By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION is anticipated to have declined modestly in March as the costs of rice and fuel continued to decrease, analysts noted.

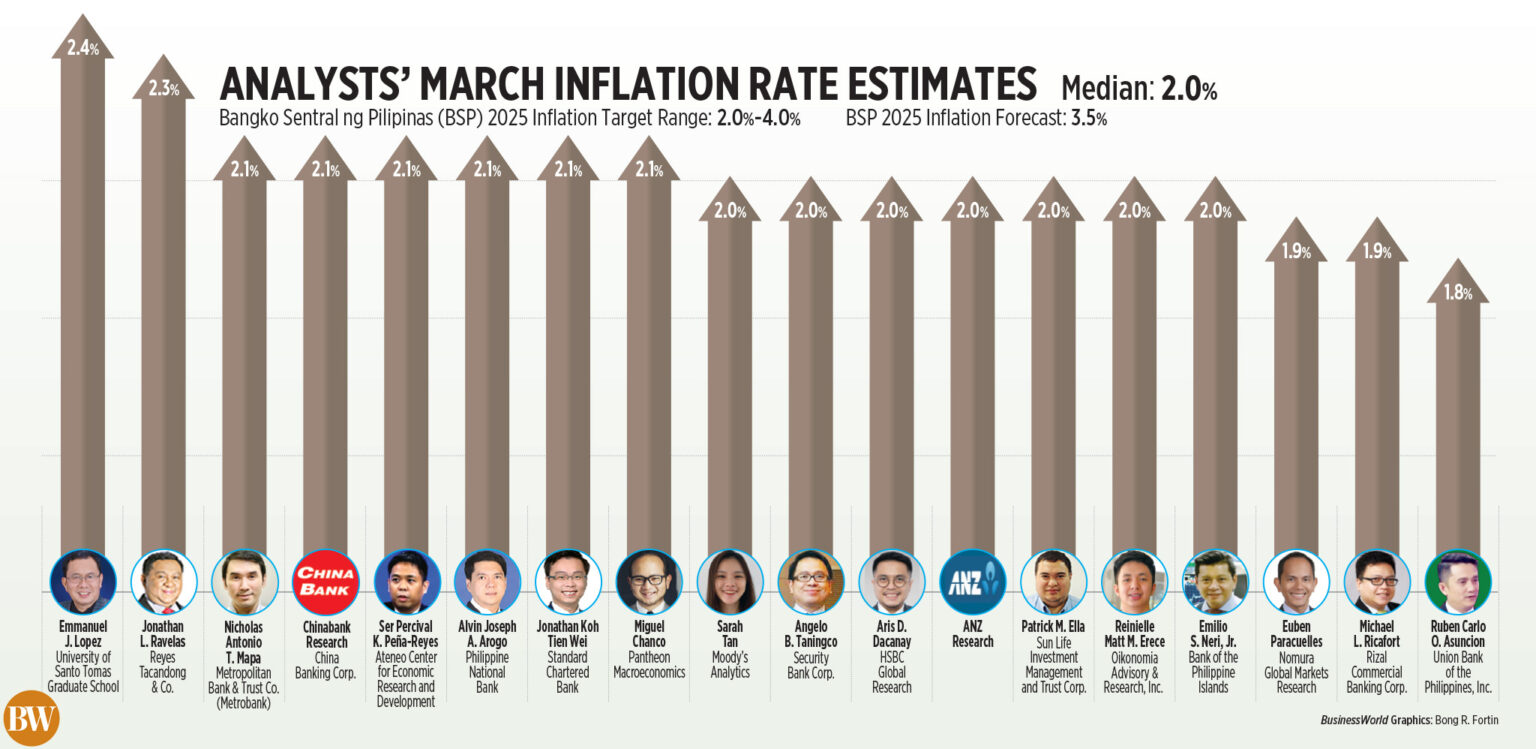

A BusinessWorld survey of 18 analysts carried out last week resulted in a median prediction of 2% for the March consumer price index (CPI).

If this occurs, it would represent a slower rate compared to 2.1% in February and the 3.7% rate in the same month last year.

This would also mark the lowest monthly inflation in half a year or since the 1.9% figure in September.

The Bangko Sentral ng Pilipinas (BSP) has yet to publish its inflation forecast for March.

The Philippine Statistics Authority (PSA) is scheduled to unveil the March inflation figures on Friday, April 4.

“For March, I anticipate a 2% inflation rate as food prices are likely to keep slowing down, influenced by favorable weather and further decreases in rice costs,” remarked Sun Life Investment Management and Trust Corp. economist Patrick M. Ella.

Security Bank Corp. Vice-President and Research Division Head Angelo B. Taningco provided a March inflation forecast of 2% due to “low food inflation resulting from decreasing rice prices despite monthly increases in fish, meat, fruits, and vegetables.”

Rice inflation fell to 4.9% in February from a 2.3% reduction in January, the lowest rice inflation since the 5.7% decrease recorded in April 2020.

The PSA had previously indicated that rice inflation might remain negative for the remainder of the year due to ongoing government interventions.

The government has reduced tariffs on rice imports to 15% beginning July 2024.

“The tariff reduction on rice will assist in lowering prices compared to a year prior,” commented Moody’s Analytics economist Sarah Tan.

In February, the Agriculture department declared a food security emergency regarding rice, which enabled the National Food Authority to distribute buffer stocks at subsidized rates.

In mid-February, the department also decreased the maximum suggested retail price (MSRP) of 5% broken imported rice to P52 per kilo from the previous P55. This price was further reduced to P49 per kilo, effective March 1.

Besides rice, pork prices are also expected to play a role in the reduced inflation figures.

“The main factor behind the slowdown will stem from the food sector, particularly in pork and rice pricing,” Ms. Tan noted.

She pointed out the Agriculture department’s decision to set a retail price cap on pork in March to “shield the domestic market from increasing prices caused by the African swine fever affecting supply chains.”

On March 10, the MSRP was established at P380 per kilo for liempo (pork belly) and at P350 per kilo for kasim (shoulder) and pigue (rear leg).

LOWER FUEL PRICES

In the meantime, Nomura Global Markets Research analyst Euben Paracuelles highlighted the drop in energy prices, as well as steady core inflation in March.

In March, adjustments in pump prices resulted in a net reduction of P1.50 per liter for gasoline, P1.10 per liter for diesel, and P2.40 per liter for kerosene.

Aris D. Dacanay, an economist for ASEAN at HSBC Global Research, stated that retail fuel prices declined in March “due to softer global oil prices and a strengthened peso.”

“However, upward price pressures persist in the less-weighted goods and services category. Electricity prices rose by more than 2%, while the prices of certain food items, like fish and eggplants, saw substantial increases,” Mr. Dacanay added.

Chinabank Research also stated that inflationary pressures “arose from increased costs of essential food items such as meat, fish, and fruits, along with hikes in electricity rates.”

In March, Manila Electric Co. (Meralco) raised the overall rate by P0.2639 per kilowatt-hour (kWh) to P12.2901 per kWh, up from P12.0262 per kWh in February.

Analysts have also observed upward price pressures throughout the month.

Mr. Dacanay indicated that the risks to inflation remain tilted towards the downside as rice prices still have potential to decrease.

“While this is not our baseline assumption, it is still feasible for inflation to go beyond the lower end of the central bank’s 2-4% target band,” he added.

PENDING RATE CUT?

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines (UnionBank), projected that inflation is likely to diminish further.

UnionBank’s nowcast models predict that monthly inflation will settle below 2% until June.

“Certainly, the inflation forecasts with the key premise that these are expected to align with actual data, support a BSP rate cut of 25 basis points (bps) — 50 bps sooner than later,” Mr. Asuncion mentioned.

“The concern about materially positive real interest rates establishing themselves, posing deflationary risks to spending and growth prospects, should trigger prompt BSP rate cuts,” he continued.

The BSP’s foundational forecasts for inflation stand at 3.5% for 2025 and 2026. Considering risks, inflation might reach 3.7% in 2026.

“Looking forward, with inflation near the lower bound of the BSP’s 2-4% target range, we believe the central bank could resume its easing cycle during its April 10 meeting,” Chinabank Research added.

“However, it will probably maintain a cautious approach due to ongoing inflation risks and increasing global policy uncertainties,” it remarked.

Ms. Tan indicated that inflation stabilizing around the “low 2%” will fortify the case for a rate cut in April.

“Another month of muted inflation provides the BSP with ample justification to finally enact a rate cut in April,” stated Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co.

Both Mr. Paracuelles and Mr. Ella also foresee the BSP implementing a 25-bp cut next month.

The Monetary Board has rescheduled its meeting to April 10 from the originally planned April 3.

“I am confident the Monetary Board will consider this release for its upcoming April meeting, and if we are accurate about it remaining close to the lower band of the BSP’s target range, then members will likely have the clear to proceed with another 25-bp rate cut,” noted Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco.

“Of course, unforeseen events could intervene, as the planned announcement in Washington about potential global reciprocal tariffs on April 2 could introduce more uncertainties,” he added.

Mr. Taningco pointed out that the March CPI will be significant data for the Monetary Board’s decision-making.

“Other elements to take into account for the forthcoming meeting include global tariffs, international oil prices, and the fluctuations of the US dollar,” he concluded.

Markets are broadly anticipating President Donald J. Trump’s announcement regarding reciprocal tariffs on April 2.

“The BSP will also have time to assess the impact of the US reciprocal tariffs on the Philippine economy, which are set to take effect from April 2,” Ms. Tan remarked.

“Further easing of monetary policy in the nation will alleviate pressure on household budgets, which will offer some relief to the domestic economy amid global uncertainties,” she added.

Reinielle Matt M. Erece, economist at Oikonomia Advisory and Research, Inc., also mentioned that the BSP could reduce rates “to avert weakening consumer demand and to stimulate economic growth.”

“I anticipate a 25-bp cut, which serves as a suitable compromise to stimulate market activity while averting extreme fluctuations in foreign exchange,” he remarked.

Conversely, Standard Chartered Bank economist and FX (foreign exchange) analyst Jonathan Koh Tien Wei suggested the central bank might decide to maintain rates steady due to ongoing uncertainties.

“In our opinion, this uncertainty remains significant even though USD-PHP is lower, and we are still advocating for the BSP to pause in April and delay any rate cut until June,” he stated.

“The risk to our perspective is, however, a 25-bp rate cut in April, given recent statements by BSP Governor [Eli M.] Remolona [Jr]. The movements in USD-PHP will be crucial to monitor due to concerns over imported inflation and inflation expectations.”