Larry Fink, Chief Executive Officer of BlackRock, recently hypothesized that Bitcoin might feasibly attain valuations nearing $700,000 per BTC. This outlook arises amid escalating worries regarding currency devaluation and worldwide economic uncertainty, positioning Bitcoin as a safeguard against weaknesses in conventional financial frameworks. Fink’s comment was not an explicit endorsement but rather a contemplation on a recent discussion he had with a sovereign wealth fund. The fund was looking for guidance on whether to invest 2% or 5% of its portfolio in Bitcoin. According to Fink, if institutional embrace continues to expand and similar investment strategies are widely adopted, market conditions could propel Bitcoin to those extraordinary heights.

Fink made this notable assertion during a recent interview, clarifying that Bitcoin’s potential for substantial growth is closely linked to apprehensions about economic recessions and fiat currency depreciation. He referred to Bitcoin as an “international asset” capable of alleviating localized economic anxieties.

JUST IN: $11.5 trillion BlackRock CEO Larry Fink says Bitcoin could rise to $700,000 if fears of currency devaluation and economic instability increase.pic.twitter.com/WOXclAsjDP

— Bitcoin Magazine (@BitcoinMagazine) January 22, 2025

A Message to the Market

With BlackRock overseeing $11.5 trillion in assets, Fink’s statements carry considerable influence, delivering a clear signal to both retail and institutional investors. His affirmation goes beyond personal belief, acting as a market indicator concerning Bitcoin’s potential direction. Long regarded as “digital gold,” Bitcoin is perceived as a means of preserving wealth against inflation and governmental fiscal mismanagement. Fink’s acknowledgment of this narrative could hasten its adoption among conventional investors.

Related: From Laser Eyes to Upside-Down Pics: The New Bitcoin Campaign to Flip Gold

A Timely Forecast

Fink’s forecast emerges as global economies wrestle with rampant inflation, mounting national debts, and geopolitical unrest that jeopardizes currency stability. Bitcoin, with its capped supply of 21 million coins and decentralized framework, offers an alternative asset category that is resistant to the inflationary pressures ingrained in fiat currencies. In such an environment, its value proposition becomes increasingly persuasive.

BLACKROCK IS BACK.

THEY JUST ACQUIRED $600 MILLION IN BITCOIN, THEIR LARGEST PURCHASE TO DATE THIS YEAR. pic.twitter.com/QLAm5eaik4

— Arkham (@arkham) January 22, 2025

BlackRock’s Bitcoin ETF: A Signal of Institutional Interest

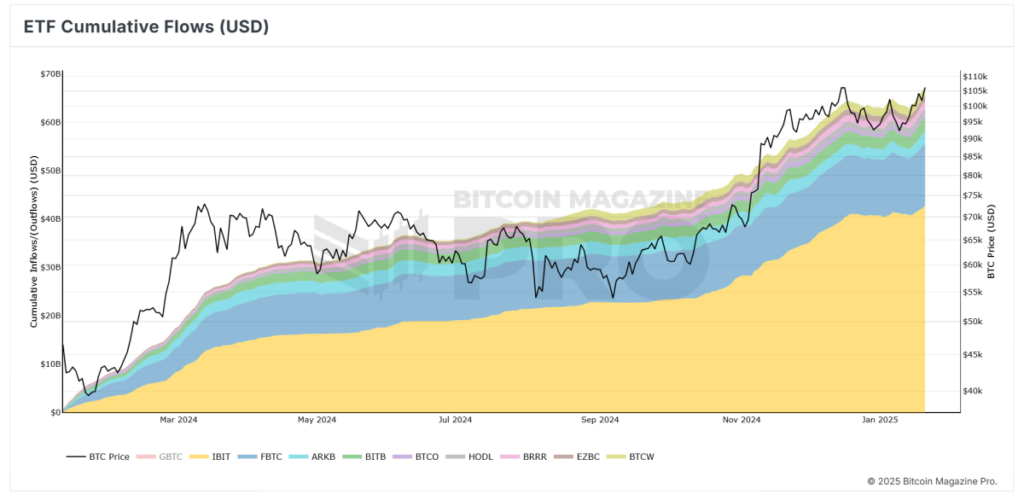

BlackRock’s increasing engagement with Bitcoin reached a milestone on January 21, 2025, when the company purchased $662 million worth of Bitcoin for its exchange-traded fund (ETF), marking their largest single-day acquisition this year.

BlackRock’s iShares Bitcoin Trust (IBIT) outpaced the firm’s iShares Gold Trust (IAU) in net assets as of October 2024. This achievement occurred just months after IBIT’s inception in January 2024, emphasizing the swift expansion and rising investor interest in Bitcoin-focused exchange-traded funds.

A Balanced Perspective

While Fink’s outlook is undeniably optimistic, it is still dependent on the ongoing economic trends. Should global economic stability improve or innovative financial systems emerge to mitigate worries regarding currency devaluation, Bitcoin’s price trajectory may stabilize at a lower threshold. Nonetheless, Fink’s high-profile comments highlight its evolving role as a legitimate asset class.

Related: David Bailey Forecasts $1M Bitcoin Price During Trump Presidency

Bitcoin’s Next Chapter

Bitcoin’s transformation from a niche digital experiment to a prominent financial instrument is picking up pace. Fink’s statements may indicate a critical juncture, not just for Bitcoin, but for its expansive acceptance in traditional finance. For investors and supporters, this signifies more than a show of confidence—it’s an indication that the integration of Bitcoin into the global financial framework is not just forthcoming but already in progress.

As the global audience observes, Bitcoin’s influence in redefining finance continues to expand. Fink’s forecast serves as a reminder that Bitcoin is no longer merely an unconventional idea but a vital participant in the evolution of money.