Justifications for trust

Rigorous editorial standards prioritizing precision, significance, and objectivity

Produced by field professionals and thoroughly vetted

The utmost benchmarks in journalism and publishing

Rigorous editorial standards prioritizing precision, significance, and objectivity

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

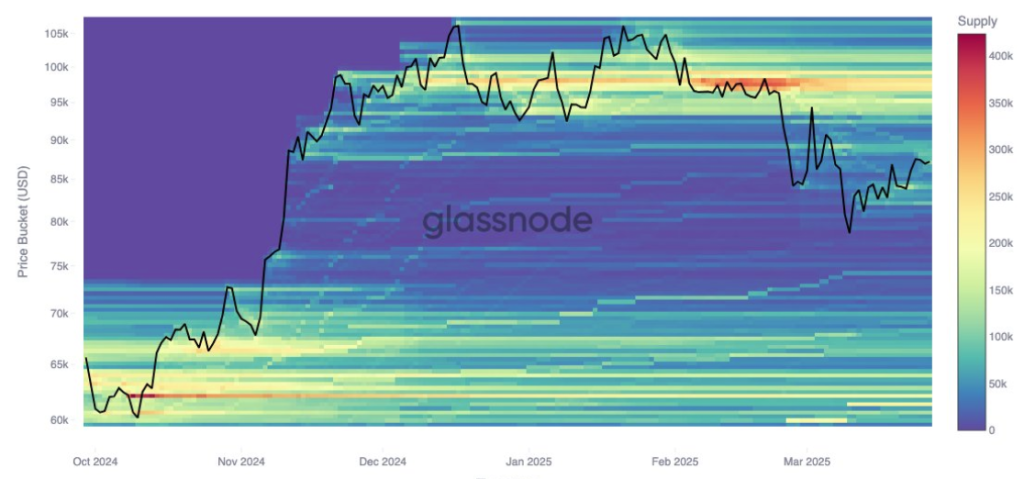

In the last 48 hours, Bitcoin’s price behavior has brought it closer to the $80,000 price point once more, with the potential for a downturn. Analyzing on-chain metrics highlights a significant support area between $80,920 and $78,000 that needs to remain intact.

Associated Reading

Specifically, on-chain analysis from Glassnode indicates a weakening support at the $78,000 level, where just a few cost basis clusters exist. This observation follows a significant shift that saw savvy traders purchase close to 15,000 Bitcoin at the March 10 nadir before selling at the local peak of $87,000.

Support Cushion Increases With Clusters Between $80,000 And $84,000

Bitcoin commenced March with a drastic drop that drove its price below $77,000 on March 10 and 11. Much of the month involved Bitcoin recuperating from this position, eventually reaching as high as $88,500 last week.

Interestingly, on-chain analytics from Glassnode reveal that some Bitcoin investors seized the opportunity during the drop and acquired roughly 15,000 BTC at this low point. Nevertheless, many addresses from this group sold at the $87,000 local peak, leaving behind an exhausted buffer zone that might not provide the same price stability.

Bitcoin’s most robust cost basis clusters have gradually moved upward from $78,000 throughout the month, with the key support levels currently located between $80,920 and $84,100. Approximately 20,000 BTC were obtained at $80,920, 50,000 BTC at $82,090, and an additional 40,000 BTC around $84,100. These recent accumulations now represent new confidence areas among recent purchasers that may provide cushions against the recent market downturn.

Currently, Bitcoin is being traded at $83,120, indicating a loss of the buffer zone of 40,000 BTC around $84,100. This responsibility shifts to the $82,090 and subsequently, the $80,920 price levels. However, if the decline sharpens further, structural support might not reappear until after $78,000, emerging at $74,000 and $71,000, where long-term conviction purchasing had occurred, estimated at 49,000 BTC and 41,000 BTC, respectively.

Image From X: Glassnode

$95,000 Cost Basis Cluster Expands With Diminished Demand

As support continues to gradually escalate, resistance appears to be solidifying near the $95,000 threshold. Data on investor cost basis indicates a rise of 12,000 BTC clustered at this level since March 24.

This suggests that some investors now foresee a peak forming around $95,000, and selling pressures may intensify if prices approach that region. This resistance, paired with the support levels, could confine Bitcoin within a narrowing range in the near future.

Associated Reading

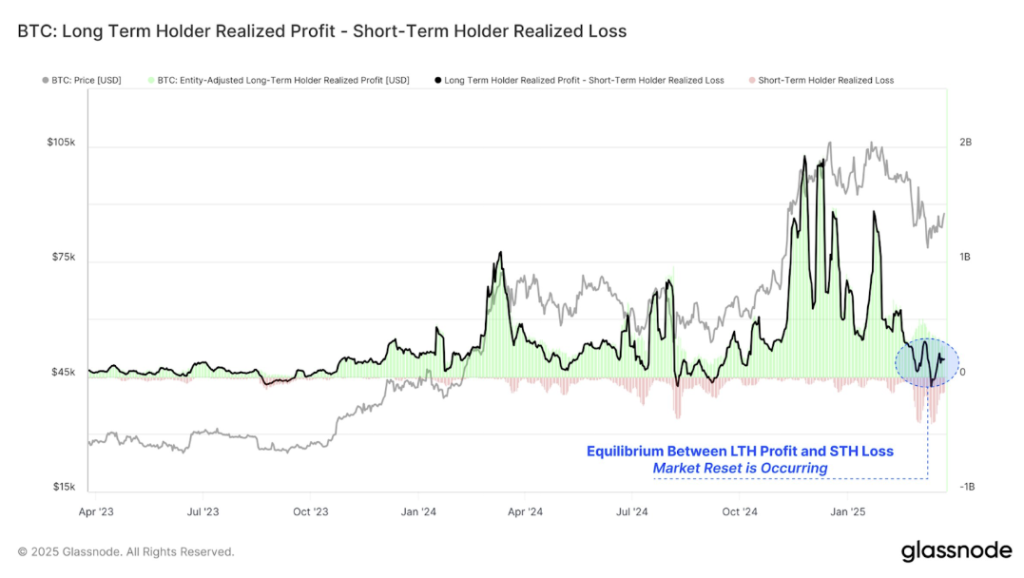

Glassnode data verifies that long-term holders (addresses retaining Bitcoin for over 150 days) have predominantly engaged in profit-taking recently. The profit-taking from long-term holders is now almost equaled by the losses suffered by short-term traders who have maintained Bitcoin for less than 155 days.

Image From X: Glassnode

Featured image from Tech Research Online, chart from TradingView