By Luisa Maria Jacinta C. Jocson, Reporter

THE PHILIPPINES’ balance of payment (BoP) surplus significantly decreased in 2024, falling below the central bank’s annual forecast.

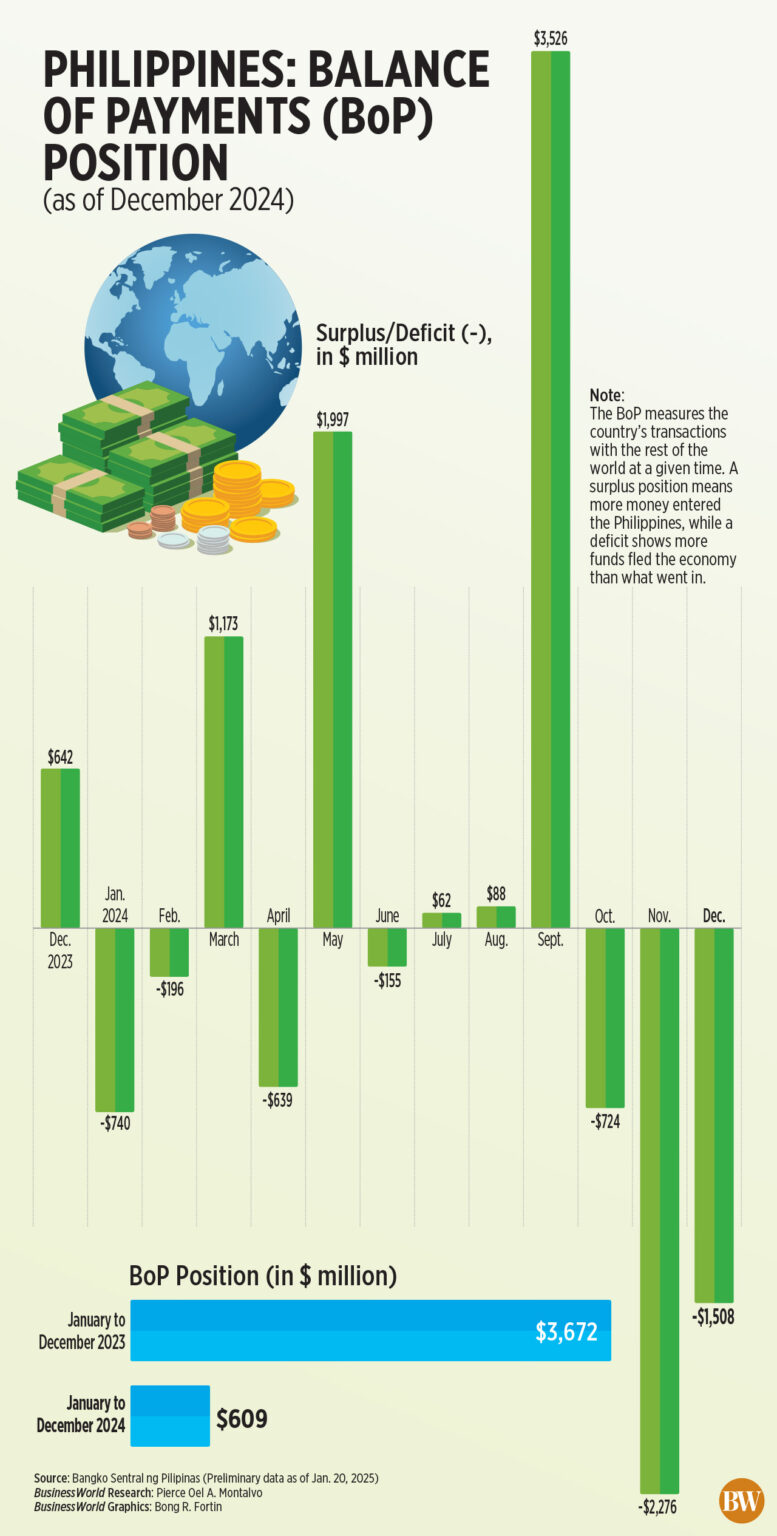

Data from the Bangko Sentral ng Pilipinas (BSP) indicated that the total BoP position recorded a surplus of $609 million last year, plummeting by 83.4% from the $3.672-billion surplus at the conclusion of 2023.

This was also considerably lower than the BSP’s annual estimate of $3.5 billion.

The BoP provides an overview of the nation’s transactions with the global community. A surplus indicates that more money flowed into the nation, while a deficit signifies more money exited.

“According to initial data, the reduction in the cumulative BoP surplus stemmed from an increased trade-in-goods deficit and diminished net earnings from trade in services and foreign borrowings by the National Government (NG),” stated the BSP.

Information from the local statistics bureau demonstrated that the trade deficit broadened by 3.2% year-on-year to $49.96 billion during the January-November timeframe.

External debt surged to an all-time high of $139.64 billion as of the end of September, according to BSP data.

“This drop was somewhat mitigated, however, by the persistent net inflows from personal remittances and net foreign portfolio and direct investments,” the central bank added.

In December alone, the BoP shifted to a deficit of $1.508 billion, reversing the $642-million surplus recorded a year prior.

“The BoP deficit in December 2024 was a result of the BSP’s net foreign exchange operations and withdrawals from the NG’s deposits with the BSP to fulfill its foreign currency debt obligations.”

In the previous year, the government procured $2 billion from international bonds in May and an additional $2.5 billion from its dollar bond issuance in August.

As of the end of December, the BoP indicated a gross international reserve (GIR) level of $106.3 billion, representing a decline of 2% from $108.5 billion as of the end of November.

“Specifically, the current GIR level guarantees the availability of foreign currency to address BoP financing requirements, such as for import payments and debt servicing, particularly in extreme situations where there are no export revenues or external loans,” stated the central bank.

The dollar reserve level was sufficient to cover 7.5 months of imports and payments for services and primary income. It also equated to approximately 3.7 times the national short-term external debt based on residual maturity.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort noted that the larger BoP deficit in December was partly due to the recent trade shortfall.

“There is a consistent increase in imports, particularly in energy, food, and capital goods that likely outstripped export performance,” remarked John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies.

“The ongoing downturn in exports due to diminished global demand, especially from major trading partners like China, has worsened the trade deficit, a key component of the current account,” he added.

Mr. Ricafort suggested that peso volatility, particularly from November to December, might have influenced the BoP position.

“The strong US dollar also augmented debt servicing expenses for dollar-denominated obligations,” Mr. Rivera remarked.

At the end of 2024, the peso concluded at P57.845, down by P2.475 or 4.28% from its end-2023 value of P55.37 against the dollar.

The peso dropped to a record-low P59 level three times last year—twice in November and once in December.

Mr. Rivera remarked that the recovery in tourism receipts and revenues from business process outsourcing may not have been sufficient to “completely counterbalance the adverse effects of the trade imbalance.”

“Furthermore, the government and private sector’s initiatives to settle maturing foreign debt obligations may have contributed to outflows in the financial account, further deteriorating the overall BoP position,” he added.

In the months ahead, the BoP could improve if structural inflows continue to grow, according to Mr. Ricafort.

“Any enhancement in BoP and GIR data in the coming months could still provide a more significant cushion for the peso exchange rate against the US dollar, particularly in the face of speculative pressures, as well as help fortify the country’s external standing,” he asserted.

Recent reforms would further assist in attracting additional investments into the nation, Mr. Ricafort stated.

In November, President Ferdinand R. Marcos, Jr. enacted the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy.

The legislation broadens fiscal incentives and reduces the corporate income tax for certain foreign entities.

The BSP anticipates a BoP surplus of $2.1 billion for 2025, which corresponds to 0.4% of gross domestic product.