Individuals frequently commemorate times of reduced feerates. It’s the moment to tidy up, consolidate any UTXOs you wish to, launch or terminate any Lightning channels you’ve been anticipating, and engrave an absurd 8-bit jpeg into the blockchain. They are regarded as a favorable period.

However, they are not. We have observed remarkable price surges over the past months, ultimately reaching the 100k USD milestone that everyone thought was inevitable during the last market cycle. That’s atypical.

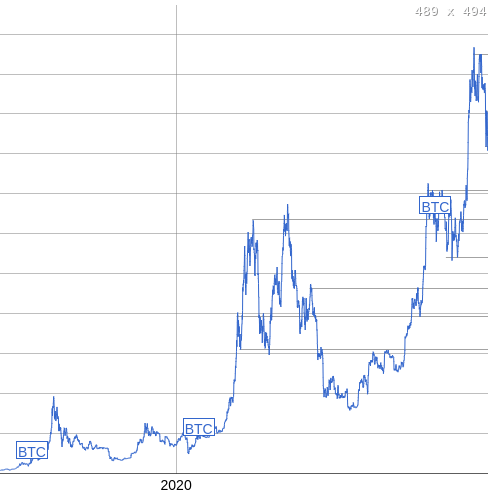

The illustration on the left represents the daily average feerate since 2017, while the illustration on the right depicts the daily average price since 2017. When prices surged and exhibited high volatility, historically, we have witnessed feerates increase correspondingly. Typically synchronizing with the rise and peaking at the same time as the price. The participants engaged in buying and selling executed transactions on-chain, retaining custody of their own coins upon purchase.

This recent surge past 100k appears not to have influenced feerates in the same proportional manner that even prior movements in this cycle have done. Now, if you truly examined both of those graphs, I’m certain many observers are pondering, “What if this cycle is concluding?” It’s a possibility, but let’s entertain the idea that it isn’t for a moment.

What else might this signify? It suggests that the actors propelling the market are evolving. A cohort that was once predominantly comprised of individuals managing their own custody and minimizing counterparty risks by withdrawing gains from exchanges, who created time-sensitive on-chain activities, is shifting to a demographic that merely trades ETF shares without any necessity for on-chain settlement.

This is detrimental. Bitcoin’s essence is defined by the individuals who interact directly with the protocol. Those who possess private keys to authorize transactions, generating revenue for miners. Those who receive funds and validate transactions according to consensus rules via software.

Both those aspects, being stripped from users and placed under the control of custodians, jeopardizes the fundamental stability of Bitcoin’s nature.

This represents a critical existential challenge that requires resolution. The entire stability of consensus surrounding a specific set of rules relies on the premise that there are sufficient independent actors with divergent interests that converge on a value derived from utilizing that rule set. The smaller the cohort of independent actors (and the larger the group of individuals “utilizing” Bitcoin through those actors as intermediaries), the more feasible it becomes for them to coordinate fundamental changes, and the more likely it is that their collective interests will misalign from those of the broader group of secondary users.

If trends continue in this direction, Bitcoin could ultimately embody none of the attributes that those of us present today hope it to retain. This matter is both technical, in terms of scaling Bitcoin in a manner that grants users independent control over their on-chain funds, even if only as a last resort, and it is also a matter of incentives and risk management.

The framework must not only scale but also offer mechanisms to alleviate the risks associated with self-custody to a degree that people are accustomed to in the traditional financial domain. Many actually require it.

This situation isn’t merely about “emulating my approach as it’s the sole correct method,” it has implications regarding the foundational characteristics of Bitcoin itself over the long term.

This article is a Take. The views expressed are solely those of the author and do not necessarily represent those of BTC Inc or Bitcoin Magazine.