys, forgotten wallets) indicating that not every coin will ever be utilized. Lee further stated he envisions Bitcoin reaching $2 million or $3 million per coin. This would set his average “bull case” at $2.5 million, which represents a roughly 2,300% increase from the present levels.

Related Reading

Other Analyst Forecasts

Matthew Sigel, head of digital asset research at VanEck, also presents a long-term outlook. Based on what Sigel conveyed to investors, VanEck anticipates Bitcoin reaching $3 million by 2050. This prediction aligns with Lee’s concept of Bitcoin equalling or even surpassing gold in the future. Both predictions assume consistent growth in demand, along with broader adoption by major institutions such as hedge funds or pension plans.

Featured image from Gemini, chart from TradingView

Source link

“`