Purchasing Bitcoin at substantially elevated prices compared to a few months prior can be intimidating. Nevertheless, by employing effective strategies, you can acquire Bitcoin during downturns with an advantageous risk-to-reward ratio while benefiting from the bullish market.

Verifying Bull Market Conditions

Before acquiring, confirm that you are still operating in a bull market. The MVRV Z-score assists in determining overheated or undervalued scenarios by examining the discrepancy between market value and realized value.

Refrain from purchasing when the Z-score attains high levels, such as exceeding 6.00, which can imply that the market is overextended and close to a potential bearish turnaround. If the Z-score falls below this threshold, dips are likely to represent favorable opportunities, particularly if additional indicators align. Avoid aggressive accumulation during a bear market; instead, concentrate on identifying the macro bottom.

Short-Term Holders

This graph illustrates the average cost basis of new market entrants, providing insight into Short-Term Holder behavior. Traditionally, during bullish cycles, whenever the price rebounds from the Short-Term Holder Realized Price line (or slightly dips beneath it), it has presented excellent accumulation opportunities.

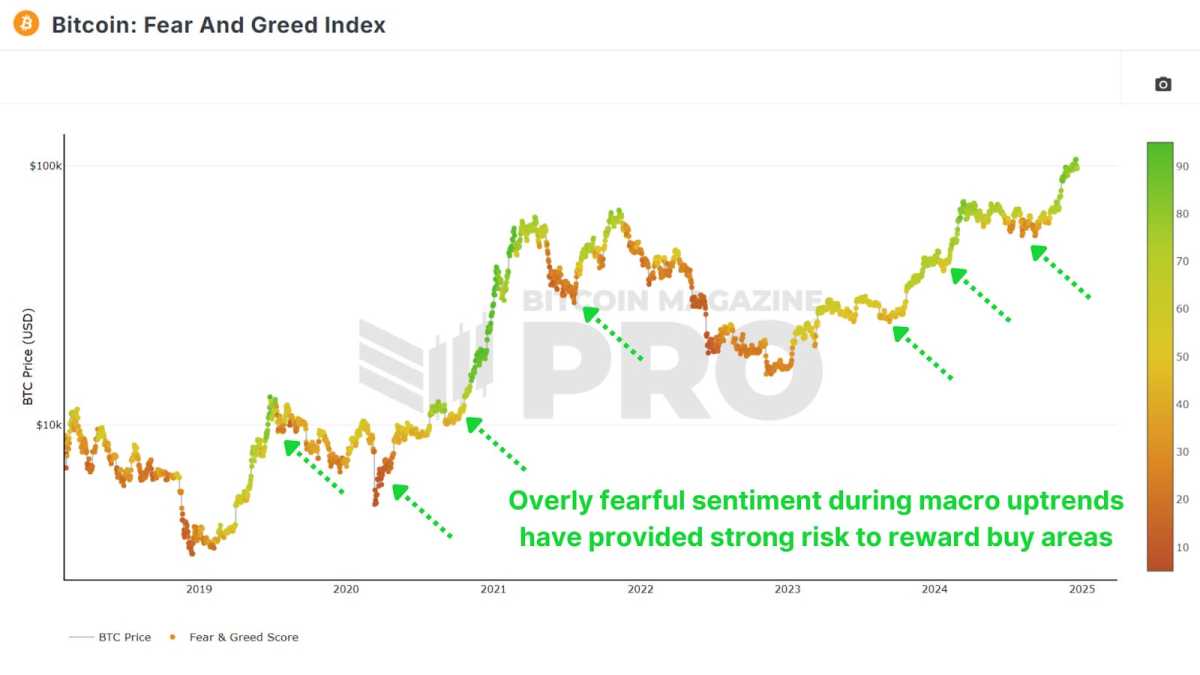

Assessing Market Sentiment

Though straightforward, the Fear and Greed Index offers valuable insight into market emotions. Scores of 25 or lower typically indicate extreme fear, often leading to irrational sell-offs. These instances present favorable risk-to-reward conditions.

Identifying Market Overreaction

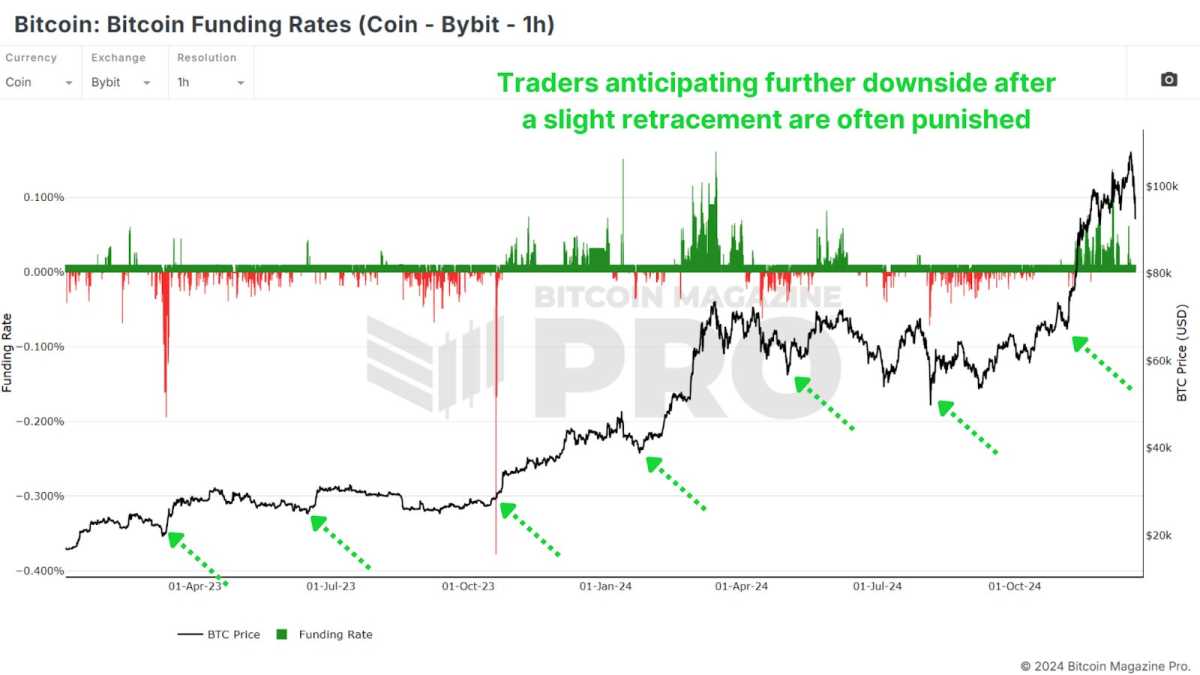

Funding Rates reflect trader sentiment within futures markets. Negative Funding during bullish cycles is particularly revealing. Platforms like Bybit, which cater to retail investors, indicate that negative Rates serve as a robust signal for accumulation during downturns.

When traders utilize BTC as collateral, negative rates frequently signal outstanding buying opportunities, as those shorting with Bitcoin tend to be more cautious and discerning. Thus, I prefer concentrating on Coin-Denominated Funding Rates over regular USD Rates.

Active Address Sentiment Indicator

This tool gauges the divergence between Bitcoin’s price and network activity. When a discrepancy is observed in the Active Address Sentiment Indicator (AASI), it signifies overly bearish price movements given the strength of the underlying network usage.

My preferred approach is to wait until the 28-day percentage price change falls below the lower standard deviation band of the 28-day percentage change in active addresses before crossing back above. This buying signal validates network strength and often indicates a reversal.

Conclusion

Capitalizing on bull market dips involves managing risk rather than pursuing bottoms. Acquiring slightly higher but in oversold conditions mitigates the chances of enduring a 20%-40% drawdown compared to buying during a steep rally.

Ensure we’re operating in a bull market and that dips are for purchasing, then identify advantageous buying zones using various metrics for alignment, such as Short-Term Holder Realized Price, Fear & Greed Index, Funding Rates, and AASI. Emphasize small, incremental purchases (dollar-cost averaging) over making significant investments and focus on risk-to-reward ratios rather than absolute dollar figures.

By merging these tactics, you can make well-informed decisions and seize the distinct opportunities presented by dips in a bull market. For a more comprehensive examination of this subject, check out a recent YouTube video here: How To Accumulate Bitcoin Bull Market Dips

For further detailed Bitcoin analysis and to access advanced features such as live charts, personalized indicator notifications, and comprehensive industry reports, visit Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes only and should not be construed as financial advice. Always conduct your own research before making any investment choices.