The Ethereum Foundation has disclosed that it will collaborate with the New York-based banking alliance R3CEV to develop a new blockchain-based currency, Lizardcoin, which intends to illustrate the advantages of blockchain technology while highlighting the consortium’s capability to present the technology to institutional clients and the regulation-prone general public by enhancing it with an ample measure of centralized oversight.

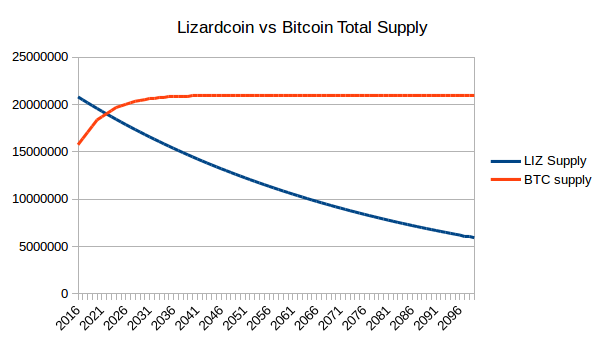

Lizardcoin aspires to emerge as a formidable rival to Bitcoin as a store of value, surpassing Bitcoin’s 21 million capped supply with a pioneering deflationary model, commencing with a cap of 20.9 million and then diminishing the supply by 1.5% annually. This is achieved by leveraging one of the most significant breakthroughs of contemporary central banking: negative interest rates. All accounts incur a storage fee of 2.5% per annum, where 1.0% is allocated to member banks for their discretionary use.

To utilize Lizardcoin, an individual must first undergo KYC verification with 28 out of 42 member banks. “This enhances decentralization,” Tim Grant explains; “even in the event that a total of 13 banks are co-opted by the Goa’uld at the upcoming Illuminati summit, the extraterrestrials will not have the capacity to create an unlimited number of new accounts, disrupt the operational framework, or navigate through fragmented member banks to establish multiple accounts for a single individual.” The system has received validation from Byzantine fault tolerance specialists Andrew Miller and Emin Gun Sirer, although Turkish prime minister Recep Tayyip Erdogan has chosen not to comment, describing it as highly offensive for computer scientists to reference a previous name of Istanbul in relation to compromised or malevolent parties.

Paul Randomer from IBM has praised the initiative, stating, “we at IBM have a team of two individuals developing on Lizardcoin technology, and we hope that our readiness to integrate this platform into our portfolio of 37125 internal research initiatives—spanning nearly every technology across various sectors—demonstrates that This Is Huge™, and that we believe Lizardcoin undoubtedly represents the future.” Bob Inthere from JP Morgan adds, “for far too long, banks have felt threatened by decentralized technology. Now, we possess a platform that allows us to harness the power of cryptocurrency not to disrupt our fundamental operations but instead to reinforce them, securing an endless flow of revenue for ourselves, and better serving our true lizard-headed overlords.”

We are also engaged in discussions with the Department of Homeland Security to formulate a strategy on how Lizardcoin can be utilized in the global fight against terrorism. We hope that individuals behind us in the security queue won’t be too inconvenienced—after all, we are constructing the next generation of revolutionary economy.

The Lizardcoin crowdsale* will commence in two weeks, with ether and unicorns accepted as forms of payment, at an exchange rate of 1 unicorn = 2.014 ETH = 4.712388 LIZ; anyone worldwide will have the opportunity to partake, although they must complete the KYC procedure with 28 banks initially, which involves several in-person visits across multiple nations; we have collaborated with Coindesk to conduct blockchain conventions in each of these nations over the upcoming year, enabling participants to continue summitting while acquiring their approval stamps to procure the pinnacle of blockchain technology offerings.

*The Lizardcoin crowdsale bears no legal assurances or commitments; neither R3CEV nor Ethereum assume any responsibility for the ongoing development of the Lizardcoin platform upon the completion of the crowdsale. Indeed, since Ethereum is a public blockchain and thus lacks definitive settlement, neither ether, unicorns, nor Lizardcoin will ever truly change hands—it will merely approach doing so with increasing probability; for this reason, the Lizardcoin crowdsale does not legally qualify as an offering of any type.