Reasons to Believe

Rigorous editorial guidelines that emphasize precision, significance, and neutrality

Developed by field specialists and thoroughly examined

The utmost standards in journalism and dissemination

Rigorous editorial guidelines that emphasize precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

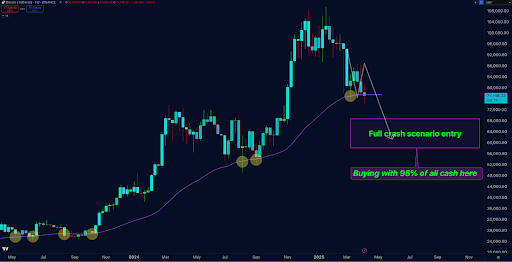

Bitcoin’s price decline from $97,000 in late February astonished most participants in the crypto market, yet this analyst was not taken aback. The crypto analyst known as Doctor Profit, who previously cautioned about a correction as Bitcoin approached $97,000, has recently published a new technical forecast that suggests a bearish trend in the near term.

In a summary shared on the social media platform X, Doctor Profit remarked that the downtrend is not yet finalized. This forecast stems from a previous thorough analysis in which the analyst pointed out various Bitcoin price fluctuations to monitor, all of which have occurred.

Doctor Profit Predicts Bitcoin Market Decline Is Just Starting

In recent days, Bitcoin has faced significant fluctuations with extremely volatile movements. These fluctuations led Bitcoin’s price to dip below $75,000 earlier this week, after which it has spent the last four days on a recovery trajectory towards $80,000. Amidst the price fluctuations, crypto analyst Doctor Profit clarified that he anticipates the current downward trend in Bitcoin’s price to continue.

Related Reading

In a recent update on the social media platform X, the analyst referred to the correction as a “market massacre” likely to persist, stating that the festivities have just begun. He disclosed that he had entered his initial buying orders in the $58,000 to $68,000 range, indicating that the Bitcoin price would continue to decline until it reaches this range.

Instead of viewing the recent downturn as a hindrance, the price movement is a strategic component of the larger plan which the analyst detailed in a previous thorough examination.

Doctor Profit’s analysis relies on the M2 money supply, a macroeconomic indicator he perceives as widely misinterpreted in the crypto domain. Many traders have recently pointed to the rise in M2 as a bullish sign for Bitcoin, presuming that increased liquidity will lead to immediate price surges. However, the analyst emphasized that timing is crucial. He stated that Bitcoin tends to precede traditional markets when reacting to M2 increases, but even then, the response is not immediate.

What to Anticipate with BTC

He reminds his audience that back in July 2024, he forecasted a 50bps rate reduction, which was deemed highly improbable at the time. Once that reduction took place in September, coinciding with Bitcoin hovering near $50,000, he termed it highly bullish and predicted a significant rally. Ultimately, the M2 money supply began to grow in February 2025, aligning with his prediction. Still, he warns that while M2 is presently on the rise, its impact on Bitcoin will unfold gradually.

Related Reading

Focusing on Bitcoin’s price behavior in the charts, Doctor Profit shifted his attention to the $70,000 to $74,000 zone. He posits that this range could either act as a launching pad for a new upward rally if a strong daily close occurs above the “Golden Line” around the weekly EMA50 or serve as an indicator for a deeper decline if the price drops below it.

In the event of a more significant breakdown, the analyst recommended scaling back and waiting for even lower entry points around the $50,000 to $60,000 range. Doctor Profit predicted that the bull market will not resume until approximately May or June, with upside targets set at $120,000 to $140,000.

Bitcoin has successfully surpassed $81,000 following Donald Trump’s announcement of a 90-day pause on his controversial tariffs. At the moment of writing, Bitcoin is trading at $82,000, reflecting a 7% increase over the past 24 hours.

Featured image from Unsplash, chart sourced from Tradingview.com