Justifications for confidence

Rigorous editorial standards concentrating on precision, relevance, and neutrality

Developed by specialists in the field and thoroughly evaluated

The utmost criteria in journalism and publishing

Rigorous editorial standards concentrating on precision, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

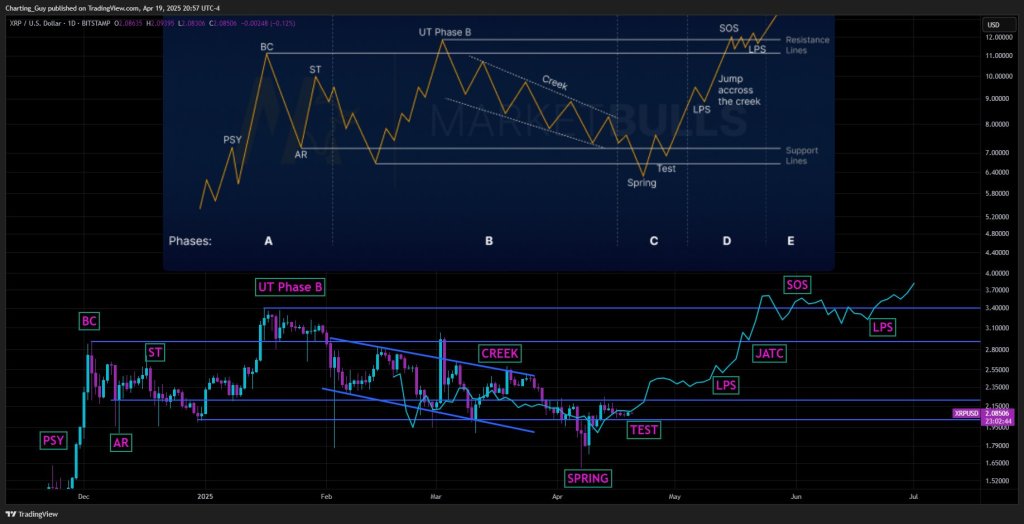

The cryptocurrency analyst Charting Guy (@ChartingGuy), posting on X on April 20, has traced the daily XRP/US Dollar chart on Bitstamp onto an archetypal Wyckoff re‑accumulation diagram, contending that the model is sufficiently advanced to indicate a summer markup towards— and possibly exceeding— the $3.70 mark.

“Wyckoff Pattern Fuels XRP Bullish Outlook

The chart encompasses the five‑month foundation that started with preliminary supply (PSY) in late November. An upward surge propelled the price up to a $2.68 Buying Climax (BC) in early December, which was swiftly followed by an Automatic Reaction (AR) that retraced back to approximately $1.90, establishing the lower limit of what would evolve into the Phase A trading range. A Secondary Test (ST) in mid‑December revisited the $2.72 territory, finalizing Wyckoff’s initial “stop‑action” process.

Phase B unfolded throughout January: demand was rebuilt, generating an Up‑Thrust (UT) in Phase B that briefly breached $3.40 in mid-January before supply reasserted itself. Following that peak, XRP traced a descending, low-angled channel—termed the “Creek”—with successively lower highs and lows into early April. Throughout this decline, Charting Guy’s overlay illustrates the familiar saw‑tooth of Wyckoff’s internal testing, implying weak-handed distribution instead of genuine distributional topping.

Related Reading

On April 7 the market dipped under range support, plummeting to around $1.61, and immediately rebounded: the classic Spring of Phase C. A light Test of the spring ensued near $2.00, fulfilling Wyckoff’s prerequisite for bullish affirmation. From that juncture, the analyst’s anticipated trajectory trends upward.

Phase D initiates with what Wyckoff referred to as Last Point of Support (LPS) between $2.35 and $2.55 in early May, succeeded by a sharper increase that breaks through the February apex. This is succeeded by a Jump Across The Creek (JATC)—a decisive thrust beyond the descending channel top and horizontal resistance at around $2.70.

The model then indicates that a price breakout above the mid-January high at $3.40 would represent the Sign of Strength (SOS) around $3.40 in late May, finalizing the move into Phase E. Subsequently, Charting Guy anticipates a second backing up into a first Last Point of Support (LPS) between $3.10 and $3.30 in mid-June, followed by a steeper advance.

Related Reading

In Phase E, the schematic speeds up, propelling XRP into the $3.70 range by early July—an objective that lies just above the $3.40 resistance band on the analyst’s price chart. With the spot price at $2.12 at publication, the roadmap suggests a potential increase of nearly 74% over the forthcoming two and a half months.

However, Charting Guy warns that “this doesn’t imply only upward movement now—timing could be slightly misaligned,” emphasizing Wyckoff’s probabilistic nature. Still, the careful correlation of real-world price behavior with the classical re‑accumulation stages—complete with labeled PSY, BC, AR, ST, UT, Spring, Test, LPS, JATC, and SOS—adds credibility to the bullish scenario. Should the market adhere to those technical milestones, XRP could soon experience prices not witnessed since the peaks of the previous cycle.

At the time of writing, XRP was trading at $2.11.

Featured image generated with DALL.E, chart from TradingView.com