“`html

Institutional possession of Bitcoin has risen dramatically over the last year, with approximately 8% of the complete supply now controlled by significant entities, and that figure continues to grow. ETFs, publicly listed firms, and even national governments have started acquiring substantial stakes. This prompts essential inquiries for investors. Is this increasing institutional involvement beneficial for Bitcoin? And as more BTC becomes stored in cold wallets, treasury assets, and ETFs, is the reliability of our on-chain data diminishing? In this analysis, we examine the data, track the flow of capital, and investigate whether Bitcoin’s decentralized principle is genuinely under threat or simply undergoing evolution.

The New Whales

Let’s begin with the Treasury of Publicly Listed Companies table. Major corporations, including Strategy, MetaPlanet, and others, have collectively amassed over 700,000 BTC. Given that the total capped supply of Bitcoin is 21 million, this accounts for roughly 3.33% of all BTC that will ever be created. Although that supply limit won’t be reached within our lifetimes, the consequences are evident: institutions are making long-range investments.

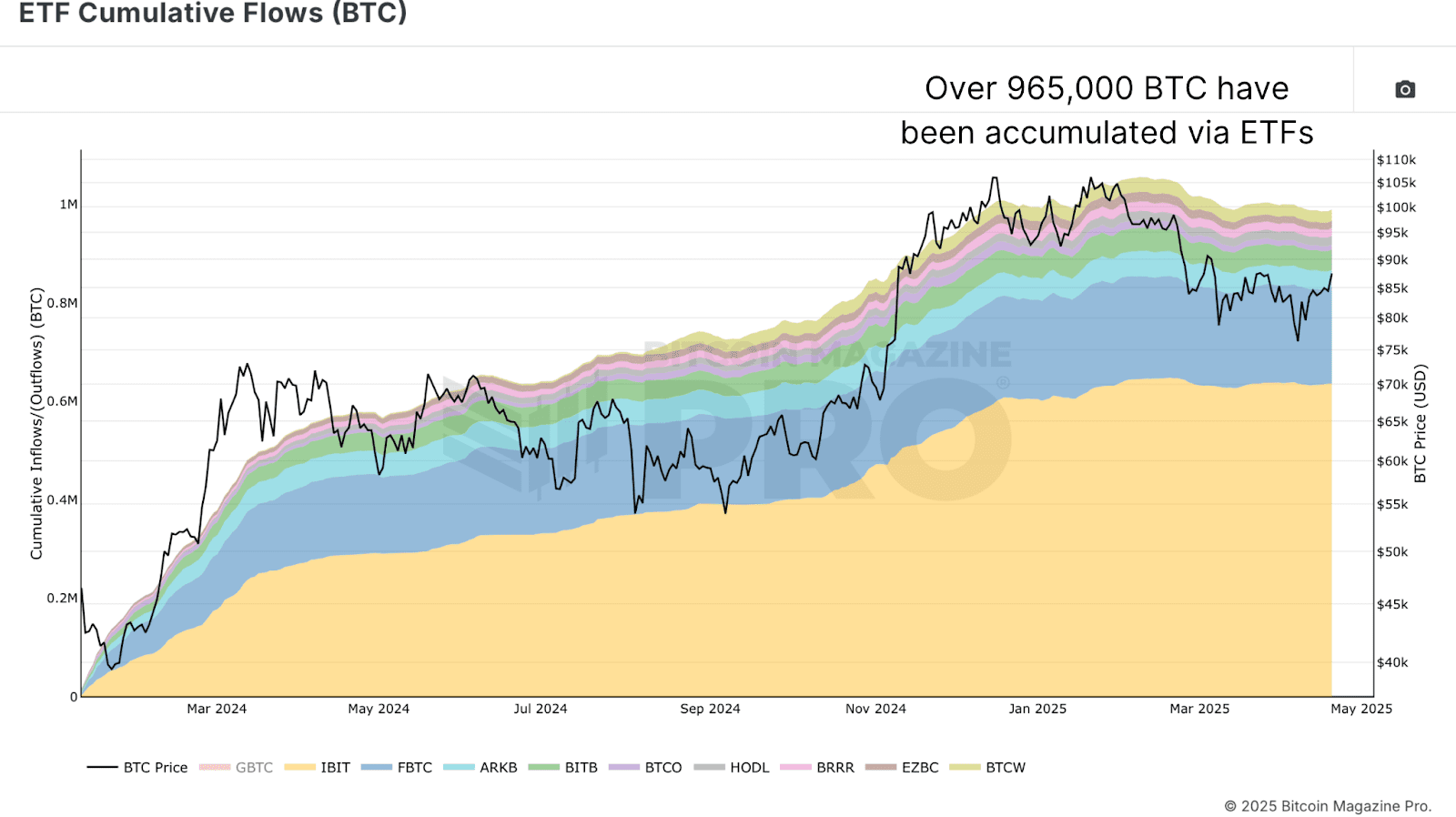

In addition to direct corporate investments, we observe from the ETF Cumulative Flows (BTC) chart that ETFs now control a considerable portion of the market as well. At the time of this writing, spot Bitcoin ETFs possess approximately 965,000 BTC, just under 5% of the total supply. This figure varies slightly but remains a significant factor in everyday market fluctuations. When we merge corporate treasuries with ETF holdings, the total exceeds 1.67 million BTC, or roughly 8% of the total theoretical supply. However, the narrative extends further.

Beyond Wall Street and Silicon Valley, some governments have also become active participants in the Bitcoin domain. Through sovereign acquisitions and reserves under initiatives like the Strategic Bitcoin Reserve, nation-states collectively hold around 542,000 BTC. When combined with earlier institutional holdings, we reach over 2.2 million BTC in the possession of institutions, ETFs, and governments. On the surface, this amounts to approximately 10.14% of the complete 21 million BTC supply.

Forgotten Satoshis and Lost Supply

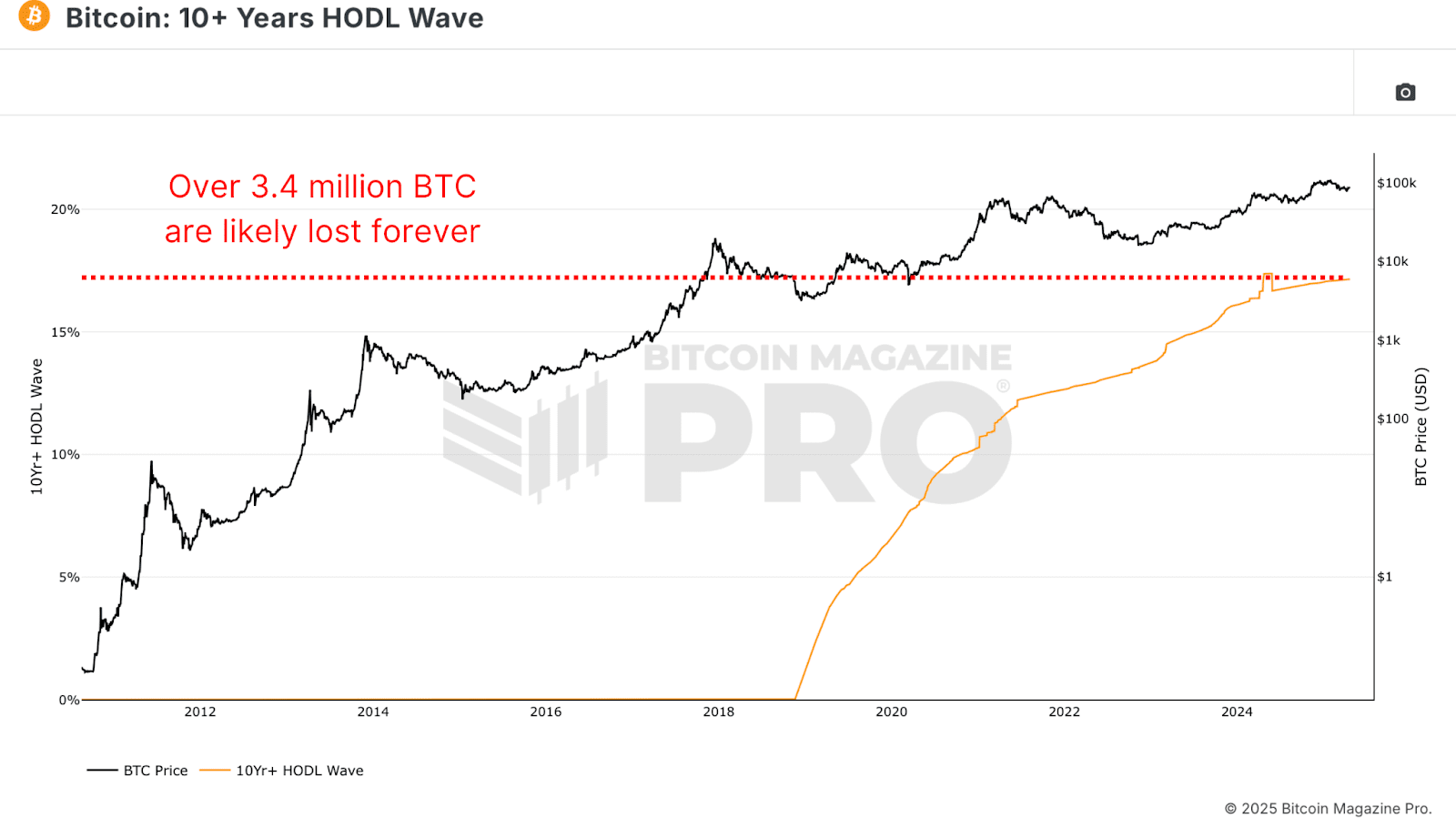

Not all 21 million BTC are genuinely accessible. Assessments based on 10+ Years HODL Wave data, which tracks coins that have remained stagnant for a decade, indicate that over 3.4 million BTC could be permanently lost. This figure includes Satoshi’s wallets, early mining-era coins, forgotten phrases, and even USBs buried in landfills.

With around 19.8 million BTC currently circulating and an estimated 17.15% believed to be lost, the effective supply is closer to 16.45 million BTC. This significantly alters the figures. When evaluated against this more realistic supply, the share of BTC held by institutions rises to approximately 13.44%. In other words, about one in every 7.4 BTC available on the market is currently held by institutions, ETFs, or sovereigns.

Are Institutions Controlling Bitcoin?

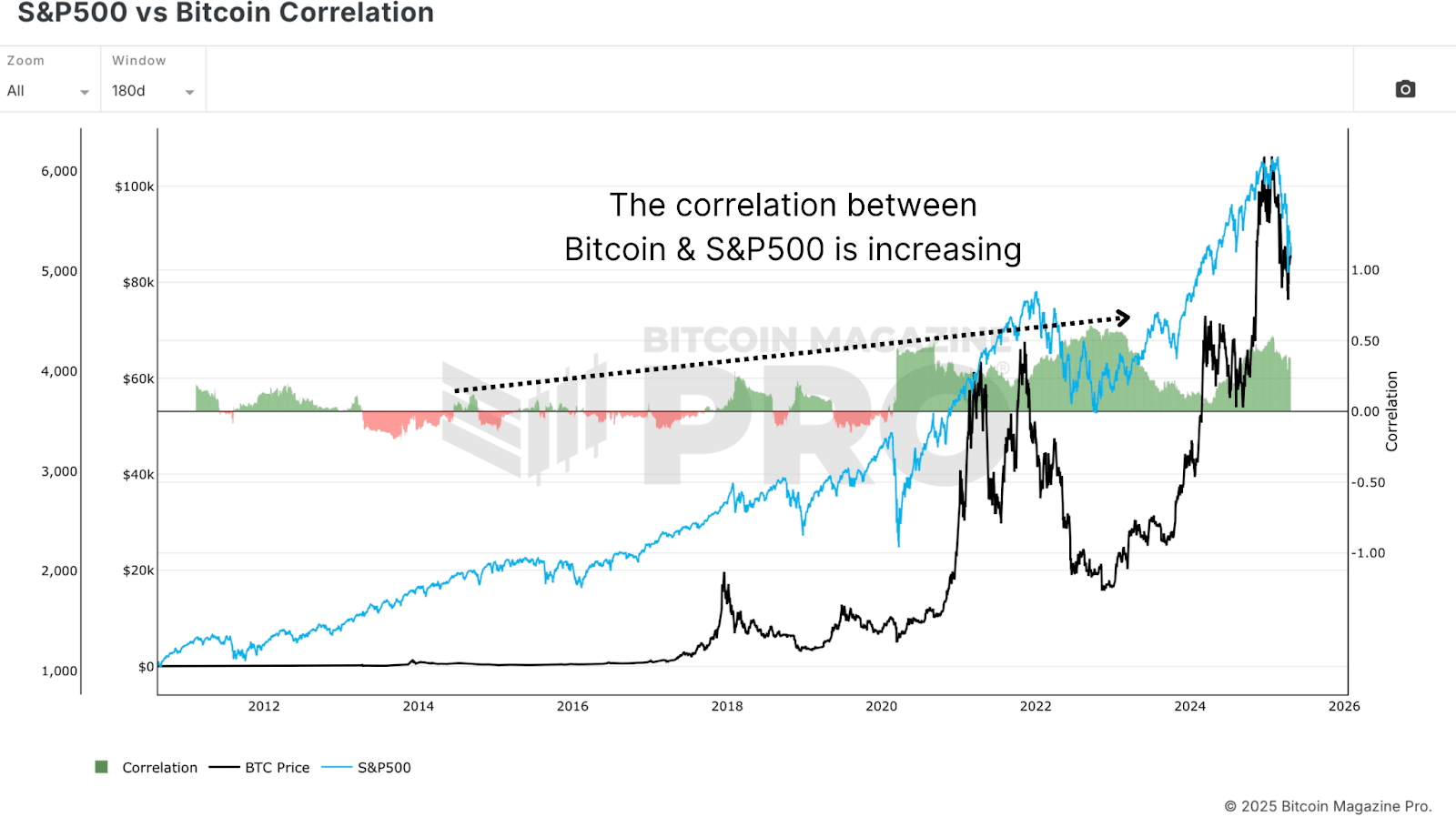

Does this imply that Bitcoin is being governed by corporations? Not at this point. However, it does indicate an increasing influence, particularly concerning price behavior. The S&P 500 vs Bitcoin Correlation chart shows that the correlation between Bitcoin and traditional stock indices like the S&P 500 or Nasdaq has tightened considerably. As these large entities enter the market, BTC is increasingly perceived as a “risk-on” asset, suggesting its price tends to rise and fall with broader investor sentiment in conventional markets.

This can prove advantageous in bull markets. When global liquidity increases and risk assets perform well, Bitcoin stands to gain larger inflows than before, particularly as pensions, hedge funds, and sovereign wealth funds start allocating even a small fraction of their portfolios. Yet there’s a trade-off. As institutional involvement deepens, Bitcoin becomes increasingly reactive to macroeconomic factors. Central bank policies, bond yields, and stock volatility begin to gain significance more than ever before.

Despite these transformations, over 85% of Bitcoin remains outside institutional ownership. Retail investors continue to hold the vast majority of the supply. And while ETFs and company treasuries may hoard substantial amounts in cold storage, the market retains its broad decentralization. Critics contend that on-chain data is becoming less valuable. After all, if so much BTC is sequestered in ETFs or inactive wallets, can we still draw precise conclusions from wallet activities? This

“`

the apprehension is reasonable, yet not unprecedented.

Need for Modification

Traditionally, a significant portion of Bitcoin’s trading has taken place off-chain, particularly on centralized platforms like Coinbase, Binance, and (in the past) FTX. These transactions seldom appeared on-chain in substantial manners but still impacted pricing and market dynamics. Currently, we encounter a comparable scenario, but with enhanced tools. ETF inflows, corporate disclosures, and even state purchases fall under disclosure regulations. Unlike opaque trading venues, these institutional entities frequently need to reveal their assets, furnishing analysts with abundant data for monitoring.

Additionally, on-chain analytics is not fixed. Instruments like the MVRV-Z score are advancing. By concentrating on a specific aspect, for instance, an MVRV Z-Score 2YR Rolling average instead of comprehensive historical statistics, we can more accurately reflect current market behaviors without the interference of long-forgotten coins or dormant supply.

Conclusion

In conclusion, institutional interest in Bitcoin has reached unprecedented heights. With ETFs, corporate reserves, and governmental bodies, over 2.2 million BTC are already accounted for, and that figure continues to rise. This influx of capital has certainly had a stabilizing influence on prices during downturns. However, along with that stability comes interconnection. Bitcoin is increasingly linked to conventional financial frameworks, amplifying its correlation with equities and overall economic sentiment.

Nevertheless, this does not indicate a demise for Bitcoin’s decentralization or the importance of on-chain analytics. In fact, as more BTC is held by identifiable institutions, the capacity to monitor flows becomes even more refined. The retail presence remains significant, and our tools are becoming more intelligent and agile in response to market changes. Bitcoin’s core principle of decentralization isn’t jeopardized; it’s simply evolving. And as our analytical frameworks progress alongside the asset, we’ll be thoroughly prepared to handle whatever lies ahead.

For additional in-depth research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article serves informational purposes only and should not be interpreted as financial guidance. Always conduct your own research prior to making any investment choices.