Throughout the last year, the Bitcoin Renaissance has drawn considerable focus to BTCfi, or “Bitcoin DeFi” solutions. In spite of the excitement, only a handful of these solutions have fulfilled their commitments or succeeded in maintaining a substantial number of “actual” users.

To provide some context, the top lending platform for Bitcoin assets, Liquidium, permits users to borrow against their Runes, Ordinals, and BRC-20 assets. Where does the yield originate, you may wonder? Similar to any other loan, borrowers are required to pay an interest rate to lenders in return for their Bitcoin. Furthermore, to ensure the integrity of the loans, they are consistently overcollateralized by the Bitcoin assets themselves.

How substantial is Bitcoin DeFi currently? It varies based on your viewpoint.

In approximately 12 months, Liquidium has facilitated over 75,000 loans, signifying more than $360 million in total loan activity, and has disbursed over $6.3 million in native BTC interest to lenders.

For BTCfi to be deemed “authentic,” I would contend that these metrics must increase dramatically and become comparable to those on alternative chains like Ethereum or Solana. (Although, I firmly believe that over time, such comparisons will lose significance as all economic transactions ultimately settle on Bitcoin.)

Nonetheless, these accomplishments are remarkable for a protocol that’s scarcely a year old, functioning on a chain where even the slightest reference to DeFi often encounters intense skepticism. For further context, Liquidium is already surpassing altcoin rivals such as NFTfi, Arcade, and Sharky in volume.

Bitcoin is advancing in real time, without necessitating alterations to its base protocol — I’m here for it.

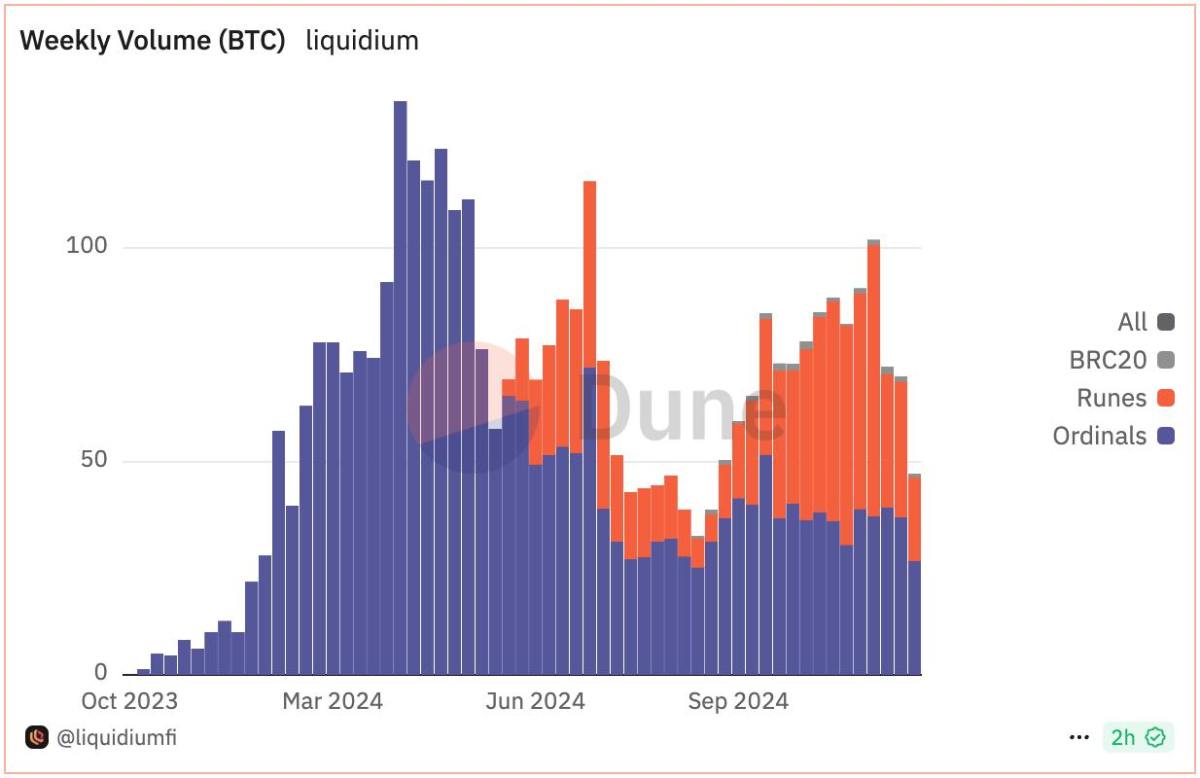

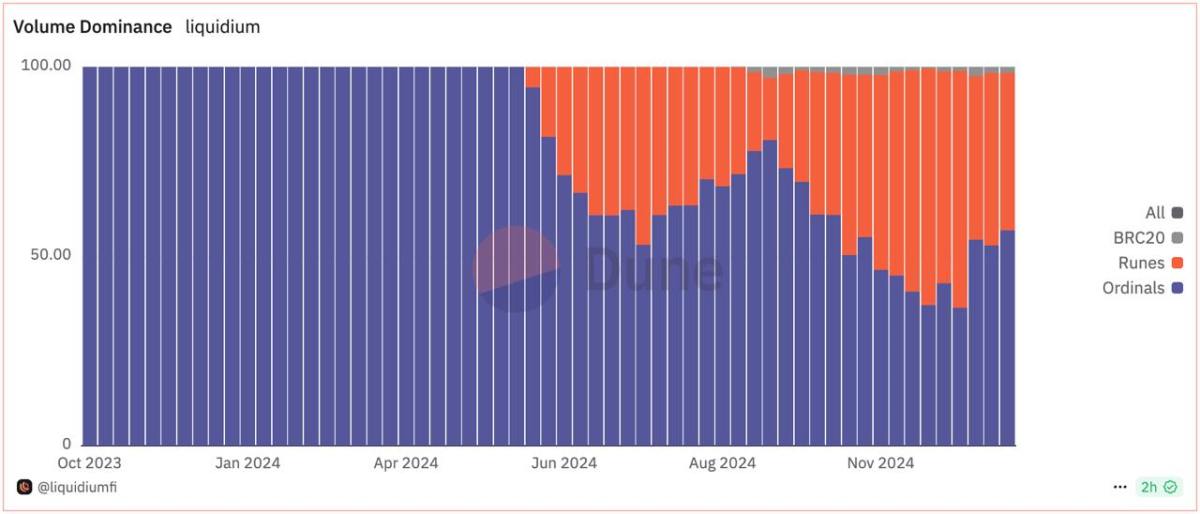

After a tumultuous beginning, Runes are now accountable for the majority of loans taken on Liquidium, surpassing both Ordinals and BRC-20s. Runes represent a notably more efficient protocol that places a lighter burden on the Bitcoin blockchain and offers a slightly enhanced user experience. The improved user experience that Runes provides not only streamlines the process for current users but also attracts a significant influx of new users who might be inclined to engage with on-chain activities in a more sophisticated manner. In contrast, BRC-20 faced challenges in drawing in new users due to its intricacy and less intuitive design. The presence of additional financial structures like P2P loans thus marks a progressive step in the usability and adoption of Runes, and potentially other Bitcoin-backed assets in the future.

The volume of loans on Liquidium has steadily risen over the past year, with Runes currently accounting for the majority of activity on the platform.

So Runes are now the prevailing asset backing Bitcoin native loans, why is this important? Is this advantageous for Bitcoin?

I would assert that, irrespective of your individual views on Runes or the current on-chain speculative activities, the fact that real individuals trust the Bitcoin blockchain to obtain decentralized loans denominated in Bitcoin ought to inspire freedom enthusiasts to celebrate.

We’re succeeding.

Bitcoin advocates have consistently claimed that no alternative blockchain can rival Bitcoin’s security assurances. Now, this perception is starting to shift as others begin to recognize this as well, facilitating new forms of economic activities on-chain. This is undoubtedly optimistic.

In addition, all transactions are inherently secured on the Bitcoin blockchain—no wrapping, no bridging, solely Bitcoin. We should promote and support those who are constructing in this manner.

This article is a Take. The views expressed are solely those of the author and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.