“`html

Reasons to believe

Rigorous editorial standards emphasizing precision, relevance, and neutrality

Developed by field specialists and thoroughly evaluated

The utmost standards in journalism and publishing

Rigorous editorial standards emphasizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin persists in demonstrating signs of tenacity in the $95,000 area, recovering from recent lows and striving to restore its bullish framework after a tumultuous April. The monthly candlestick for April on the CME Futures chart currently indicates a robust bullish engulfing pattern, which, if maintained into the weekly close, might deliver the market with bullish momentum to conclude May with another bullish candle.

The prospect of this bullish closure is sufficient to influence the attitude among bearish supporters, per crypto analyst Tony “The Bull” Severino.

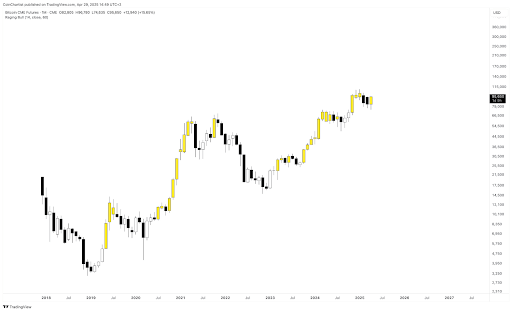

Raging Bull Tool Signals Activation On CME Futures

Bitcoin’s price dynamics in the last two weeks has been favorable and has observed a previously declining bullish sentiment gradually returning among crypto traders. Notably, this price activity has also revealed Bitcoin’s net taker volume turning positive for the first time in a considerable duration. Although the trend is still at an early phase, the reinvigorated strength is already starting to mitigate some of the more pessimistic perspectives, especially as vital indicators begin to shift.

Related Literature

Tony “The Bull” Severino, a prominent crypto analyst, recently disclosed on social media platform X that his exclusive “Raging Bull” signal has been activated again. However, this indication has only reactivated on the Bitcoin CME Futures chart, not the spot BTC/USD chart.

The disparity between CME Futures and the spot chart, with only the former indicating this bullish signal, has added depth to Bitcoin’s current outlook. The Raging Bull tool, which utilizes weekly pricing data, is designed to identify initial stages of significant upward movements. According to Severino, the emergence of this signal, despite maintaining a bearish view, suggests a substantial change in market structure may be unfolding. Nevertheless, he quickly noted that a confirmed weekly close is still required before any solid conclusions can be drawn.

Pivotal Break Above This Level

Analyzing the monthly chart provided by the analyst, the bullish engulfing candlestick is distinctly observable following a rapid rebound from April’s lows beneath $83,000. Bitcoin initiated the month of April at approximately $83,000, but a sharp decline during the initial days drove the price down until it reached a low point near $75,000. Nonetheless, the current April candlestick not only negates March’s losses but also signifies rising interest in Bitcoin from institutional investors on the CME platform.

Related Literature

However, despite the reassuring candlestick pattern, Bitcoin must decisively surpass the $96,000 to $100,000 range, where prior uptrends have faltered. This level is serving as a barrier that could ascertain whether the recent bullish energy persists or halts. A failure to close above this interval, whether on the weekly or monthly scope, could negate the Raging Bull signal.

Furthermore, the Raging Bull indicator must be reactivated on the spot BTCUSD chart to affirm a robust bullish perspective. This can solely occur if Bitcoin effectively breaks significantly above $96,000.

At the moment of writing, Bitcoin is priced at $94,934.

Featured image from Pixabay, chart from Tradingview.com

Source link

“`