Bitcoin is maintaining its position above the $82,000 mark, exhibiting tenacity following weeks of fluctuation. Nevertheless, bulls have yet to regain the pivotal $88,000 resistance area, and the price movements remain uncertain. With no significant macroeconomic triggers in view, financial markets find themselves in a holding phase, awaiting further clarity before committing to a new direction.

Some experts caution that Bitcoin may persist in its recent downward trend, as global economic conditions stay frail. Trade disputes between the U.S. and China, ongoing inflation concerns, and delicate investor sentiment are all exerting pressure on overall market activity — including cryptocurrencies.

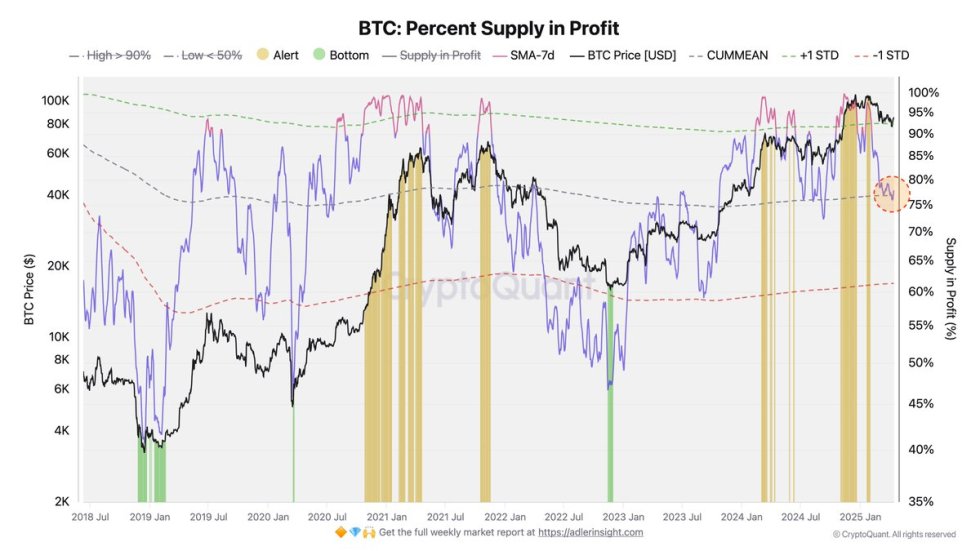

Data from CryptoQuant indicates that the Percent Supply in Profit metric reveals roughly 80% of the Bitcoin supply is currently in profit, whereas 20% is experiencing a loss. Historically, when this metric escalates to 95–98%, the market tends to overheat, often leading to significant profit-taking. The existing balance illustrates a decelerating market, but not fully in capitulation mode just yet.

Until Bitcoin surpasses $88K or loses support in the $81K-$80K range, traders may continue to observe lateral price movement and indecisive momentum in the upcoming days.

Bitcoin Remains Steadfast Amid Trade Conflicts

Bitcoin persists in demonstrating strength above the $82K threshold, though risks stay heightened as global macroeconomic challenges amplify. Strains between the United States and China are altering global trade forecasts, with uncertainty about tariffs and foreign policies continuing to heavily influence financial markets.

Although inflation is gradually abating, the instability of the US stock market might soon lead the Federal Reserve to transition towards interest rate reductions to prevent an economic downturn. Yet, that scenario could take time to materialize, and geopolitical complexities are shifting rapidly.

Meanwhile, on-chain metrics suggest that Bitcoin’s current market framework may be shifting into a transitional phase. Leading analyst Axel Adler pointed to CryptoQuant metrics and highlighted the Pareto Principle — which asserts that 20% of causes generally result in 80% of effects — to depict the present market sentiment. Currently, 20% of the Bitcoin supply is at an unrealized loss, while 80% remains profitable.

Historically, when the portion of profitable coins exceeded 95–98%, markets became overheated, typically resulting in considerable profit-taking, as illustrated by the yellow bars in Adler’s chart. Following Bitcoin’s all-time high earlier this year, the market cooled, and the metric reverted to its average range, indicating consolidation rather than capitulation.

BTC Price Encounters Resistance Amid Bearish Influence

Bitcoin is presently trading at $83,600 after failing to recapture the 200-day exponential moving average (EMA) around the $85,000 level. This significant technical rejection denotes increasing bearish momentum, as bulls find it challenging to generate movement for a definitive breakout. In spite of last week’s bullish attempts to rise above resistance, the market remains ensnared within a broad consolidation range, with sentiment continuing to shift cautiously.

At this moment, the $81,000 support line is the most critical defense point. Maintaining a position above this level is vital to preserve the ongoing consolidation structure and prevent a renewed downturn towards lower levels. If this support fails, Bitcoin could be susceptible to a more profound correction, possibly revisiting the $75,000 range.

On the higher end, reclaiming the $85K level and firmly closing above it would mark the initial step towards a bullish reversal. However, actual confirmation of strength would necessitate a breakout above the $90,000 threshold — a level that would reflect renewed buyer confidence and negate the recent downward trend.

Until that time, Bitcoin remains in a neutral-to-bearish status, with macroeconomic uncertainty and technical resistance compelling bulls to assume a defensive posture.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist focuses on providing thoroughly researched, precise, and impartial content. We adhere to stringent sourcing standards, and each page is subject to careful review by our team of leading technology experts and experienced editors. This approach guarantees the integrity, relevance, and value of our content for our audience.