Reasons to trust

Rigorous editorial policy prioritizing precision, significance, and neutrality

Developed by sector specialists and thoroughly examined

The utmost standards in journaling and publishing

Rigorous editorial policy prioritizing precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

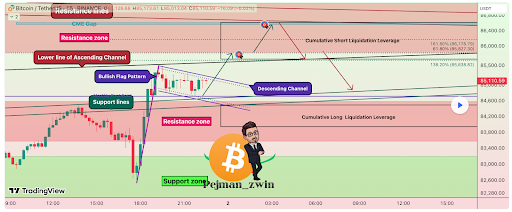

The crypto analyst Pejman has cautioned that the Bitcoin price may experience further declines in the near term. He disclosed the threshold the leading cryptocurrency needs to maintain to avert these “severe downturns.”

The Bitcoin Price May Experience Additional Decline If It Drops Below This Threshold

In a TradingView post, Pejman indicated that the Bitcoin price could suffer significant declines if it drops beneath $83,500. This caution was issued following an optimistic analysis in which he commented that BTC appears to be forming a bullish flag pattern. The analyst expressed that he anticipates the premier cryptocurrency to surge as it aims to bridge the CME gap at around $86,000.

Related Reading

This eventually materialized as the Bitcoin price surged to a peak of $88,000 amid the extensive fluctuations that ensued following Trump’s reciprocal tariffs announcement. Nevertheless, Pejman suggested that the ascent to $88,000 may represent the local peak for BTC, noting that there exists a chance for Bitcoin to decline again after this price increase.

Furthermore, the Bitcoin price has since corrected after the ascension to $88,000. This price drop occurred as Trump announced customized tariff rates for nations like China, the European Union, the United Kingdom, and Japan. This action by the US president is anticipated to incite a trade war, with these nations retaliating with counter-tariffs, which is considered bearish for BTC and the wider cryptocurrency market.

BTC May Still Plummet To As Low As $78,000

According to crypto analyst Kevin Capital’s assessment, the Bitcoin price could soon fall to a low of $78,000. The analyst observed that there exists a small amount of long liquidity at the $78,000 to $80,000 threshold, but there is also significant liquidity at the $87,000 to $90,000 range.

Related Reading

He further remarked that market makers could aim to operate in that $87,000 to $90,000 zone just ahead of Trump’s tariff announcement, which occurred as anticipated. With the Bitcoin price absorbing the liquidity at the $87,000 to $90,000 level, it appears likely to descend towards the $78,000 to $80,000 range to also absorb the liquidity at that area.

Notwithstanding the Bitcoin price’s downward trend over the past two months, crypto analyst Rekt Capital remains optimistic about the trajectory of the leading crypto. He noted that BTC underwent a 32% downturn from mid-March 2024 to early September 2024, a pullback lasting nearly six months before its price surged to new all-time highs (ATHs). Therefore, the analyst indicated that this downturn is not cause for concern as BTC could still surge to new highs swiftly.

At the point of writing, the Bitcoin price is trading near $83,000, down over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com