By Luisa Maria Jacinta C. Jocson, Senior Correspondent

THE BANGKO SENTRAL ng Pilipinas (BSP) is anticipated to lower rates this week as subdued inflation and the US’ tariff strategy will provide it ample leeway to recommence its rate-reducing cycle, analysts indicated.

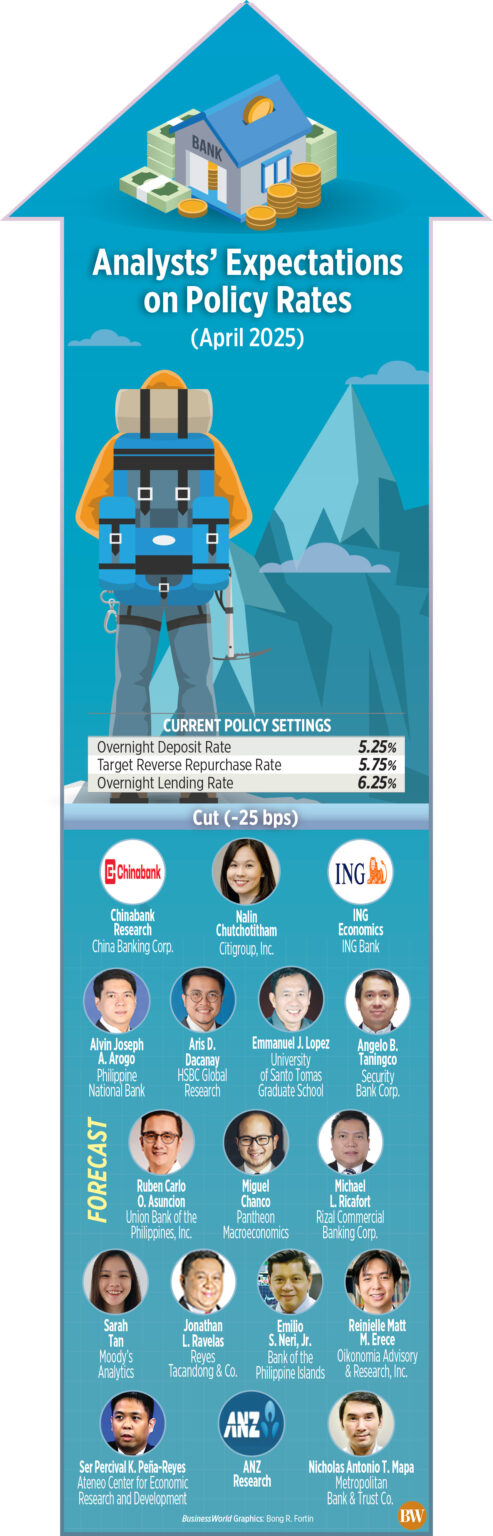

A BusinessWorld survey conducted last week revealed that all 17 analysts consulted predict the Monetary Board will trim the target reverse repurchase rate by 25 basis points (bps) during its policy session on April 10.

If this materializes, the benchmark rate would decrease to 5.5% from the existing 5.75%.

The central bank maintained interest rates stable in February as it awaited developments in global trade uncertainties. It lowered borrowing costs by a cumulative 75 bps in 2024.

“The opportunity to further ease has now expanded, as domestic factors have become increasingly favorable for a rate reduction,” stated HSBC economist for ASEAN Aris D. Dacanay.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. expressed there is a “90% chance” that the Monetary Board will decrease rates by 25 bps on Thursday.

“We anticipate a gradual reduction due to the lower-than-expected inflation for March and the necessity to bolster economic growth in light of rising global tariffs,” said Angelo B. Taningco, Vice-President and Head of Research Division at Security Bank Corp.

Economist Alvin Joseph A. Arogo from Philippine National Bank remarked that additional easing will be warranted by “low inflation, increased chances of a Fed rate cut, and a comparatively favorable reciprocal tariff in relation to other Asian nations.”

“We believe there is space for a ‘baby-step’ rate reduction despite global trade uncertainties. A significant factor is the ongoing deflation narrative, with inflation stabilizing within the government’s inflation target of 2-4%,” said Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc.

SLOWING INFLATION

The March inflation report is one of the key metrics that will motivate the central bank to reduce rates this week, analysts asserted.

March inflation declined to 1.8% in March from 2.1% in February, marking its slowest rate in nearly five years.

Inflation averaged 2.2% in the first quarter, comfortably within the central bank’s 2-4% target.

“I’m predicting the (Monetary) Board to resume easing (this week), with a 25-bp reduction to the target reverse repo rate,” stated Miguel Chanco, Chief Emerging Asia Economist at Pantheon Macroeconomics.

He indicated that the recent inflation figures “strongly suggest that the BSP retains substantial latitude to nominally lower rates while adhering to its objective of pursuing a ‘less-restrictive’ policy.”

Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., noted that the data thus far “indicates the necessity and potential for easing.”

“Inflation resides at the lower limit of the target; risk-adjusted inflation forecasts point to consistent target inflation this year and next, while growth is anticipated to fall short of target for a third consecutive year,” he added.

Citi Economist for the Philippines Nalin Chutchotitham stated that the sub-2% inflation “strengthens the argument for an April policy rate reduction.”

“While expected to rise from April, we forecast inflation to remain firmly within the lower half of the BSP’s target range for the remainder of 2025 and have lowered our 2025 inflation projection to 2.2%,” she explained.

The BSP’s baseline forecasts for inflation are set at 3.5% for 2025 to 2026. Considering risks, inflation could reach 3.7% in 2026.

“With inflation significantly lower than the BSP’s risk-adjusted inflation projections, we anticipate the central bank will revise its inflation forecast downward next week,” Mr. Dacanay remarked.

“With inflation decreased, the real policy rate has expanded sufficiently for the BSP to make cuts even without a similar move from the Fed. All is well,” he concluded.

TRUMP TARIFFS

Conversely, analysts indicated that the central bank will be capable of factoring in the tariff implications and adjust interest rates accordingly.

“A reduction in interest rates would provide additional support for the Philippine economy amidst challenges posed by elevated US tariffs,” stated Chinabank Research.

“Reduced borrowing costs, which is advantageous for investments, could mitigate the effects of potentially diminished external demand and sustain the economy’s upward growth path.”

ING Regional Head of Research for Asia-Pacific Deepali Bhargava mentioned that the “global growth uncertainty” resulting from US tariffs has enhanced expectations of a rate decrease.

Last week, the Philippines was not immune to US President Donald J. Trump’s announcement of extensive tariffs affecting all trading partners. He implemented a 17% reciprocal tariff on all Philippine exports to the US, effective April 9.

Although this rate is higher than the 10% baseline tariff levied on most nations, the US tariff on the Philippines was the second lowest in Southeast Asia, following Singapore (10%).

Nonetheless, Chinabank Research observed that the Philippines is somewhat insulated from tariffs compared to its regional counterparts because of its strong domestic demand and the relatively lower tariff.

“Additionally, a less restrictive monetary policy might help mitigate the negative effects of an intensifying global trade war on the Philippine economy,” it added.

The stabilizing currency will also enable the BSP to make further rate cuts, analysts noted.

“The peso further appreciated against the US dollar as of March, reaching P57 levels, the strongest for the peso in over five months, which could enhance import prices and overall inflation, thus supporting additional monetary easing moving forward,” stated Michael L. Ricafort, Chief Economist at Rizal Commercial Banking Corp.

The peso closed at P57.21 against the dollar at the end of March, strengthening by 78.5 centavos from P57.995 at the end of February.

“An inflation rate that remains within the target range and a generally stable peso will give the BSP the assurance to implement a rate cut, even though the US Fed maintained interest rates steady in March,” remarked Sarah Tan, economist at Moody’s Analytics.

Last month, the US central bank held its benchmark overnight rate steady in the 4.25%-4.5% range amid expectations of rising prices preceding Mr. Trump’s tariff proposal.

“We uphold our view that the 100-bp resultant interest rate differential with the Fed remains a comfortable level unlikely to generate significant capital outflows or a sharp depreciation of the peso that could exacerbate inflationary pressures,” Chinabank Research further noted.

FURTHER CUTS?

Analysts conveyed that the central bank is most likely to persist on its easing trajectory for the remainder of the year.

“Nevertheless, the latest figures should provide the Monetary Board sufficient confidence to resume its easing cycle next week; we foresee a 25-bp reduction this month, succeeded by an additional 75 bp worth of easing by year-end,” stated Mr. Chanco.

After April, Ms. Chuchotitham indicated she anticipates the BSP to implement rate cuts in August and December in increments of 25 bps.

“Restarting the easing cycle will furnish much-needed support to domestic demand, particularly with the reserve requirement ratio reduced to 5% last week, making the BSP’s monetary transmission more effective,” commented Mr. Dacanay.

“Credit demand in the economy remains lukewarm, while consumption is still subdued as high interest rates have diminished the demand for large purchases.”

Recent data from the BSP showed that bank lending growth decelerated to 12.2% in February from 12.8% in January.

“Lowering the policy rate will also bolster the domestic economy at a time when uncertainties loom over the outlook for its externally facing sectors,” Ms. Tan remarked.

Oikonomia Advisory & Research, Inc. economist Reinielle Matt M. Erece stated that the BSP should concentrate on promoting growth next.

“Since inflation is currently floating within the central bank’s targeted levels, it’s time to target another area, namely economic growth,” he mentioned.

“The disappointing growth from last quarter highlights the necessity for policy measures such as monetary policy easing to stimulate consumer demand and business activity.”

Conversely, Chinabank Research noted that the central bank will likely remain cautious as it evaluates the impact of global policies on the domestic economy.