Reasons to have faith

Rigorous editorial framework centered on precision, significance, and neutrality

Developed by field specialists and thoroughly assessed

Upholding the utmost standards in journalism and dissemination

Rigorous editorial framework centered on precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is trading at values nearly 40% lower than its predicted “energy value,” yet a rare convergence of technical, fundamental, and policy indicators indicates that the market might be shifting, according to Charles Edwards, the founder of Capriole Investments, a quantitative crypto hedge fund. In his recent newsletter, Edwards asserts that a newly-established “Triple Put”—concurrent safeguards from the White House, the Federal Reserve, and the US Treasury—has changed the risk dynamics for all risk assets just as on-chain and macro indicators for Bitcoin decisively trend upward.

Bitcoin Turns Bullish

Edwards starts with market sentiment, describing it as “in the depths.” He notes that the American Association of Individual Investors’ bull–bear gap is “as pessimistic as 2009 and the lows of 2022, and considerably worse than during the 2020 Covid crash,” even though both Bitcoin and the S&P 500 have decreased by less than fifteen percent from their recent highs.

The CNN Fear & Greed Index has recorded its darkest reading “in years,” while Capriole’s own Active Manager Sentiment measure indicates equity managers are at near-historic low levels of exposure. “To put it simply, investors are in a state of panic today,” he writes, cautioning that such extreme indicators “usually align at the mid-to-late phase of a significant price bottom.” This combination results in what Edwards describes as “blood (and fear) on the street,” echoing the Rothschild principle he cites in full: “the time to buy is ‘when there’s blood on the streets, even if the blood is your own.’”

Further Reading

Technically, Bitcoin recently exhibited a sharp turnaround. A breakout candle to $94,000 recaptured the entire $91,000–$100,000 range that had restricted the market since February. Edwards categorizes the movement as a “significant range reclaim,” adding that “for Bitcoin, such bullish range claims infrequently look back at pricing.”

Unless the market produces “a daily close below $91K,” he writes, “it’s difficult to obtain a technical chart that is more optimistic than this.” The breakout aligns with his firm’s machine-learning fundamentals model, the Bitcoin Macro Index, suggesting a positive outlook after months of neutrality. The index incorporates over seventy on-chain, macro-economic, and equity-market metrics; price is intentionally excluded to prevent feedback loops. Last week, the model “reset to ‘fair value’ and then resumed a bullish trajectory,” a transition Edwards describes as “a very encouraging fundamental data reading.”

The ‘Triple Put’

Policy advancements present the third aspect of the narrative. On April 2—the so-called “Liberation Day”—the United States enacted extensive global tariffs, only to reduce them and implement a 90-day pause after equities declined by approximately fifteen percent, the VIX surpassed 30, and credit spreads widened.

Edwards characterizes the swift reversal as the initiation of the “Trump Put,” indicating that “if markets fall excessively, Trump will intervene, implement policy, and support them.” The day before, on April 1, the Federal Reserve commenced reducing the speed of quantitative tightening by 95% (the “Fed Put”), effectively concluding a four-year contraction of the balance sheet; derivatives traders utilizing the CME FedWatch tool now allocate the base-case to three rate cuts before the end of the year.

Further Reading

Simultaneously, Treasury Secretary Scott Bessent informed reporters that the decline in Treasuries was driven by deleveraging rather than foreign divestment and that the department “possessed tools to alleviate the situation, including boosting buybacks if required” (“Treasury Put”).

Edwards wraps up by stating that “we currently possess three major financial market supports, all prepared to undergird financial markets. Collectively, the US President, Federal Reserve, and US Treasury constitute the Triple Put,” an unparalleled volatility support in its extent.

Is BTC Mispriced?

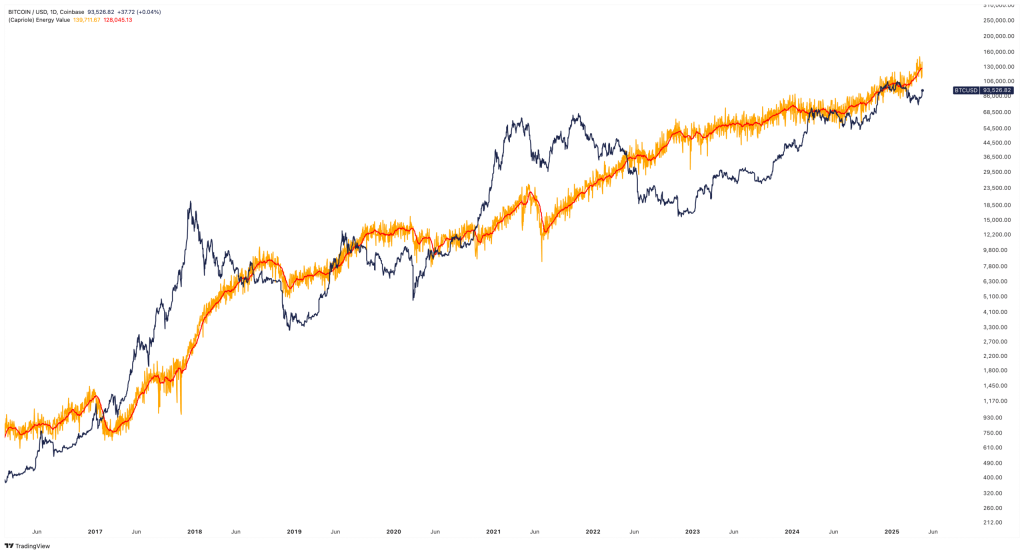

Capriole’s own “Chart…

of the Week” highlights the valuation perspective. The Bitcoin Energy Value—an internal measure that evaluates the network based on total miner electricity usage—spiked above $130,000 for the first occasion this month.

With the spot market trading close to $94,000, Bitcoin currently stands at an “approximately 40% discount to intrinsic value,” a level of undervaluation that Edwards refers to as “rather unusual” in the initial year post-halving and “a very encouraging sight.” Historically, the energy value has influenced price direction; discrepancies of this magnitude have decreased in every past cycle.

Edwards tempers the optimistic scenario with warnings. “Political and volatility risks persist, and alterations in policy pose the greatest threat to market stability at present,” he notes, specifying that Capriole will monitor Bitcoin’s ability to maintain $91,000 on a weekly close and for the Macro Index to continue its expansion.

Nonetheless, his overall sentiment is undeniably positive: “As it stands now, the outlook for Bitcoin is extremely bullish, with alignment across technical indicators, fundamentals, and market sentiment,” he concludes. If the week concludes above current figures, Edwards “believes we will be approaching new all-time highs for Bitcoin very soon.”

At the time of reporting, BTC was priced at $93,723.

Featured image produced with DALL.E, chart from TradingView.com