Last evening, President Trump enacted the “Digital Assets” executive order (EO), and let’s just mention that Bitcoin enthusiasts are feeling quite… disheartened. At first, there were speculations that this could be the long-awaited Strategic Bitcoin Reserve (SBR) legislation. But nope — not even close. Bitcoin reserves didn’t receive a single reference.

Instead, the EO stated:

“The Working Group will assess the feasibility of developing and sustaining a national digital asset store and suggest criteria for establishing such a stockpile, potentially sourced from cryptocurrencies lawfully confiscated by the Federal Government through its law enforcement initiatives.”

In simpler terms: This EO resembles a vague “let’s examine altcoins” guideline rather than a bold advancement towards a Strategic Bitcoin Reserve. If you were anticipating a moment of enlightenment for nation states, this isn’t it.

However, before you unleash your anger on social media, take a moment to relax. There is a silver lining. The EO does prohibit CBDCs — a significant victory for financial freedom and a more Bitcoin-friendly future.

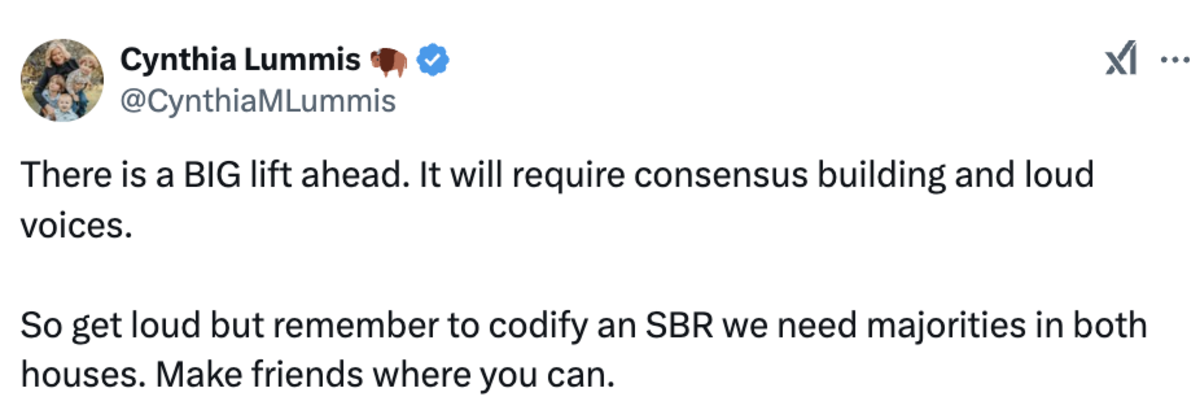

Additionally, as Senator Cynthia Lummis reminded us yesterday, her Strategic Bitcoin Reserve Bill is “a BIG lift”:

Why is this encouraging news? Let’s analyze:

- Executive Orders Are Temporary: EOs are fast to execute but can be swiftly repealed by the subsequent administration. They’re mere political reminders, not enduring solutions.

- Legislation Is Robust: Laws enacted through both chambers of Congress are significantly more challenging to overturn. Lummis’ long-term approach aims to fortify Bitcoin’s position in the U.S. economy for generations to come, not just the upcoming election cycle. She is choosing the long-term mindset, and I commend her for that.

Senator Lummis articulated it herself in a direct message on X that she permitted me to share:

“Even if the EO had constituted a definitive Strategic Bitcoin Reserve, the next administration (following Trump) could revoke it (what’s established administratively can usually be undone administratively). Therefore, to achieve the 20-year minimum HODL that my bill advocates for, and to genuinely tackle America’s debt, we must navigate the legislative route (passing through both the House and Senate) to deliver it to the President for endorsement.

It’s crucial that we maintain momentum for a marathon, not a sprint. I don’t want individuals feeling disheartened. The trajectory is upward but we have to stay committed and engage with the process. There’s a lot to accomplish, but the EO was a solid starting point to propel us forward.”

So indeed, the EO may appear to be a swift win for crypto leaders eager to maximize their investments. Yet, the genuine battle for Bitcoin’s future is just beginning.

A congressional ratified SBR is preferable to an SBR through Executive Order. Period!

Bitcoin has consistently thrived amidst challenges. Be it prohibitions, limitations, or now the “national digital asset stockpile” absurdity, Bitcoin’s fortitude is unparalleled. As Senator Lummis endeavors to advance the Strategic Bitcoin Reserve Bill through Congress, individual states are already taking the lead. States are proposing Bitcoin-specific reserve laws, rather than ambiguous “digital asset” schemes.

Meanwhile, international momentum is surging. Putin didn’t declare, “no one can manage digital assets,” he stated “no one can manage Bitcoin”. Nation states are not about to FOMO into $TRUMP or FARTCOIN. They’re observing, learning, and gradually inching towards Bitcoin.

Bitcoin prevails because it represents superior money. Each news update, even setbacks, ultimately favors Bitcoin as it reveals vulnerabilities in fiat and reinforces Bitcoin’s narrative. Therefore, remain patient. The slow ascent will be rewarding.

See you in Vegas — and keep in mind: best money prevails.

This article is a Take. Views expressed are solely those of the author and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.