Reasons to rely on

Rigorous editorial standards emphasizing precision, relevance, and neutrality

Developed by field specialists and thoroughly evaluated

The utmost standards in journalism and publication

Rigorous editorial standards emphasizing precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has experienced the vast majority of the last 24 hours in a remarkable surge that saw its value peak at an intraday high of $94,320. This upswing signifies an intriguing shift from the narrow consolidation range between $80,000 and $85,000 that characterized Bitcoin’s movement throughout much of April.

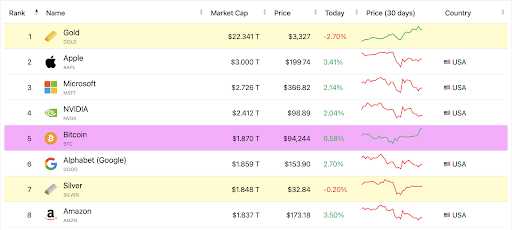

This breakout is supported by a notable increase in institutional engagement via Spot Bitcoin ETFs, which noted their highest daily inflows since January. Curiously, this influx has propelled Bitcoin into the top five largest assets worldwide, eclipsing Alphabet, Silver, and Amazon in market valuation.

Spot Bitcoin ETFs Witness Largest Inflows Since January

According to data from SoSoValue, US-centered Spot Bitcoin ETFs garnered $936.43 million in net inflows on Tuesday, April 22 alone, representing their best single-day achievement since January 17, when they recorded $1.08 billion. Wednesday, April 23 also saw a similar performance, accruing inflows of $916.91 million.

Related Reading

BlackRock’s iShares Bitcoin Trust (IBIT) took the lead with a remarkable $643.16 million in inflows, closely followed by Ark & 21 Shares’ ARKB with $129.5 million. Additionally, Spot Bitcoin ETFs have now achieved four consecutive days of inflows exceeding $100 million. The last occurrence of such activity was in the final week of January.

These inflows into Spot Bitcoin ETFs come on the heels of a weeks-long lull in ETF activity, which left many traders questioning the longevity of institutional interest. Nevertheless, the timing of these inflows couldn’t be more critical. Bitcoin’s price ascended alongside the recent ETF activity, illustrating the strong influence these ETFs have had on the spot price of Bitcoin.

BTC Overtakes Amazon And Google To Become Fifth Largest Asset Globally

The ETF inflows ignited the momentum, and the subsequent market reaction propelled Bitcoin’s ascent up the global rankings. As per data from CompaniesMarketCap, Bitcoin’s overall market worth rose to over $1.87 trillion as it crossed the $94,000 threshold for the first occasion in eight weeks.

Related Reading

This captivating movement enabled it to surpass both Google (Alphabet) and Amazon in market cap standings, particularly as these stock values have shown a significant downturn over a 30-day period.

This evolution places BTC not only as a premier cryptocurrency but also as a top macroeconomic asset, contending on the international arena with conventional tech and commodity behemoths. Presently, Bitcoin is outperforming the NASDAQ 100, and analysts are indicating signs of decoupling from established indices.

With Bitcoin now trading above $90,000 again, the next focus shifts to its path forward. The bullish trend appears targeted towards the $100,000 price point, and whether BTC can surpass this mark before the month concludes. However, the $94,000 area is starting to form as an initial resistance level, and short-term taking of profits could trigger pullbacks that might liquidate purchase orders.

Featured image from Pixabay, chart from Tradingview.com