Grounds for Trust

Rigorous editorial guidelines prioritizing accuracy, relevance, and neutrality

Crafted by specialists in the field and thoroughly evaluated

The utmost standards in journalism and publication

Rigorous editorial guidelines prioritizing accuracy, relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

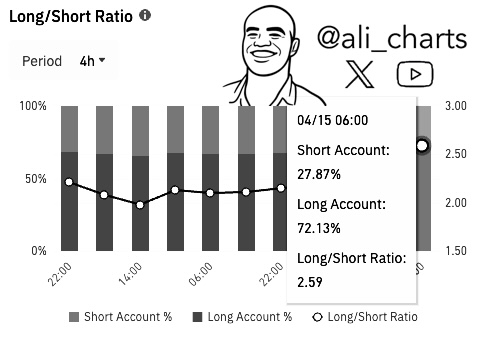

Recent insights from Binance’s futures market indicate that Dogecoin is drawing a notably optimistic outlook from traders. As per a graph disseminated by Ali Martinez (@ali_charts) on X, 72.13% of Binance participants with open Dogecoin positions are currently engaged in long trades, leaving merely 27.87% in short positions. “72.13% of traders on Binance with open Dogecoin DOGE positions are currently long!” Martinez stated, highlighting how sentiment is skewed towards a price surge.

What Implications Does This Have For Dogecoin’s Price?

What does such a significant majority of long positions imply for Dogecoin’s future? In many scenarios, such a stark imbalance suggests that the majority of market players anticipate the price to continue rising, at least in the near term. When a substantial number of traders are wagering on increases, it often indicates optimism—or even enthusiasm—regarding the token’s momentum. Dogecoin has consistently demonstrated its capability to incite fervor among retail investors and large traders alike, making spikes in bullish interest hardly surprising.

Connected Insights

This type of data can be seen as a possible signal of strength for Dogecoin. Should the market coalesce around a bullish narrative, sustained buying momentum may emerge, pushing prices higher. However, it’s not always that uncomplicated. When a considerable segment of the market skews to one side, it increases the risk that an abrupt decline could trigger a series of forced liquidations among those long positions. If the wider crypto market falters—or if Dogecoin encounters unexpected challenges—traders who entered anticipating a quick return could hastily exit, intensifying downward pressure.

Nevertheless, the figure “72.13%” is indisputably high, enough to attract substantial attention. A long/short ratio that elevated doesn’t ensure an ongoing climb; rather, it illustrates the current sentiment among a particular group of traders. It represents a singular moment in time, derived from the behaviors of one of the most active crypto exchanges globally. Even so, it serves as a firm reminder that, at present, a large contingent of Dogecoin traders on Binance believes that the path of least resistance leads upward.

Connected Insights

Of course, market dynamics can change rapidly. Some traders will closely monitor overall liquidity, Bitcoin’s movements, and any tariff updates from US President Donald Trump. Dogecoin is recognized for sudden price increases, often driven by social media activity or endorsements from notable figures, so even data as decisive as this long/short ratio does not fully forecast future developments. However, it does provide an insider perspective on how Binance traders are positioning themselves and, in doing so, sets the stage for Dogecoin’s short-term interest.

Currently, the notable prevalence of long positions suggests: traders are optimistic and are prepared to support that sentiment with open contracts. This could indicate confidence in Dogecoin’s durability, or it might set the stage for unforeseen volatility if sentiment shifts. Regardless of how it plays out, Martinez’s chart illuminates the ongoing enthusiasm for this meme-influenced asset in certain sectors of the crypto market.

As of the latest update, Dogecoin was trading slightly below its multi-year trendline, following a rejection at the 0.786 Fibonacci retracement level near $0.167. A renewed drop toward the critical support area around $0.14 could be possible if DOGE closes beneath the trendline. Conversely, the 0.786 Fib remains the most crucial resistance level, succeeded by a possible channel test close to $0.18.

Featured image generated using DALL.E, chart sourced from TradingView.com