“`html

Bitcoin is presently priced over $93,000, demonstrating resilience following several weeks of fluctuation and stabilization. The most recent breakout indicates that bulls are asserting their dominance, with momentum shifting towards a sustained upward movement. Nonetheless, macroeconomic unpredictability continues to obscure market sentiment, with experts divided on future trends. Some contend this signals the onset of a recovery phase, while others caution that the most severe parts of the correction may still be forthcoming.

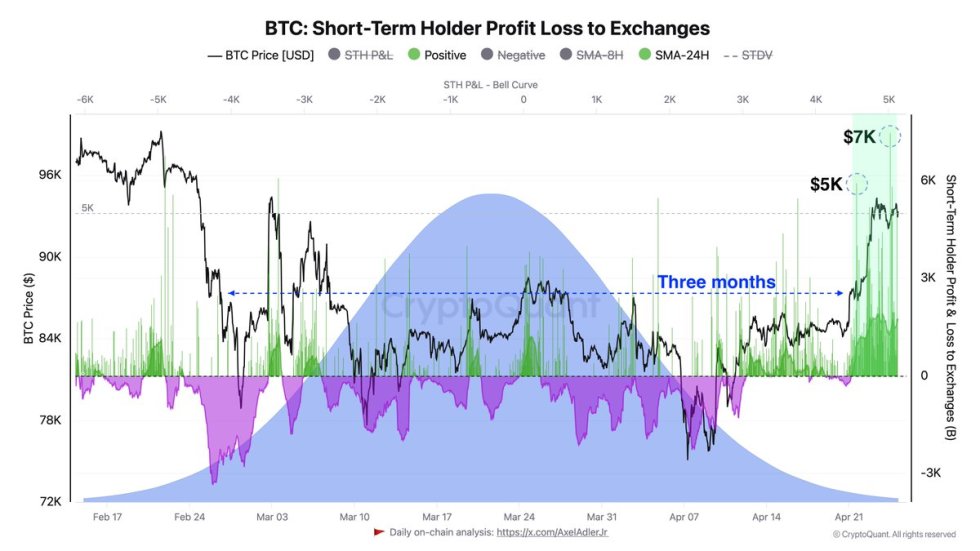

Compounding the conflicting signals, newly released information from CryptoQuant indicates that short-term investors—those who have experienced losses for the previous three months—are now actively liquidating their holdings. This surge of profit-taking seems to have momentarily hindered Bitcoin’s upward path, acting as a barrier precisely as bulls endeavor to reclaim the $95K–$100K range. Historically, this kind of selling activity from short-term investors typically occurs during periods of fragile optimism, potentially stalling growth until a stronger belief re-emerges.

At present, all attention is focused on Bitcoin’s capacity to sustain support above $90K and decisively surpass the $95K threshold. Whether the ongoing momentum culminates in a complete recovery or encounters another obstacle may rely on broader economic circumstances and the extent of selling pressure exerted by short-term holders.

Bitcoin Investors Target $100K Amid Geopolitical Strain

Bitcoin is presently trading 14% beneath its historic peak, yet bullish momentum is gathering as the price steadily nears the $100,000 psychological mark. After rebounding from recent lows, market sentiment has enhanced—albeit risks persist. The ongoing trade conflict between the US and China, exacerbated by increasing tariffs and escalating economic pressures, continues to unsettle global financial markets. If unresolved, the clash could disturb supply chains and heighten volatility, leading investors to exercise caution in both traditional and cryptocurrency markets.

In spite of these challenges, there is hope that a diplomatic resolution may restore investor confidence and ignite a wider financial recovery. Bitcoin, frequently perceived as a macro hedge, could gain considerably from such a transformation.

Prominent analyst Axel Adler provided timely perspectives on X, observing that short-term investors—those who have been in the red over the past three months—have recently started to liquidate their positions. This trend has momentarily decelerated Bitcoin’s ascent. However, Adler notes that exchange demand has fully absorbed this sell-off during the last three days, indicating sustained robust market interest.

The $96,000 threshold remains a vital obstacle. It symbolizes the average entry price of short-term investors with holdings aged 3–6 months, marking it as a critical resistance zone. A clear breach above this level would likely instigate further gains and set the stage for new historic highs.

BTC Price Forecast: Key Levels To Monitor

Bitcoin is presently trading at $93,700 as bulls strive to reclaim the $95,000 resistance point and extend the recent surge. After increasing over 25% since early April, momentum remains robust, and traders are closely observing whether BTC can preserve its course towards the $100K milestone. However, despite this enthusiasm, some analysts are cautioning that a healthy retracement might be necessary before additional upward movement.

Technical indicators suggest that a pullback to the $89K–$91K range could provide the support necessary to trigger another upward movement. If BTC remains above the $92K level, analysts believe the probability of a breakout above $95K increases significantly, as this level acts as a crucial barrier to unlocking new peaks.

On the contrary, if BTC fails to protect $92K, a more profound correction may ensue, potentially driving the price back toward the 200-day moving average near $88,000—a level that has historically served as a dynamic support zone during times of consolidation. Presently, bulls maintain control, but short-term price fluctuations around $92K–$95K will likely dictate whether Bitcoin is poised for acceleration or a downturn.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is focused on providing thoroughly investigated, precise, and impartial content. We adhere to stringent sourcing standards, and each page undergoes thorough review by our team of leading technology experts and experienced editors. This protocol ensures the integrity, relevance, and worth of our material for our audience.

Source link

“`