In recent weeks, the cryptocurrency market has been inundated with a significant amount of doubt and instability instigated by the ever-changing global macroeconomic landscape. This unsettled condition caused the Bitcoin price to fluctuate between $74,000 and $83,000 within a matter of days.

The value of BTC dipped towards $74,000 at the beginning of last week, as cryptocurrency traders were thrown into a panic after President Donald Trump of the United States announced new trade tariffs. On Thursday, April 10, the leading cryptocurrency reclaimed the $83,000 mark after President Trump suspended trade tariffs on all nations except China.

Is Bitcoin Now Considered A ‘Mature Asset’?

The Bitcoin price has been highly responsive to nearly every piece of news concerning global trade, showcasing the extremely volatile nature of the cryptocurrency market. Nonetheless, an on-chain analytics specialist has noted that the current Bitcoin market’s volatility is insignificant compared to previous instances.

In a recent update on the social media platform X, CryptoQuant’s research director, Julio Moreno, disclosed that the Bitcoin price volatility related to the ongoing global trade situation has been “considerably less” than that observed during past events, including the COVID-19 collapse, the Terra-Luna disaster, the downfall of FTX, and the Silicon Valley Bank (SVB) bank run.

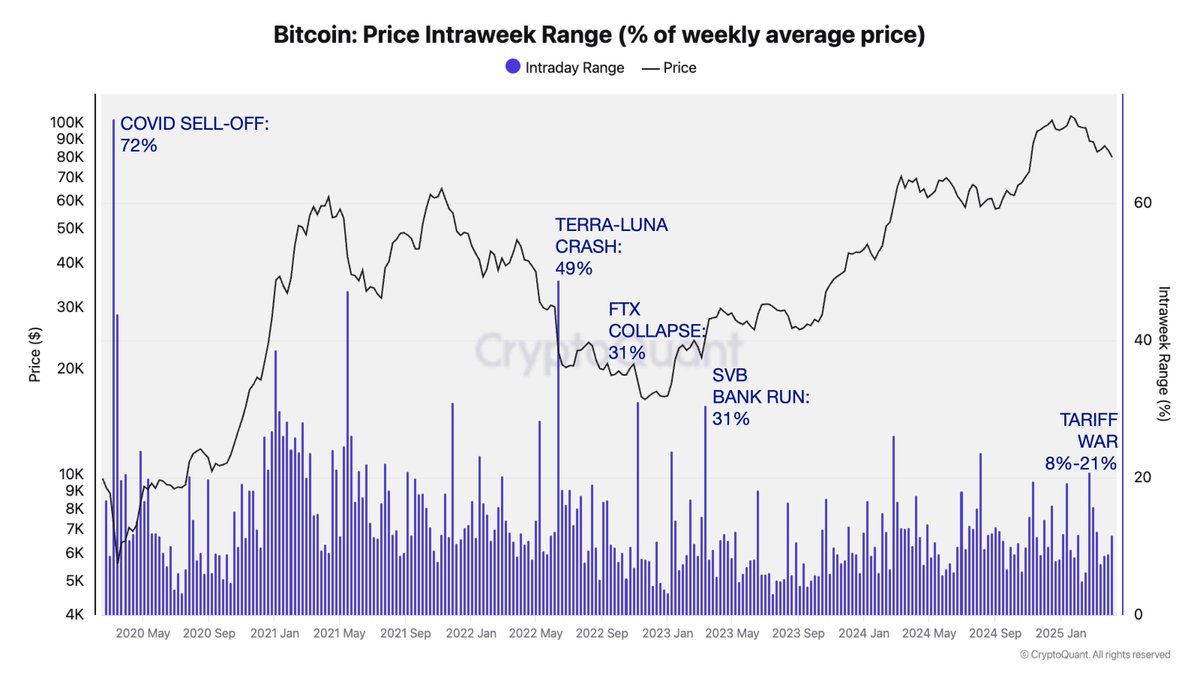

The pertinent indicator in this context is the Price Intraweek Range metric, which estimates the percentage variation in the average weekly price of Bitcoin. According to data from CryptoQuant, the Bitcoin Price Intraweek Range surged to an unprecedented 72% during the COVID-19 market decline in April 2020.

Source: @jjcmoreno on X

The chart above illustrates that the BTC Intraweek Range metric spiked to 49% following the collapse of the Terra Luna ecosystem in May 2022. Meanwhile, the indicator reached 31% in the aftermath of the Sam Bankman-Fried-led FTX exchange’s collapse in late 2022 and during the SVB bank run in early 2023.

With the increasing trade conflicts between the United States and China, the Bitcoin Price Intraweek Range metric is positioned between 8% – 21%. This diminished volatility indicates that the leading cryptocurrency has evolved as an asset, featuring deeper liquidity and an enhanced market structure.

The relatively stable price movements can be attributed to the expanding base of long-term holders and consistent corporate acceptance, as institutional investors are starting to view the world’s foremost cryptocurrency as less of a high-risk asset and more as a safeguard against macroeconomic uncertainties.

Bitcoin Price Overview

As of this moment, the price of BTC is approximately $83,700, corresponding to a 5% rise over the past 24 hours.

The price of BTC surpasses $83,000 on the daily chart | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Procedure for bitcoinist focuses on providing thoroughly researched, precise, and impartial content. We adhere to strict sourcing standards, and each page is subjected to careful review by our team of leading technology professionals and skilled editors. This protocol guarantees the integrity, relevance, and value of our material for our audience.