Bitcoin is reviving after weeks of stability and is currently testing crucial resistance levels, exhibiting signs of revitalized strength just as equities continue to decline. Global tensions, fueled by concerns of an escalating trade conflict between the U.S. and China, are reshaping the financial arena. Amidst this volatility, Bitcoin seems to be altering its behavior, rising even as the US stock market falters. This divergence has captured the attention of analysts and investors alike.

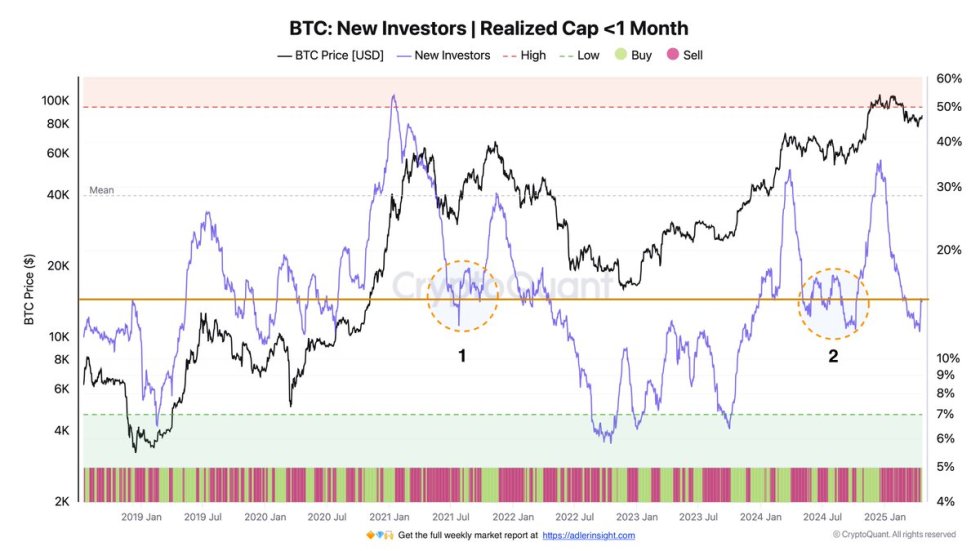

Bulls are becoming increasingly hopeful, anticipating a substantial uptick as selling pressure starts to lessen and the market adapts to the new macroeconomic context. One of the most encouraging indicators comes from crypto analyst Axel Adler, who indicated that new investors have started to enter the market. According to Adler, the metric monitoring this trend over the past 10 days has signaled a Buy.

If past trends offer any clues, this could be a significant turning point for Bitcoin. All eyes are now focused on BTC to observe whether this initial momentum can evolve into a complete recovery.

Bitcoin Restores $88K As New Investors Join

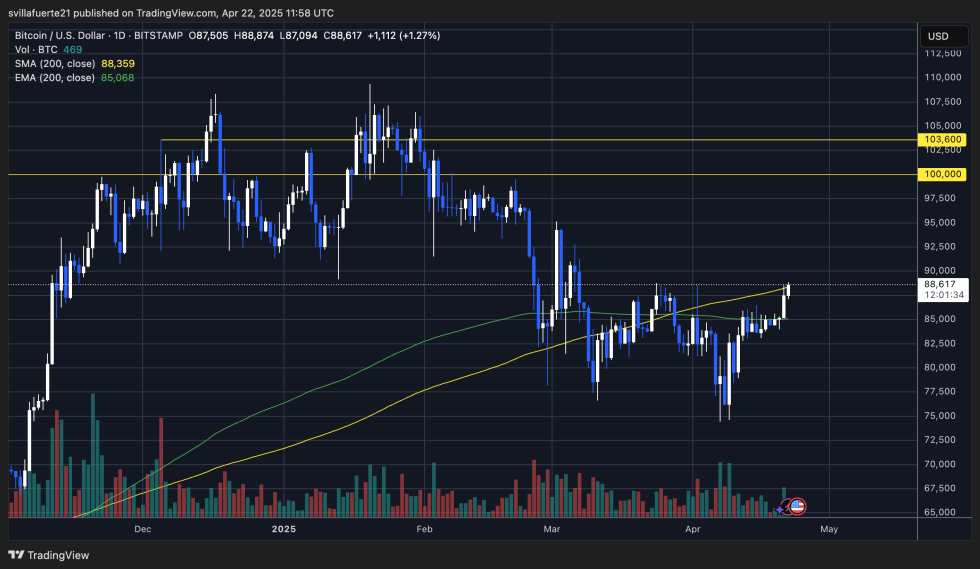

Bitcoin is once again in the limelight after regaining the $88,000 threshold earlier today, surpassing short-term peaks and indicating renewed enthusiasm from bulls. While this movement injects optimism into a market ravaged by uncertainty, it still lacks confirmation of a complete bullish reversal. For that to occur, BTC must reclaim higher resistance boundaries and demonstrate its strength beyond $90,000. Until then, the struggle between bulls and bears remains very much active.

The context of this surge is intricate. Global financial markets continue to teeter as trade tensions between the US and China escalate. With tariffs rising and diplomatic rhetoric intensifying, investors are on the lookout for safe havens—or, in Bitcoin’s case, speculative shields that can flourish in times of macro instability.

Building on the bullish narrative, Axel Adler shared persuasive data indicating that new investors have commenced entering the market. The metric tracking newcomer activity has flashed a Buy signal for the past 10 days. Similar trends were observed during significant past corrections—following China’s 2021 mining ban and again during the $65K market cooldown—both of which preceded notable recoveries.

Adler also noted that in light of President Trump’s bold calls for rate cuts and mounting pressure on Fed Chair Jerome Powell, investing in risk assets like Bitcoin may now seem increasingly logical. As the macroeconomic narrative continues to evolve, Bitcoin’s performance in the days ahead could act as a barometer for broader investor sentiment—and possibly mark the next chapter in this market cycle.

Price Action Highlights: Essential Levels To Monitor

Bitcoin is presently trading just below a significant resistance zone, striving to achieve a clean breakout above the 200-day Simple Moving Average (SMA) around $88,400. After regaining the $87K level, bulls are currently aiming for $89K in what could become a crucial movement for short-term momentum. A successful advance above this level—and particularly a reclaiming of $90K—would serve as a strong validation of a bullish breakout and the commencement of a broader recovery rally.

However, investor sentiment remains wary. Macroeconomic unpredictability, propelled by global trade disputes and poor performance in traditional markets, continues to impact risk assets. Numerous traders still anticipate additional declines, rendering this resistance area especially vital for Bitcoin’s trajectory.

If BTC fails to breach $89K in the upcoming sessions, a retreat below the 200-day SMA could signify weakness and possibly initiate another downward movement. In such a scenario, Bitcoin might revisit the $85K or even $82K thresholds as bulls regroup. For the moment, the market is watching intently—BTC is positioned at a critical juncture, and the upcoming days may determine the course for the remainder of the quarter.

Featured image courtesy of Dall-E, chart from TradingView

Editorial Process for bitcoinist focuses on providing thoroughly researched, precise, and impartial material. We adhere to stringent sourcing criteria, and each page undergoes exhaustive review by our team of leading technology experts and seasoned editors. This process guarantees the integrity, relevance, and value of our content for our audience.