Bitcoin and the wider cryptocurrency sector are facing a notable downturn, with the threat of a prolonged decline on the horizon. Following its peak of $108,300, Bitcoin’s upward momentum seems depleted, and pessimistic sentiment has taken hold of the market. This retracement has left traders wary, raising doubts about BTC’s ability to regain its upward trajectory.

In the midst of this difficult landscape, an intriguing trend has come to light. Essential metrics indicate that the rate of BTC exchange deposits has nosedived to a historic low of 30,000—a level not reached since 2016. This steep drop points to a significant transformation in investor conduct.

Instead of partaking in short-term trading, numerous BTC holders are adopting a long-term “HODL” (hold on for dear life) approach. This strategy reflects their conviction in Bitcoin’s lasting worth and potential as a safeguard against economic turmoil. By keeping their assets off exchanges, these investors are also reducing selling pressure, which might aid in stabilizing the market during this correction period.

While BTC’s near-term price movement appears negative, the decreased exchange activity offers a glimmer of hope, suggesting assurance among long-term holders. As the market maneuvers through these turbulent times, this change could prove critical in influencing Bitcoin’s upcoming actions.

Evolving Bitcoin Dynamics

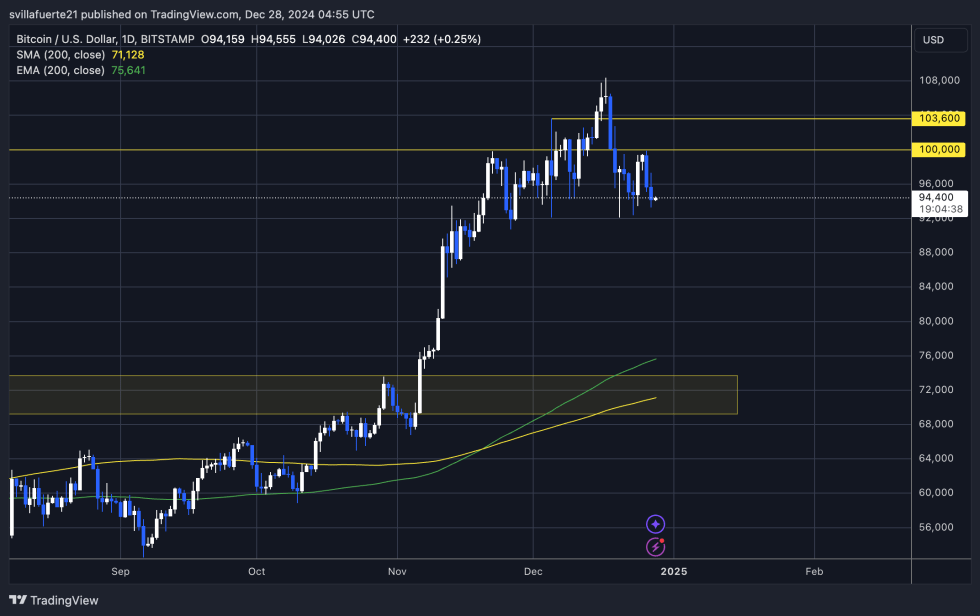

Bitcoin has encountered ongoing issues maintaining above the $100,000 threshold since falling below this vital psychological level. This decline has led numerous analysts and investors to foretell a more profound correction, possibly pushing prices even lower. Nonetheless, data points to a robust long-term dedication from BTC investors, implying a more hopeful outlook for the asset’s future.

Crucial metrics shared by well-known analyst Axel Adler on X showcase a notable change in Bitcoin holder behavior. The quantity of BTC deposits on exchanges has hit a record low of 30,000 per day, a figure not seen since 2016.

This starkly contrasts with the 10-year average of 90,000 daily deposits. Moreover, the cycle’s pinnacle of 125,000 deposits occurred when Bitcoin was priced around $66,000, indicating significant selling pressure at that time.

The ongoing contraction in exchange deposits implies that BTC holders are choosing to “HODL” their assets instead of liquidating them amid market volatility. This sentiment alleviates selling pressure, even in the face of potential price declines. It appears an increasing number of investors are embracing a long-term viewpoint, believing in Bitcoin’s value as a reservoir of wealth and a safeguard against macroeconomic instabilities.

Price Movement: Breakdown Or Breakthrough?

Bitcoin is currently trading at $94,400 after multiple attempts to recapture the $100,000 level failed, while support at $92,000 remains robust. This price range places BTC at a crucial crossroads, with its imminent move likely to dictate the market’s direction in the near future.

Should Bitcoin fall below the $92,000 level, it risks entering a more profound correction phase, which could instigate a wave of selling pressure that might push the price considerably lower. This scenario has many investors and analysts on high alert, as a drop below this point could undermine bullish sentiment within the current cycle.

Conversely, Bitcoin still possesses the capability to regain its upward momentum. A decisive move above the $100,000 threshold in the coming days would indicate a robust return of bullish influence, likely driving the price to new all-time peaks. Such a development would reinforce Bitcoin’s position as the leading asset in the cryptocurrency landscape and may attract new investments from traders eager to benefit from its upward path.

Featured image from Dall-E, chart from TradingView