After a significant price adjustment over the last three months, the Bitcoin bullish market remains precarious. Although there was a slight price increase in April, the leading cryptocurrency has yet to show a robust inclination to restart its bullish ascent due to a lack of favorable market conditions. Nonetheless, crypto analyst Axel Adler Jr. has pointed out an encouraging occurrence that could indicate substantial upside potential for Bitcoin.

Bitcoin Long-Term Holders Aiming To Reduce Selling Pressure

In a recent update on X, Adler Jr. discussed a significant change in the activity of Bitcoin long-term holders (LTH), which may have a notably positive impact on the larger BTC market.

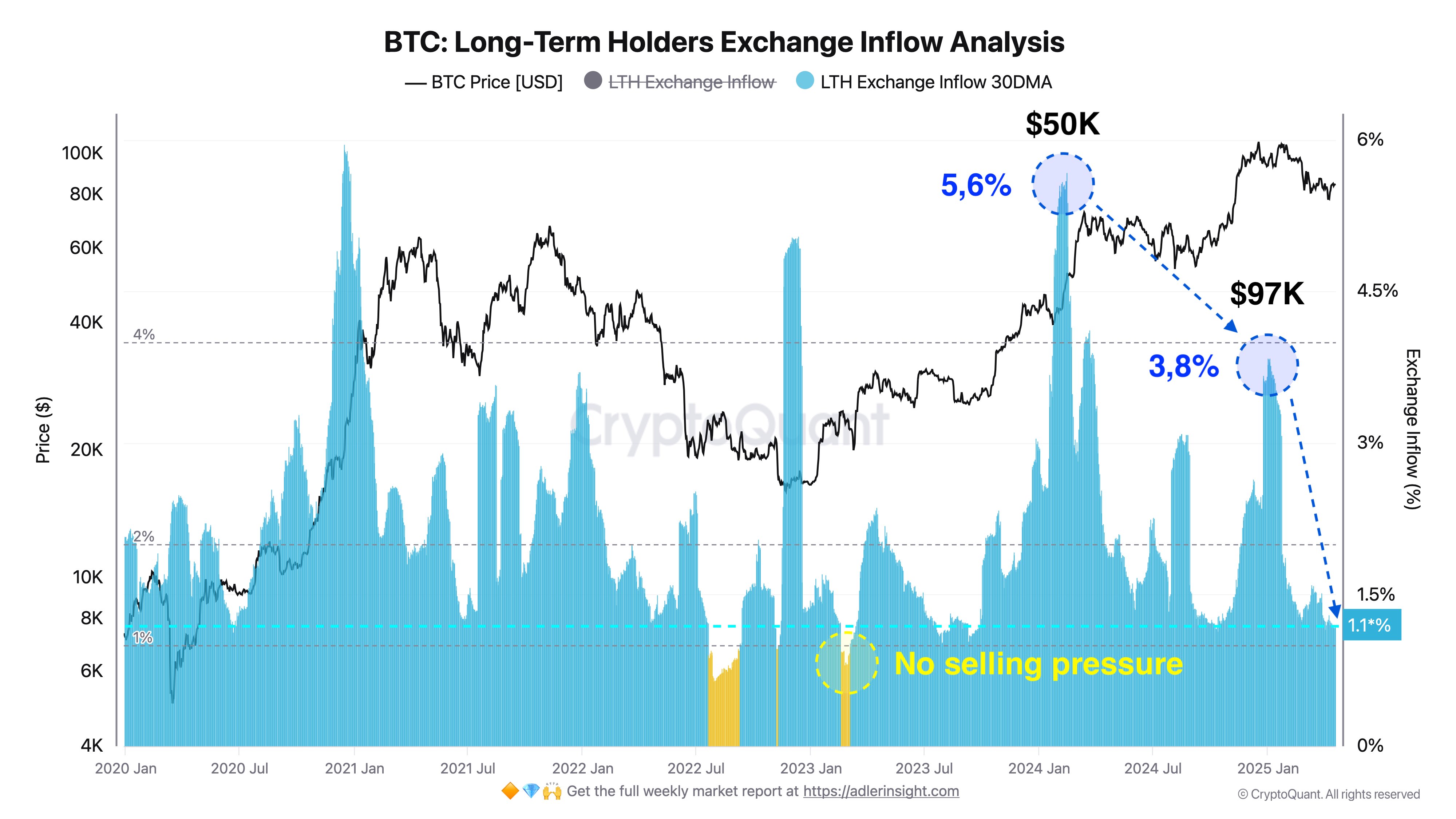

Leveraging on-chain insights from CryptoQuant, the reputable analyst notes that the selling pressure from long-term holders, specifically the percentage of LTH assets on exchanges, has dropped to its minimum at 1.1% over the last year. This situation suggests that Bitcoin LTH are currently opting to retain their investments instead of realizing profits.

Adler mentions that a further drop in these LTH exchange holdings to 1.0% would indicate the complete absence of selling pressure. Remarkably, this trend could encourage new market participation and sustained accumulation, generating significant bullish momentum in the BTC landscape.

Significantly, Adler points out that most Bitcoin LTH entered the market at an average value of $25,000. Since then, CryptoQuant has documented peak LTH selling pressure of 5.6% at $50,000 in early 2024 and 3.8% at $97,000 in early 2025.

According to Adler, these two moments likely signify the key profit-taking periods for long-term holders who planned to exit the market. Thus, a resurgence of selling pressure from this group of BTC investors in the short-term seems unlikely, which reinforces a burgeoning bullish narrative as long-term holders currently possess 77.5% of Bitcoin in circulation.

BTC Price Summary

As of the current moment, Bitcoin was valued at $85,226, having undergone a 0.36% increase in the last day and a 0.02% decrease over the past week. Both figures merely reflect the prevailing market consolidation as BTC continues to face challenges in achieving a definitive price breakout above $86,000.

Additionally, the asset’s performance over the monthly chart now shows a 1.97% uptick, suggesting a potential trend turnaround as the market correction comes to an end. However, BTC still requires a robust market catalyst to spark any lasting price rally. With a market capitalization of $1.67 trillion, Bitcoin stands as the foremost digital asset, commanding 62.9% of the crypto market.

Featured image from Adobe Stock, chart from Tradingview

Editorial Process at bitcoinist focuses on providing meticulously researched, factual, and impartial content. We adhere to rigorous sourcing standards, and each article is subjected to thorough review by our group of leading technology specialists and experienced editors. This procedure ensures the integrity, relevance, and quality of our material for our audience.