“`html

Reasons to have faith

Rigorous editorial standards concentrating on precision, relevance, and neutrality

Developed by sector specialists and thoroughly examined

The utmost standards in journalism and publishing

Rigorous editorial standards concentrating on precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is trading at pivotal levels after numerous days of attempting to decisively surpass the essential $155–$160 resistance area. Bulls are gradually gaining traction, as the wider crypto market exhibits signs of strength and suggests a potential for a prolonged rally. Nevertheless, global uncertainties remain heightened, especially since there is no clear resolution in the ongoing US-China trade dispute, which continues to influence macroeconomic sentiment and investor activity.

Related Reading

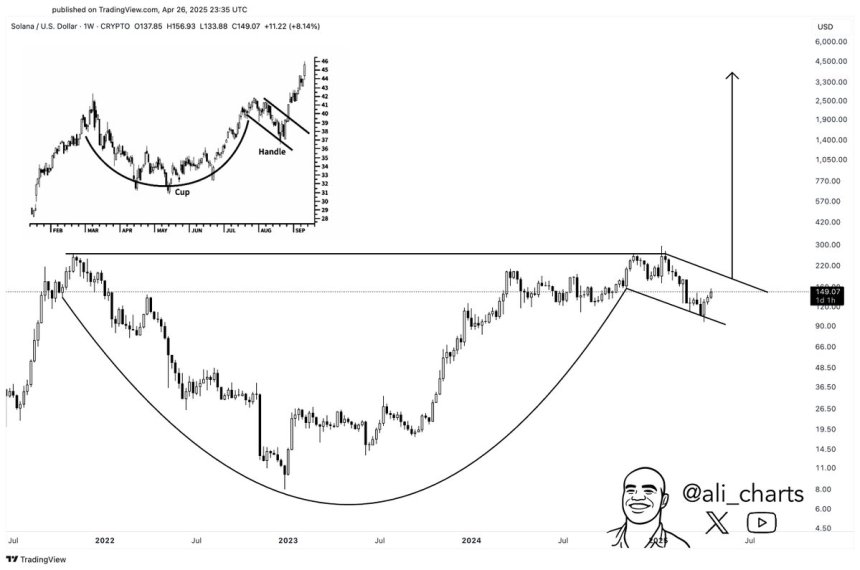

In spite of the uncertain environment, technical metrics are starting to support a bullish forecast for Solana. Leading analyst Ali Martinez shared fresh insights, indicating that when viewed from a broader perspective, Solana seems to be forming an ideal cup and handle pattern—a traditional technical setup typically linked to significant bullish breakouts. If validated, this configuration could pave the way for a substantial upward movement in the forthcoming weeks.

Still, vigilance is necessary, as the wider market volatility and unresolved geopolitical tensions could hinder the developing momentum. The next few days will be crucial for Solana’s trend, as bulls must safeguard key levels and generate sufficient pressure to make a genuine breakout above resistance.

Solana Exhibits Resilience Amid Changing Market Conditions

Solana has risen 58% since early April, demonstrating remarkable recovery momentum as market conditions begin to shift. After a lengthy period of weakness and selling pressure, Solana is now emerging as one of the stronger contenders among prominent altcoins. Analysts are attentively monitoring the $160 threshold, with many predicting a decisive breakout that could unlock additional gains. However, risks continue to be significant. The broader macroeconomic landscape remains unstable, with global trade disputes and financial market volatility impacting investor sentiment.

Solana has proven particularly responsive to this ambiguity. Since January, SOL has lost over 65% of its value, underscoring the increasing selling pressure and speculative behavior that prevailed in the market during the first quarter of 2025. Despite this, the recent upswing has pivoted short-term momentum back in favor of the bulls, providing hope for a more comprehensive recovery if key levels are regained.

Martinez’s evaluation supports a bullish outlook for Solana. He notes that zooming out reveals Solana is forming a textbook-perfect cup and handle formation. This classic technical arrangement frequently precedes strong upward movements, particularly when paired with increasing volume and favorable macro conditions. If validated, this setup could signify the onset of a major rally for SOL in the coming weeks.

Related Reading

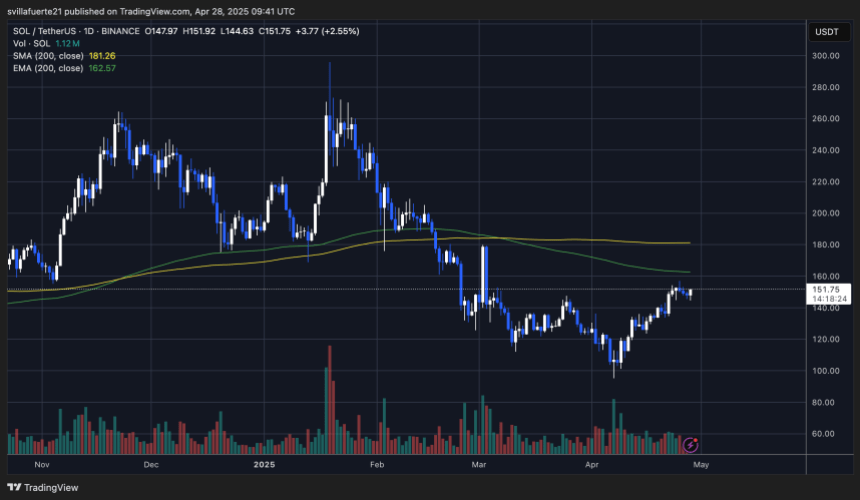

SOL Price Movement Remains Tight Beneath Key Resistance

Solana (SOL) is trading at $151 after several days of consolidation below the significant $160 resistance zone. Bulls have succeeded in defending recent gains, but momentum has decelerated as the price struggles to rise further. Reclaiming the $160 threshold is crucial for bulls to regain complete control and continue the recovery. A clear breakout above $160 could initiate a rally towards the $180 level, which aligns with the 200-day moving average (MA)—a vital technical barrier that, if converted into support, would affirm a robust trend reversal.

However, risks remain significant if bulls do not swiftly reclaim the $160 resistance. A failure at this level could expose SOL to a deeper correction, potentially pulling the price back toward the $120–$100 support threshold. This could not only nullify recent gains but also negatively impact market sentiment, hampering Solana’s recovery endeavors.

Related Reading

For now, consolidation just below resistance indicates that buyers are striving to accumulate strength. However, the next few days will be crucial in determining whether SOL can break upward or enter another corrective phase. All attention remains on the $160 breakout level as the contest between bulls and bears escalates.

Featured image from Dall-E, chart from TradingView

Source link

“`