In a publication issued this Wednesday, Fidelity Digital Assets, in partnership with Lightning payment provider Voltage, published a document concerning the current state of the Lightning Network.

The document elaborates on the numerous ways the Lightning Network has expanded since its inception in 2018.

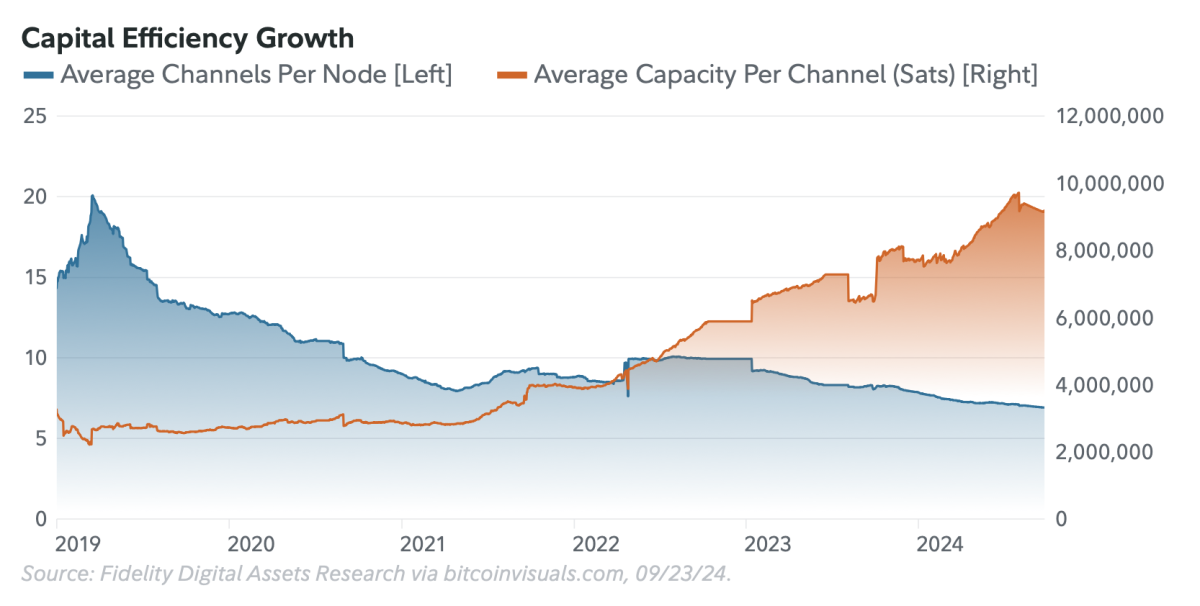

It also demonstrates that a greater number of businesses have started to incorporate Lightning in 2024 than in any previous year, that larger channels are emerging on the network, and that an increasing number of Lightning nodes are being activated.

Some notable statistics highlighted in the document include:

- The total Lightning capacity measured in U.S. dollars has surged by 2,767% since 2020

- Its capacity in bitcoin terms has increased by 384% during the same timeframe

- Currently, nearly all Lightning payments below 1,000,000 sats are processed in under 1.1 seconds

While these figures filled me with hope, it was other insights in the report that truly resonated with me and prompted me to reconsider my perspective on Bitcoin and Lightning.

Here are the top three insights from the report:

- Lightning transactions are gaining momentum on Nostr (the largest bitcoin circular economy globally), with Nostr users sending over 3.6 million individual zaps in the last half-year

- Initiatives like ARK, another Bitcoin Layer 2 solution, showcase that Lightning can be utilized beyond mere peer-to-peer channels (ARK enables users to distribute virtual UTXOs (vUTXOs) to a broader audience rather than on a one-to-one basis), and can be developed in ways many initially did not foresee

- The “HODL” mindset remains one of the factors impeding Lightning adoption; in other words, if Bitcoin advocates do not utilize their bitcoin, Lightning’s expansion may stall, which could undermine Bitcoin’s value proposition

As we embark on 2025, a year that many anticipate will be significant for Lightning, I am eager to observe the extent of traction Lightning achieves in the coming ten months.

It is indeed time for bitcoin to be utilized more as a means of exchange — the original vision Satoshi had for it.