The transition of Bitcoin from a little-known digital asset to an influential global financial entity has been remarkably impressive. As Bitcoin embarks on a fresh chapter, institutions, governments, and developers are collaborating to unleash its utmost capabilities. Matt Crosby, Bitcoin Magazine Pro’s chief market analyst, engaged in a discussion with Rich Rines, contributor at Core DAO, to explore Bitcoin’s forthcoming growth, the emergence of Bitcoin DeFi, and its promise as a global reserve resource. Catch the complete interview here: The Future Of Bitcoin – Featuring Rich Rines

Bitcoin’s Development & Institutional Integration

Rich Rines has been involved in the Bitcoin landscape since 2013, having observed its evolution from an experimental concept to a globally acknowledged financial tool.

“By the 2017 cycle, I was quite resolved that this is what I was going to dedicate the remainder of my career to.”

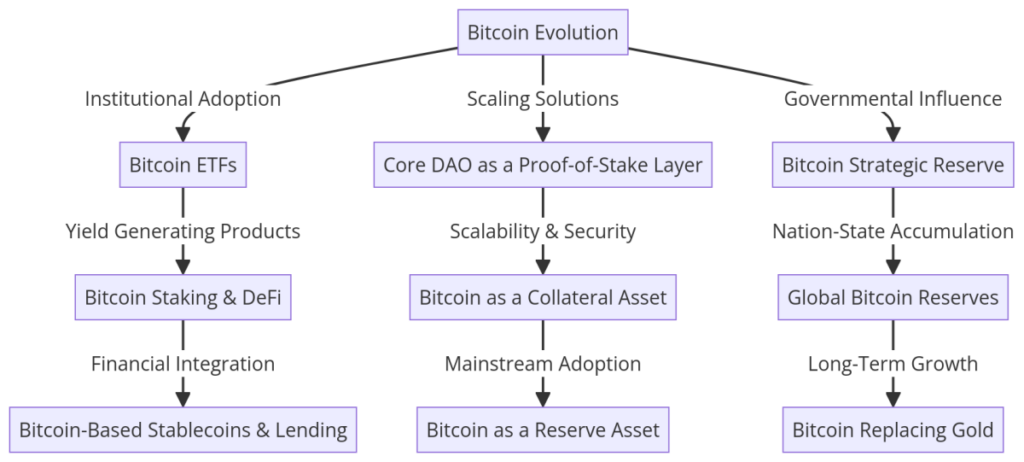

The dialogue examines Bitcoin’s increasing importance in institutional investment portfolios, with spot Bitcoin ETFs having already surpassed $41 billion in inflows. Rines contends that the institutional embrace of Bitcoin will further transform global finance, especially with the emergence of yield-generating products that attract Wall Street stakeholders.

“Every asset management firm across the globe can now acquire Bitcoin through ETFs, and that fundamentally alters the marketplace.”

What is Core DAO?

Core DAO is an advanced blockchain ecosystem aimed at enhancing Bitcoin’s utility via a proof-of-stake (PoS) methodology. In contrast to conventional Bitcoin scaling solutions, Core DAO utilizes a decentralized PoS framework to boost scalability, programmability, and interoperability while preserving Bitcoin’s integrity and decentralization.

Essentially, Core DAO functions as a Bitcoin-aligned Layer-1 blockchain, meaning it expands Bitcoin’s functionalities without modifying its foundational layer. This facilitates a variety of DeFi applications, smart contracts, and staking options for Bitcoin holders.

“Core is the premier Bitcoin scaling solution, and the perspective to have is that it serves as the proof-of-stake layer for Bitcoin.”

By securing 75% of the Bitcoin hash rate, Core DAO guarantees that the security principles of Bitcoin are upheld while providing enhanced functionality for developers and users. With a burgeoning ecosystem consisting of over 150+ projects, Core DAO is laying the groundwork for the upcoming phase of Bitcoin’s financial growth.

Core: Bitcoin’s Proof-of-Stake Layer & DeFi Growth

A major hurdle facing Bitcoin is scalability. The high fees and slow transaction speeds of the Bitcoin network make it a robust settlement layer but restrict its practicality for everyday transactions. This is where Core DAO enters the picture.

“Bitcoin lacks scalability and programmability. It’s prohibitively costly. All these factors that contribute to it being an excellent settlement layer are exactly why we require a solution like Core to broaden those capabilities.”

Core DAO acts as a proof-of-stake layer for Bitcoin, enabling users to generate yield without the risks associated with third parties. It creates an environment where Bitcoin holders can engage in DeFi applications while ensuring security is not compromised.

“We’re about to witness Bitcoin DeFi surpass Ethereum DeFi in the next three years because Bitcoin is a superior collateral asset.”

Bitcoin as a Strategic Reserve Asset

Governments and sovereign wealth funds are beginning to perceive Bitcoin not merely as a currency but as a strategic reserve asset. The possibility of a U.S. Bitcoin strategic reserve, along with wider global acceptance at the national level, could usher in a new financial framework.

“People are beginning to discuss the establishment of strategic Bitcoin reserves for the first time.”

The concept of Bitcoin superseding gold as the primary store of value is becoming increasingly plausible. Rines emphasizes that Bitcoin’s scarcity and decentralization render it a superior option compared to gold.

“I believe within the next decade, Bitcoin will evolve into the global reserve asset, replacing gold.”

Bitcoin Privacy: The Ultimate Challenge

While Bitcoin is frequently lauded as a decentralized and censorship-resistant asset, privacy remains a significant obstacle. Unlike cash transactions, Bitcoin’s public ledger reveals all transactions to anyone who has access to the blockchain.

Rines is of the opinion that enhancing Bitcoin’s privacy will be a pivotal advancement in its development.

“I’ve desired private Bitcoin transactions for quite some time. I’m rather skeptical about it ever materializing on the base layer, but there’s potential in scaling solutions.”

While solutions such as CoinJoin and the Lightning Network improve privacy to an extent, complete anonymity is still out of reach. Core is investigating innovations that might enable confidential transactions without compromising Bitcoin’s security and transparency.

“On Core, we’re collaborating with teams on possibly implementing confidential transactions—where you can identify that a transaction is occurring, but not the amount or parties involved.”

As authorities continue to scrutinize digital financial activity, the demand for enhanced Bitcoin privacy features will only escalate. Whether through native protocol adaptations or second-layer remedies, the future of Bitcoin privacy remains a pivotal area for advancement.

The Future of Bitcoin: A Trillion-Dollar Market in the Offing

As the dialogue continues, Rines outlines how Bitcoin’s economic structure is evolving beyond mere speculation and into functional financial instruments. He anticipates that within ten years, Bitcoin will hold a market capitalization of $10 trillion, with DeFi applications forming a substantial part of its economic framework.

“The Bitcoin DeFi market presents a trillion-dollar prospect, and we’re merely at the outset.”

His insight aligns with a wider industry trend where Bitcoin is not only utilized as a store of value but is also being employed as an active financial asset within decentralized networks.

Rich Rines Roadmap for Bitcoin’s Future

Concluding Thoughts

The exchange between Matt Crosby and Rich Rines offers an intriguing outlook on the future of Bitcoin. With the rapid pace of institutional adoption, the expansion of Bitcoin DeFi, and the increasing acknowledgment of Bitcoin as a strategic reserve, it is evident that Bitcoin’s most promising years lie ahead.

As Rines articulates:

“Developing on Bitcoin represents one of the most thrilling opportunities globally. There’s a trillion-dollar market ready to be tapped.”

For investors, developers, and policymakers, the key message is unmistakable: Bitcoin is no longer merely a speculative asset—it is the cornerstone of a new financial system.

For more comprehensive Bitcoin analysis and to enjoy advanced features such as live charts, personalized indicator alerts, and detailed industry reports, visit Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and does not constitute financial advice. Always conduct your own research prior to making any investment choices.