The price of Bitcoin appears poised for a positive reversal in January of the upcoming year, having exhibited lackluster price movement throughout this year. This optimistic projection for the leading cryptocurrency emerged as crypto analyst Tony Severino disclosed a potential Doji pattern, suggesting that BTC might experience this upward trend in the new year.

Related Reading

Doji Pattern May Trigger New Year Bitcoin Price Surge

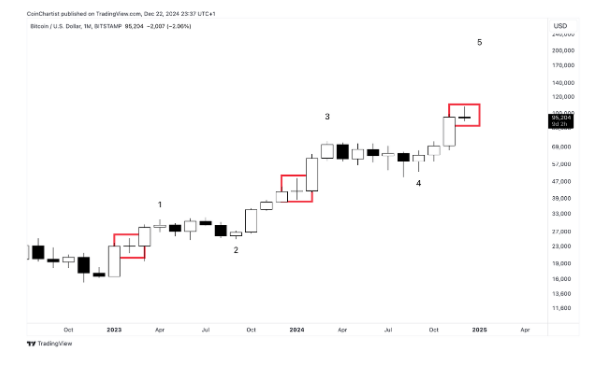

In an X post, Severino indicated that a Doji formation could pave the way for a Bitcoin price surge in the initial two months of the new year. The analyst noted his anticipation for BTC to conclude December with the Doji and then exhibit a strong continuation for the leading cryptocurrency in January. His supporting chart illustrated that this robust continuation could persist into February.

The crypto analyst elaborated that a Doji indicates a market pause due to the uncertainty of buyers and sellers. He added that the subsequent candlestick informs market participants of the direction determined by strong continuation or a reversal. In this instance, Severino predicts the upcoming candlestick will indicate a strong continuation for the Bitcoin price.

Severino pointed out that a comparable Doji at similar subwaves each led to two additional months of gains before a local peak formed in the Bitcoin price. Consequently, the cryptocurrency might witness two months of growth between January and February 2025 if history is any guide. From a fundamental standpoint, Donald Trump’s inauguration could be a catalyst for this robust continuation.

Following Trump’s success in the November US presidential elections, the BTC price surged above $100,000. Thus, the leading cryptocurrency may continue this upward trend as Trump becomes the first pro-crypto US president. Additionally, the president-elect might establish a Strategic Bitcoin Reserve upon taking office, which would further boost bullish momentum for BTC.

BTC Must Remain Above $92,730

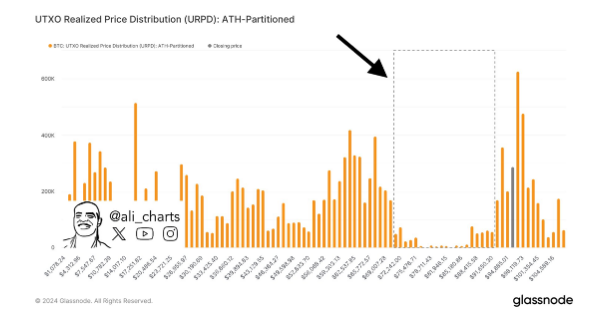

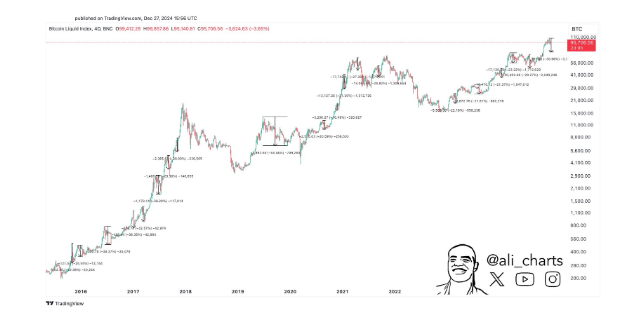

In an X post, crypto analyst Ali Martinez pointed out that the Bitcoin price must not fall below $92,730, as breaching that point could lead to a freefall. The accompanying chart from the analyst revealed that Bitcoin could plummet to the $70,000 range if it surpasses this $92,730 threshold.

Related Reading

Nevertheless, in another X post, Martinez proposed that such a decline in the Bitcoin price might not inevitably be negative. He explained that a 20% to 30% price correction could be the most favorable occurrence for Bitcoin. Simultaneously, Martinez indicated that the levels at which his bearish outlook for Bitcoin would be denied are a sustained close above $97,300 and a daily close exceeding $100,000.

As of this writing, the Bitcoin price is trading at roughly $94,400, reflecting an almost 2% decrease in the past 24 hours, according to data from CoinMarketCap.

Featured image from Reuters, chart from TradingView