Bitcoin has been experiencing lower lows in the recent weeks, causing numerous investors to wonder if the asset is on the verge of a significant bearish phase. Nonetheless, a rare data metric related to the US Dollar Strength Index (DXY) indicates that a substantial change in market behavior might be on the horizon. This bitcoin buying indicator, which has emerged only three times throughout BTC’s history, could signify a bullish turnaround despite the prevailing bearish atmosphere.

For a more comprehensive analysis of this subject, view a recent YouTube video here:

Bitcoin: This Has Only Happened 3 Times Before

BTC vs DXY Inverse Relationship

The price movements of Bitcoin have historically shown an inverse correlation with the US Dollar Strength Index (DXY). Traditionally, when the DXY rises, BTC tends to face challenges, while a decreasing DXY frequently establishes favorable macroeconomic circumstances for Bitcoin’s price growth.

In spite of this historically positive impact, Bitcoin’s valuation has continued to decline, recently falling from over $100,000 to under $80,000. However, previous instances of this unusual DXY retreat indicate that a delayed yet significant BTC resurgence could still be possible.

Occurrences of Bitcoin Buy Signal in History

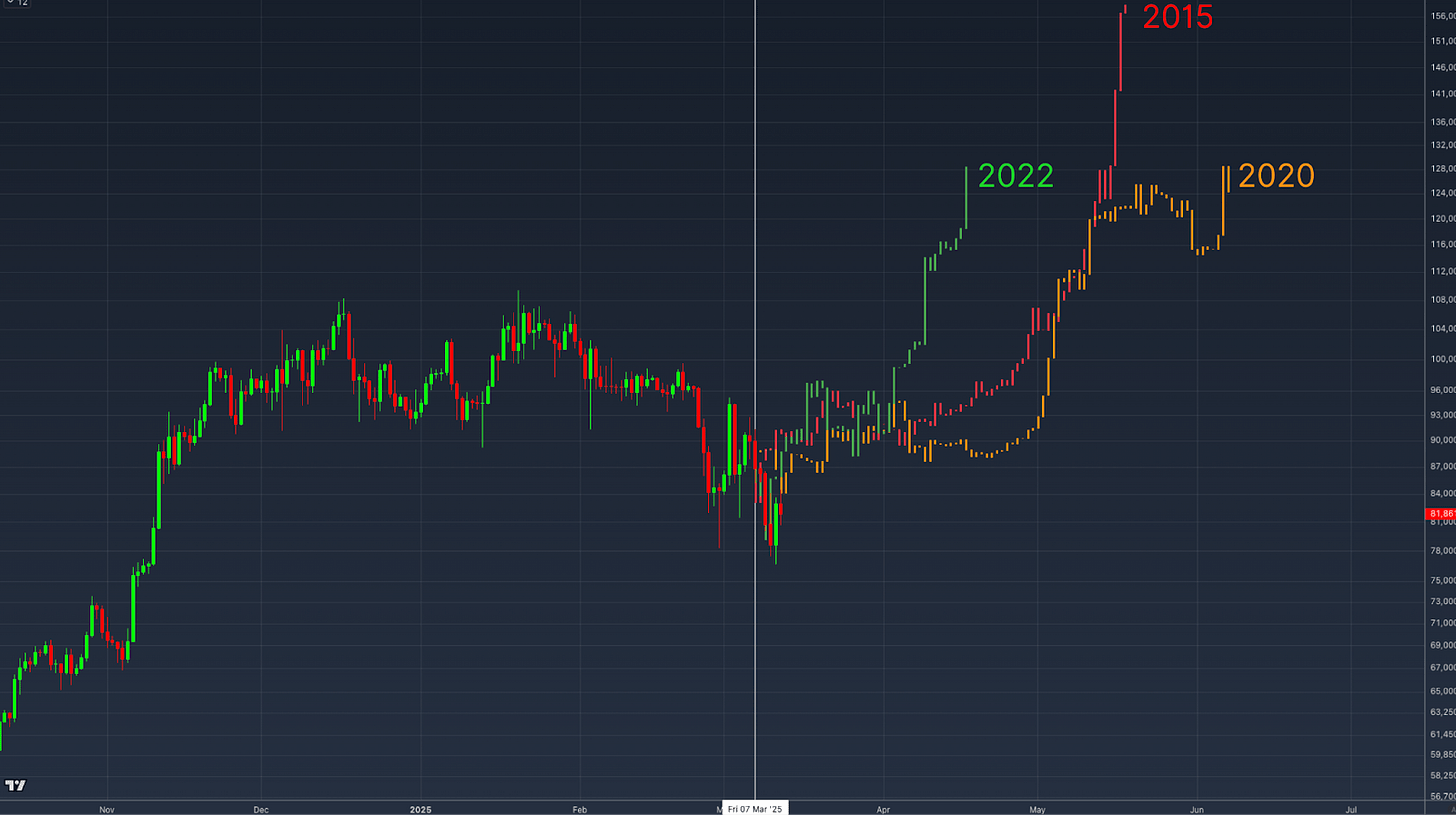

Currently, the DXY has been in a steep decline, with a drop exceeding 3.4% within just a single week, a rate of change that has only been observed three times throughout Bitcoin’s entire trading history.

To comprehend the potential ramifications of this DXY signal, let’s explore the three previous instances when this sharp drop in the US dollar strength index took place:

- 2015 Post-Bear Market Low

The initial occurrence happened after BTC’s value had reached its lowest point in 2015. After a phase of sideways consolidation, BTC’s valuation saw an enormous upward leap, rising over 200% within a few months.

The second instance took place in early 2020, subsequent to the steep market decline brought on by the COVID-19 pandemic. Similar to the situation in 2015, BTC first exhibited erratic price movements before a swift upward trajectory developed, culminating in a multi-month rally.

- 2022 Bear Market Recovery

The latest instance occurred at the conclusion of the 2022 bearish market. Following an initial phase of price stabilization, BTC proceeded with a prolonged recovery, ascending to significantly higher valuations and initiating the current bullish cycle over the succeeding months.

In all instances, the sharp dip in the DXY was succeeded by a consolidation period prior to BTC embarking on a notable bullish surge. By overlaying the price trajectories of these three occurrences with our current price developments, we can infer how events may unfold in the near future.

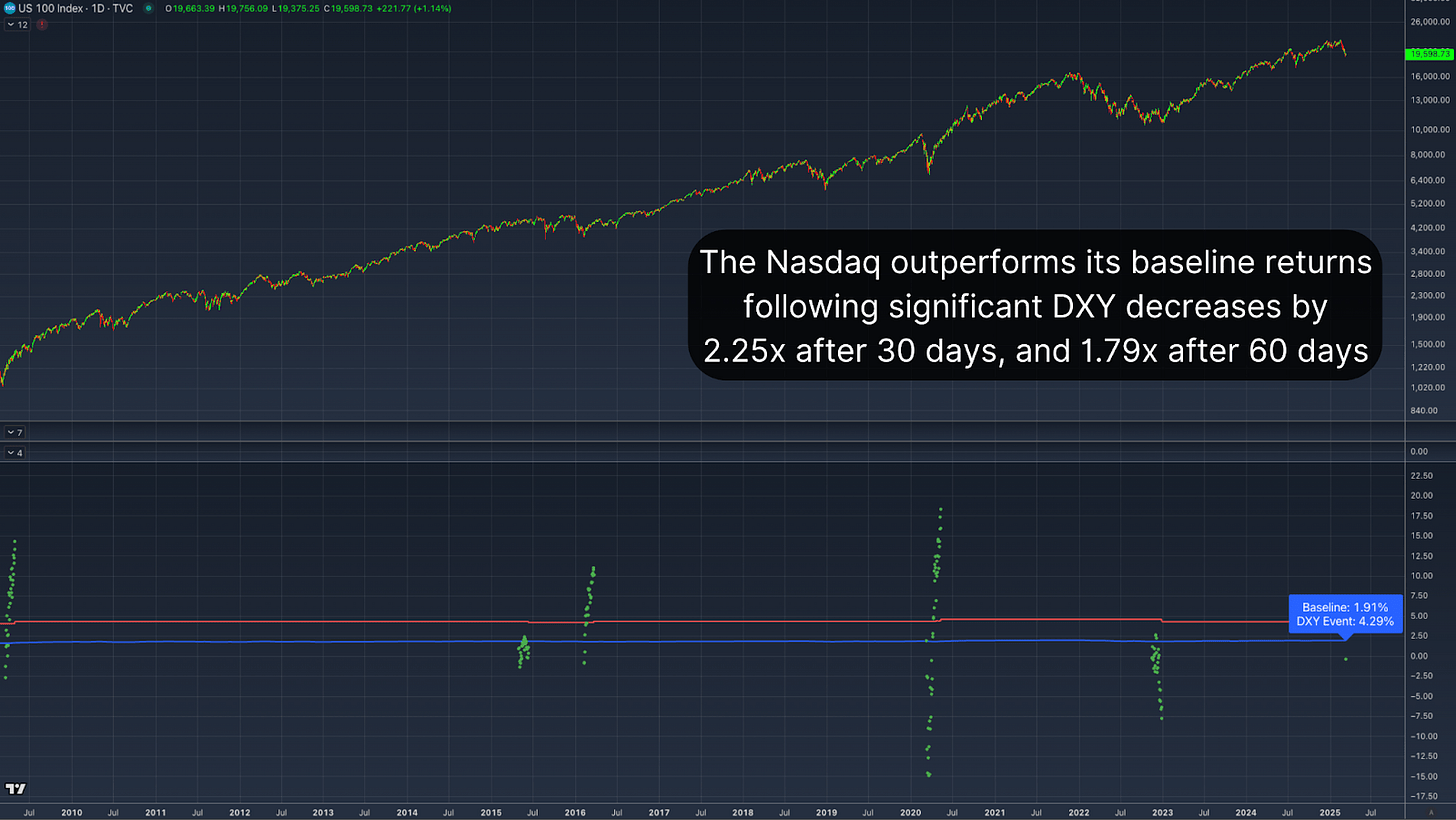

Equity Markets Correlation

Notably, this behavior isn’t exclusive to Bitcoin. A comparable connection can be seen in conventional markets, predominantly within the Nasdaq and the S&P 500. Historically, when the DXY experiences a sharp reversal, equity markets have outshone their baseline performances.

The historical average 30-day return for the Nasdaq after a comparable DXY dip sits at 4.29%, significantly surpassing the typical 30-day return of 1.91%. When broadening the time frame to 60 days, the Nasdaq’s average return escalates to around 7%, nearly doubling the usual performance of 3.88%. This association implies that Bitcoin’s performance after a sharp DXY decline is in line with historical wider market trends, bolstering the case for a delayed but certain positive reaction.

Conclusion

The ongoing drop in the US Dollar Strength Index signifies a rare and historically bullish Bitcoin purchase signal. Although BTC’s short-term price activity remains subdued, historical examples indicate that a consolidation phase is likely to precede a substantial rally. Particularly when bolstered by observing a similar reaction in indexes like the Nasdaq and S&P 500, the overall macroeconomic conditions appear favorable for BTC.

Explore real-time data, charts, indicators, and in-depth analysis to remain ahead of Bitcoin’s price movements at Bitcoin Magazine Pro.

Disclaimer: This article is intended solely for informational use and should not be interpreted as financial counsel. Always conduct your own research prior to making any financial decisions.