THE NATIONAL Government’s (NG) fiscal surplus contracted in January, as the growth of state expenditures overtook that of revenue generation, according to the Bureau of the Treasury (BTr).

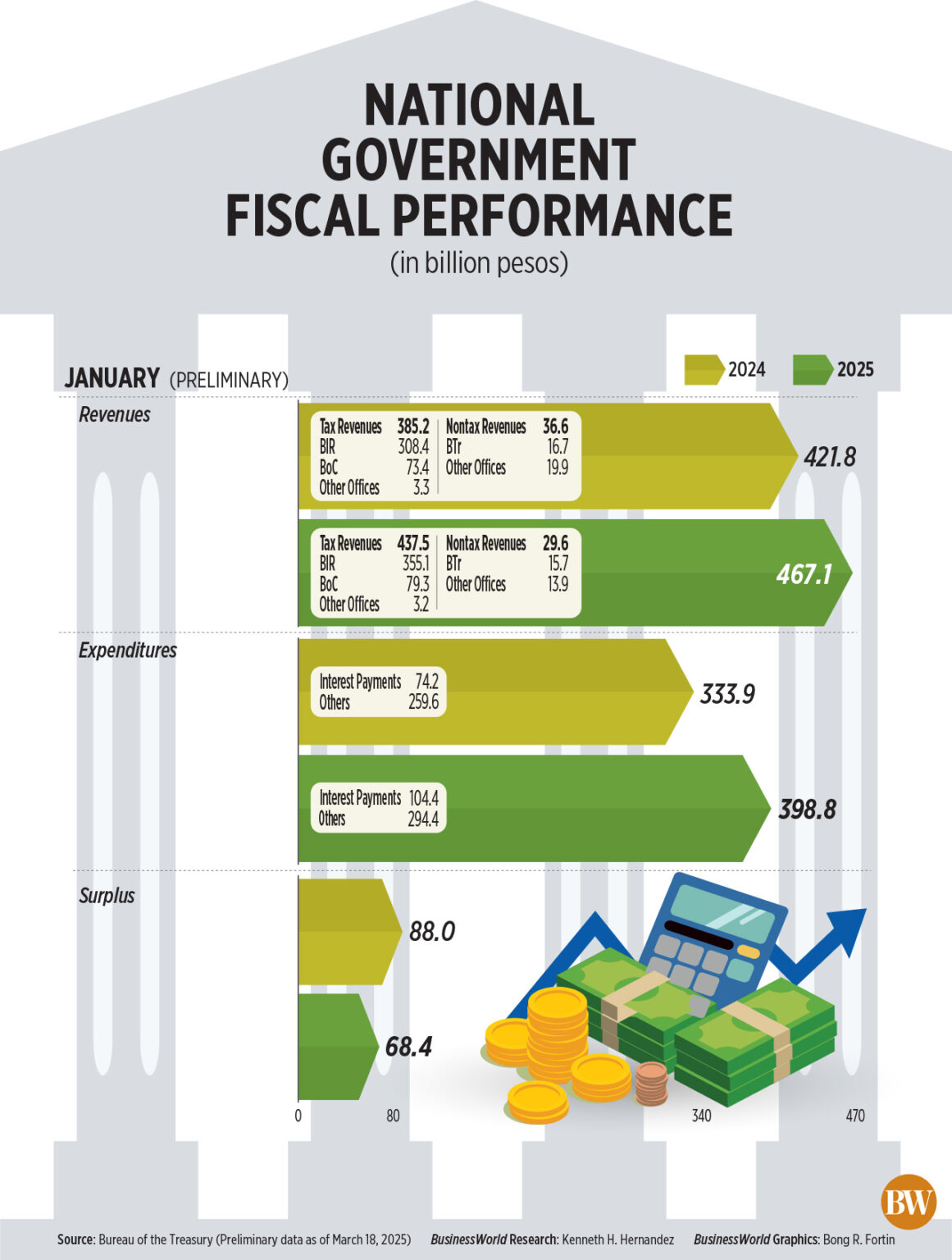

The Treasury stated that the NG recorded a P68.4-billion fiscal surplus in January, representing a 22.27% decrease from the P88-billion surplus during the same month last year attributed to “sustained revenue increase. coupled with heightened outlays.”

Comparatively, the budget situation shifted to a surplus from the P329.5-billion shortfall in December of the previous year.

This marks the first fiscal surplus recorded since the P6.34-billion surplus in October 2024.

In January, revenues surged by 10.75% to P467.1 billion from P421.8 billion in the same month last year, driven by improved tax receipts.

Tax revenues, accounting for 93.66% of total receipts, increased by 13.6% to P437.5 billion in January from P385.2 billion in January last year.

The majority of tax income was sourced from the Bureau of Internal Revenue (BIR), which reported an increase of 15.13% to P355.1 billion in January compared to P308.4 billion in the same month a year ago.

The enhancement in BIR collections was largely propelled by an 18.62% or P21.4 billion upsurge in value-added tax (VAT) and a 14.23% or P18.1 billion boost in income taxes.

Other tax categories rose by 22.2% or P3.7 billion, while percentage taxes escalated by 11.88% or P3.4 billion.

“The increase is also credited to the bureau’s enhanced collection strategies, vigorous anti-smuggling initiatives, and digital modernization projects,” stated the Treasury.

Conversely, the Bureau of Customs (BoC) amassed P79.3 billion in revenues for January, marking a 7.98% increase year on year, propelled by the agency’s upgrade program.

“Notably, VAT collections soared by 17.55% (P7.7 billion), while excise collections advanced by 10.10% (P1.8 billion), assisting in mitigating the decline in duty collections resulting from reduced tariffs on rice imports under Executive Order (EO) No. 62,” the BTr noted.

In July 2024, EO 62 lowered import tariffs on rice to 15% until 2028, along with extending the reduced tariff rates on pork, corn, and mechanically deboned poultry meat.

It also prolonged the zero-tariff policy on electric vehicles and their components through 2028 and broadened the scope to encompass other categories of e-vehicles.

Collections by other offices declined by 4.58% to P3.2 billion in January.

In contrast, nontax revenues plummeted by 19.16% to P29.6 billion, “primarily due to the base effect of one-time gains noted the previous year.”

Nonetheless, the BTr remarked that the Treasury’s revenues “remained relatively robust” despite a 5.92% year-on-year decrease to P15.7 billion in January.

The 34.62% year-on-year increase in the NG’s share of profits from the Philippine Amusement and Gaming Corp. provided a “positive impact,” the Treasury further commented.

Collections from other offices also fell by 30.3% to P13.9 billion.

Meanwhile, government expenditures surged by 19.45% to P398.8 billion in January compared to P333.9 billion in the same month last year.

“This vigorous spending performance was primarily driven by disbursements linked to progress billings of accomplished infrastructure and other capital outlay initiatives of the Department of Public Works and Highways (and) the implementation of diverse health and social welfare programs,” it elaborated.

The BTr linked the accelerated spending to costs associated with preparations for the May 12 national and local elections.

“Increased National Tax Allotment (NTA) releases and subsidies to government agencies also played a substantial role in the notable rise of disbursements in January,” stated the Treasury.

Primary spending — referring to total expenditures excluding interest payments — climbed by 13.37% to P294.4 billion in January from P259.6 billion a year earlier. It constituted 73.82% of the month’s total disbursements.

The BTr explained that the rise in interest payments “merely reflects a change in the timing of coupon payments due to the strategy involving multiple re-offerings of Treasury bonds initially issued in January last year to enhance secondary market trading activity.”

Interest payments surged by 40.71% to P104.4 billion in January from P74.2 billion the previous year.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort noted that there has been a fiscal surplus in January in recent years following “significant deficits” observed in December.

Nevertheless, he pointed out that the budget situation is likely to revert to a deficit starting in February.

Mr. Ricafort also attributed the accelerated government expenses to election preparations.

“One strategy that could aid in diminishing the NG’s budget deficit and mitigate additional borrowings/overall debt by the NG would be to increase the remittance of dividends and surplus by certain government-owned and -controlled corporations to the NG, if permitted under the law/respective charters,” he stated. — Aubrey Rose A. Inosante