By Aubrey Rose A. Inosante, Journalist

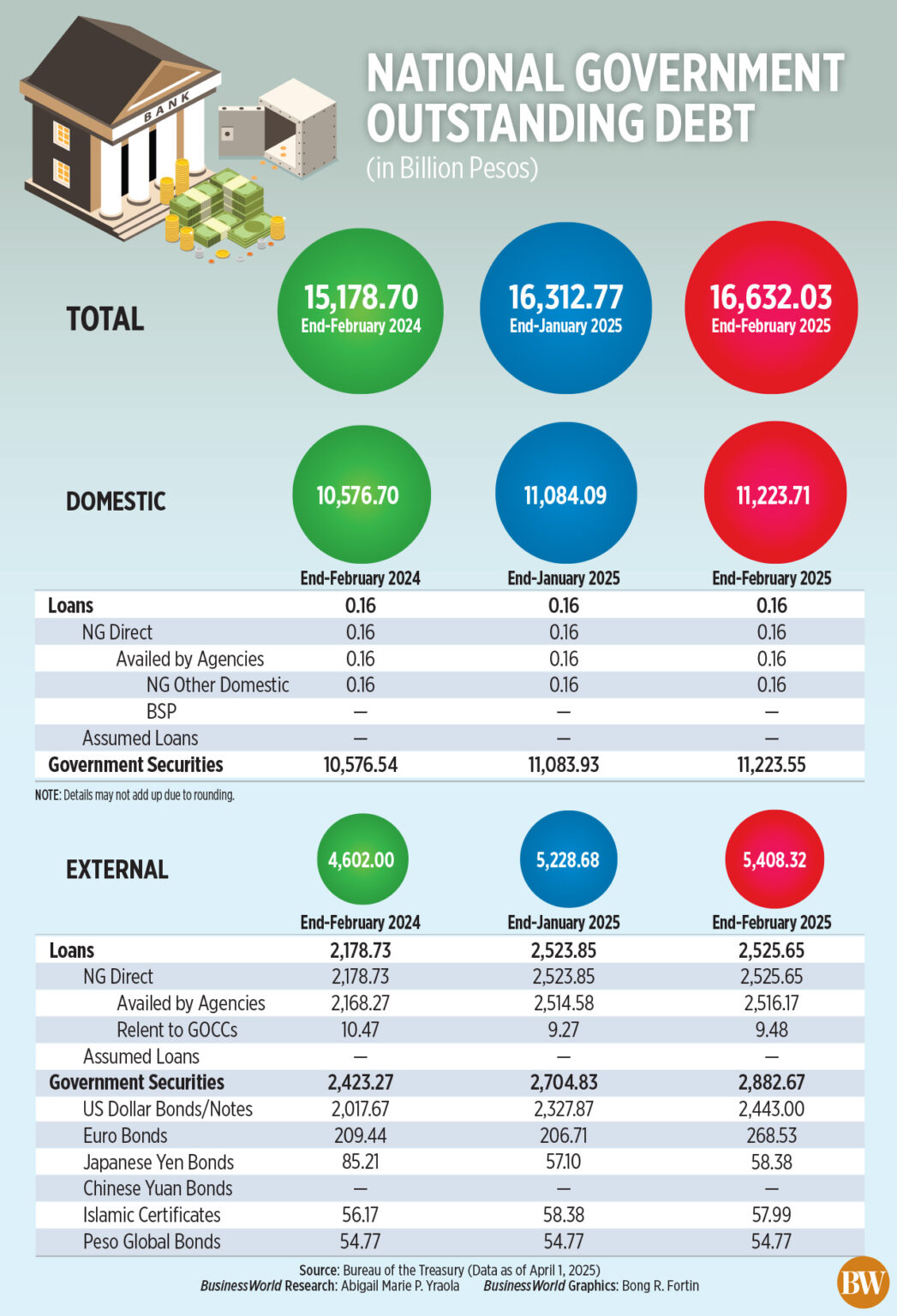

THE NATIONAL Government’s (NG) total liabilities surged to a new peak of P16.63 trillion by the end of February, as reported by the Bureau of the Treasury (BTr).

Recent figures from the BTr indicated that the liabilities increased by 1.96% from P16.31 trillion at the conclusion of January.

Compared to the previous year, outstanding liabilities rose by 9.57% from P15.18 trillion at the end of February 2024.

“The increase was mainly fueled by the net issuance of new domestic and foreign liabilities to finance more public programs and initiatives,” the BTr stated in a press release on Tuesday.

Although another record high was reached, the Treasury noted that the outstanding liabilities “remain manageable.”

NG liabilities represent the entire amount owed by the Philippine government to creditors like international financial organizations, development partner nations, banks, global bondholders, and additional investors.

“Nonetheless, the increase was somewhat mitigated by the strengthening of the peso against the US dollar, which rose from P58.375 at the end of January to P57.99 by the end of February, thereby facilitating the management of foreign liabilities,” it added.

The majority, accounting for 67.5% of the total liabilities, was owed to domestic creditors, while the remainder to foreign creditors.

“This financing composition illustrates a cautious approach to liability management, aimed at reducing exposure to external risks while taking advantage of the country’s robust domestic market,” the BTr explained.

Domestic liabilities, which consisted of government securities, rose by 1.26% to P11.22 trillion as of the end of February, up from P11.08 trillion at the end of January.

On a yearly basis, domestic liabilities also increased by 6.12% from P10.58 trillion in February 2024.

“This was primarily due to P140.72 billion in net domestic financing, as the P268.25-billion gross issuance of government securities surpassed redemptions of P127.53 billion for the month,” the BTr noted.

However, the growth in domestic liabilities was tempered by the peso’s appreciation against the US dollar, resulting in a decrease in overall valuation by P1.1 billion.

Meanwhile, foreign liabilities increased by 3.44% to P5.41 trillion from P5.23 trillion in the preceding month.

On a year-to-year basis, external liabilities surged by 17.52% from P4.6 trillion.

“This was due to the net acquisition of foreign debt totaling P193.71 billion and a P20.41-billion net appreciation effect on third currency-denominated liabilities,” the BTr stated.

“However, these factors were partially countered by a P34.48-billion reduction from the peso appreciation against the US dollar,” it added.

External liabilities were mostly composed of P2.53 trillion in loans and P2.88 trillion in government securities.

“For the month, the NG secured a total of P197.3 billion in external funding, which included P190.82 billion through a triple-tranche global bond issuance made up of 10- and 25-year USD bonds ($2.25 billion), as well as 25-year EUR bonds (1 billion euros), and P6.48 billion in project loans,” the Treasury stated.

The BTr mentioned that the project loans would finance rail initiatives via the Japan International Cooperation Agency (P3.86 billion) and health sector and connectivity efforts with the Asian Development Bank (P1.71 billion).

For February, NG-guaranteed obligations decreased by 1.49% to P341.11 billion as of the end of February, down from P346.27 billion at the end of January.

On a yearly basis, it fell by 1.11% from P344.93 billion.

“The decline was a result of net repayments of both domestic and foreign guarantees totaling P5.83 billion and P0.15 billion, respectively,” the BTr reported.

“However, this was somewhat compensated by the P1.43-billion net appreciation effect on third currency-denominated guarantees,” it added.

Oikonomia Advisory and Research, Inc. Economist Reinielle Matt M. Erece noted that the increase in the liability levels reflected fresh government borrowing.

“This trend may persist this year as the government intends to borrow again, primarily from domestic sources, to support its initiatives,” he stated.

“Additionally, the anticipated peso depreciation against the US dollar may inflate the dollar value of foreign liabilities,” Mr. Erece remarked.

He also mentioned that the liabilities remain manageable “as long as the government continues to improve its revenue generation and economic growth outpaces expenditure growth.”

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort indicated that the heightened NG liability level is due to the need to finance the budget deficit.

“It is essential to reduce the proportion of debt servicing expenses as a share of the total national budget, highlighting the necessity for more tax reforms and other fiscal measures to structurally lessen the budget deficit and limit the growth in overall liabilities in light of substantial borrowings/debts since the COVID-19 pandemic,” he commented.

Mr. Ricafort stressed the need to reduce the NG debt-to-gross domestic product (GDP) ratio below the international benchmark of 60%.

Outstanding liabilities as a percentage of GDP increased slightly to 60.7% as of the end of 2024 from 60.1% a year prior.

The NG’s outstanding liabilities are projected to reach P17.35 trillion by the conclusion of 2025.