“`html

How to Generate Bitcoins Through Mining: A Brief Guide

Here, we will examine transformations in cryptocurrency mining, Bitcoin’s future possibilities, and the elements fueling this upward trend. If you’re excited to commence mining immediately, here’s a comprehensive guide.

Here’s what you must do to set up your GPU for mining, and if necessary, convert the mined coins into bitcoins:

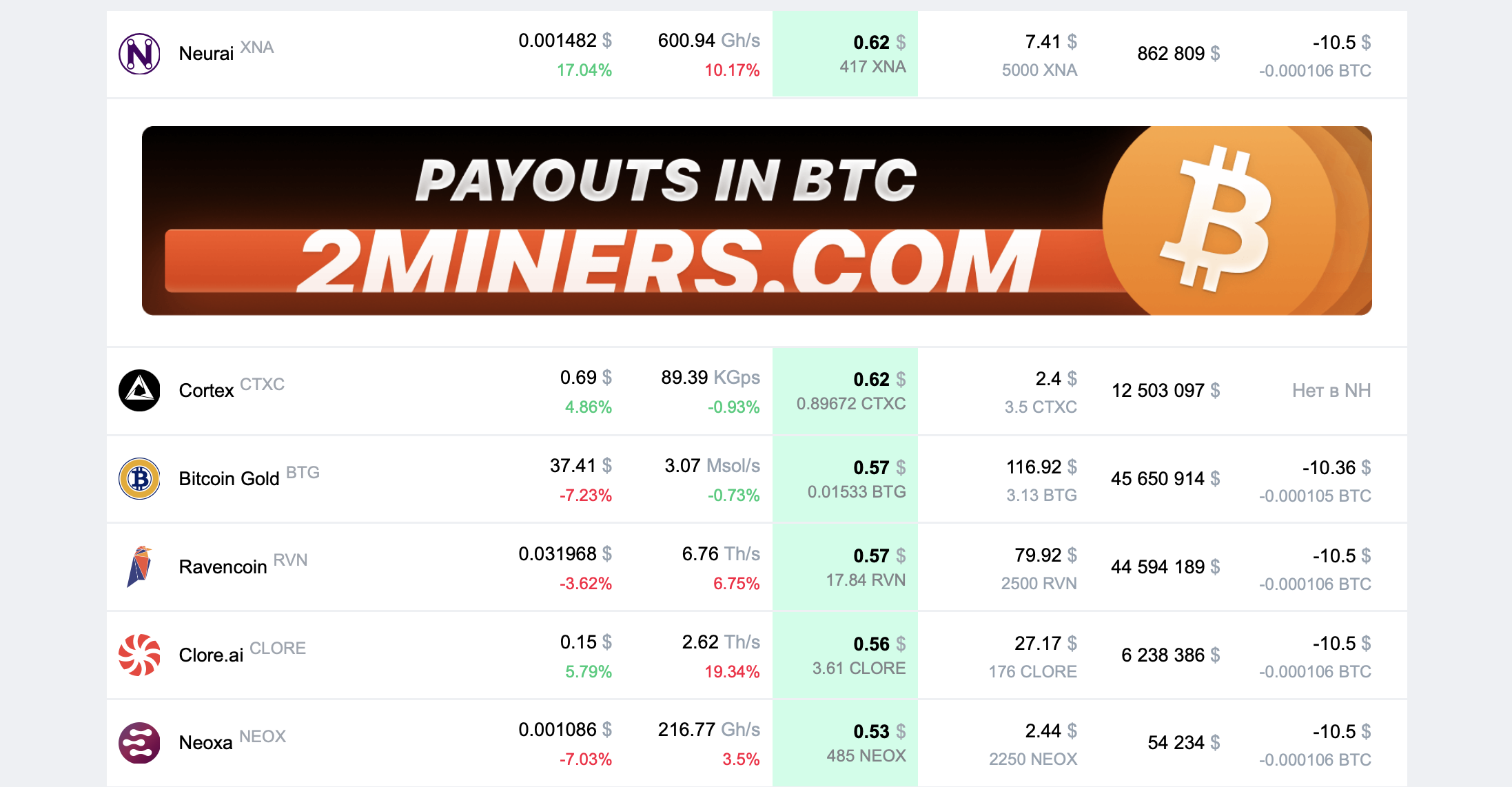

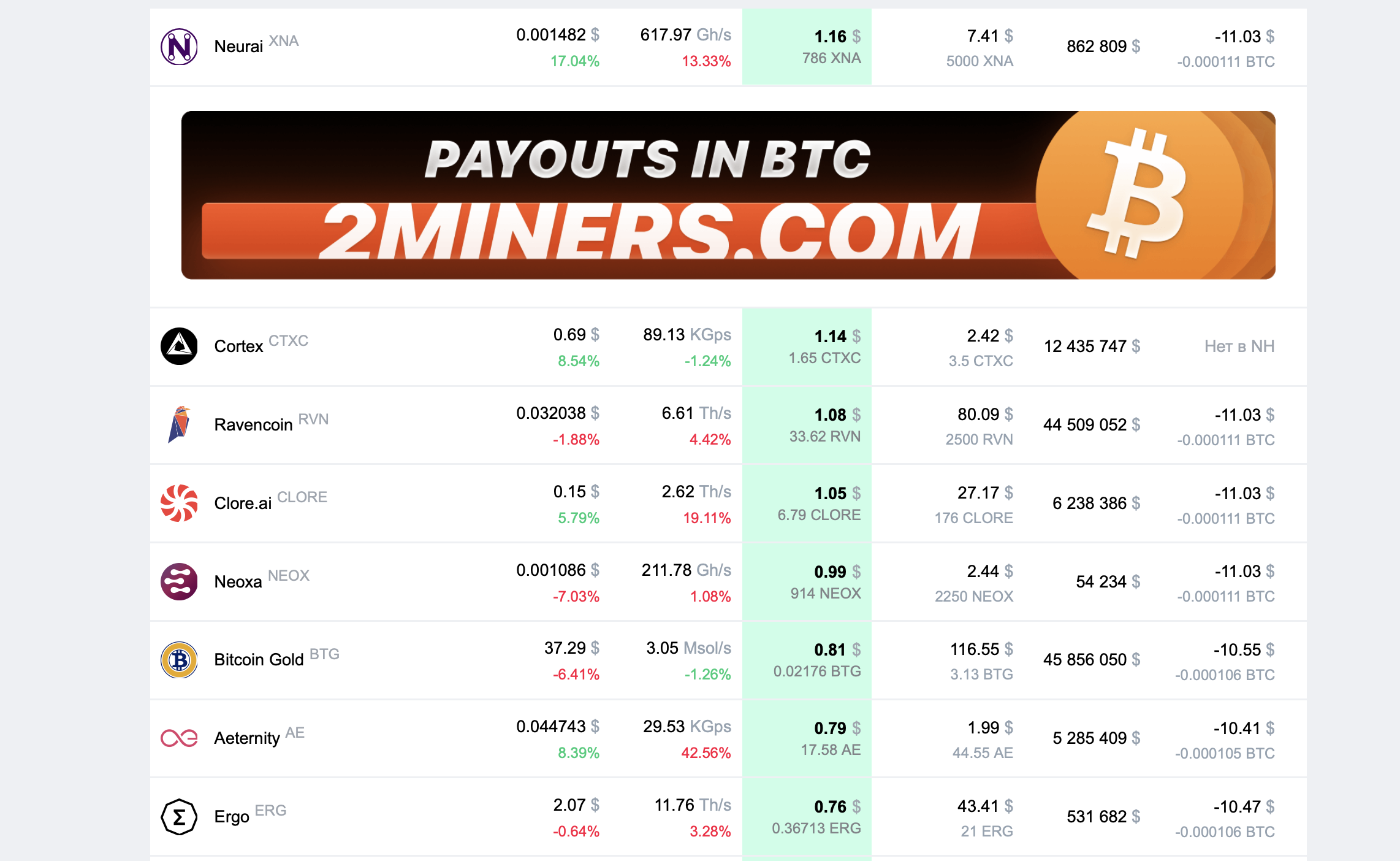

Access a mining profitability calculator and input your GPU model—for instance, Nvidia GeForce RTX 3070. Select your GPU to see a compilation of the most lucrative cryptocurrencies to mine.

For example, Naurai XNA mining yields around $0.62 each day (excluding electricity expenses). What are the subsequent steps?

- Visit the Naurai XNA mining help page.

- Establish a wallet using the links provided. Alternatively, you may utilize an address from a cryptocurrency exchange.

- Obtain a mining application from this archive (password: 2miners). For Nvidia GPUs, opt for T-Rex or GMiner; for AMD GPUs, utilize NBMiner or TeamRedMiner.

- Edit the .bat file to insert your wallet address. If you wish for the mining pool to automatically change your earnings into BTC and send them to you, indicate a Bitcoin address.

- Launch the miner, keep your computer on, and relish in the accumulation of coins over time. If you included a Bitcoin address, the payouts will be in BTC.

We have outlined the procedure for generating bitcoins via mining in a separate article. Refer to it if you are unfamiliar with mining.

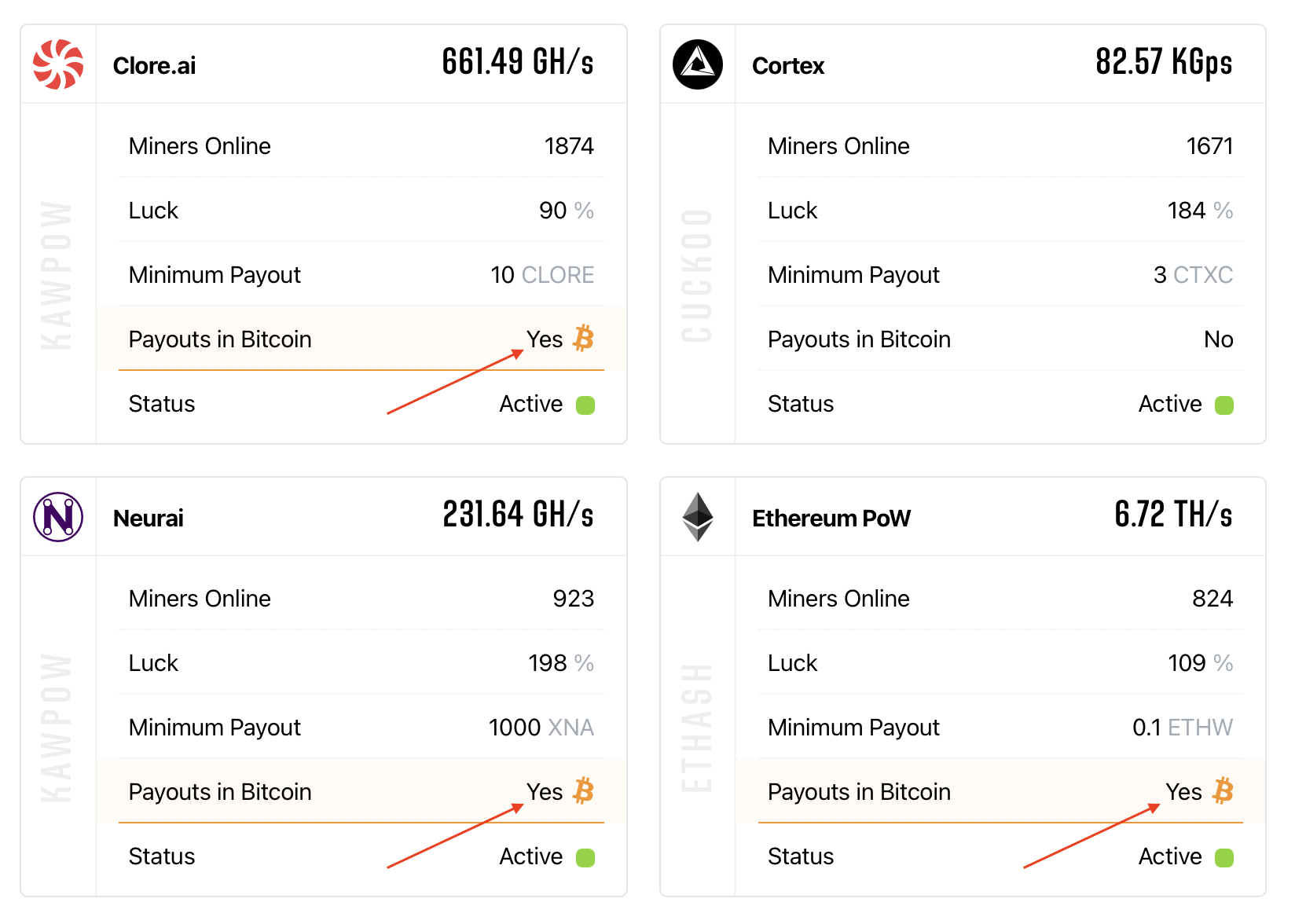

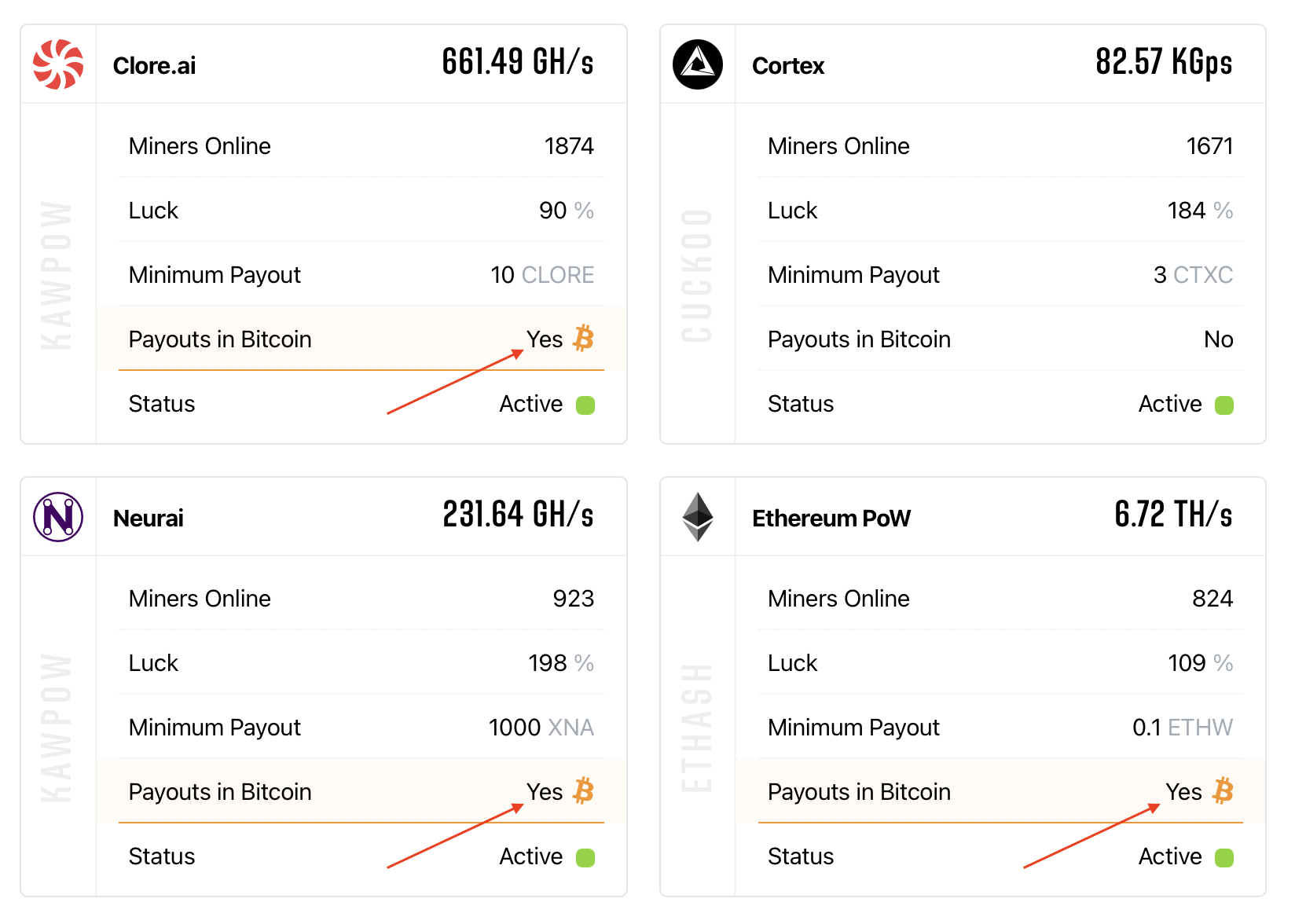

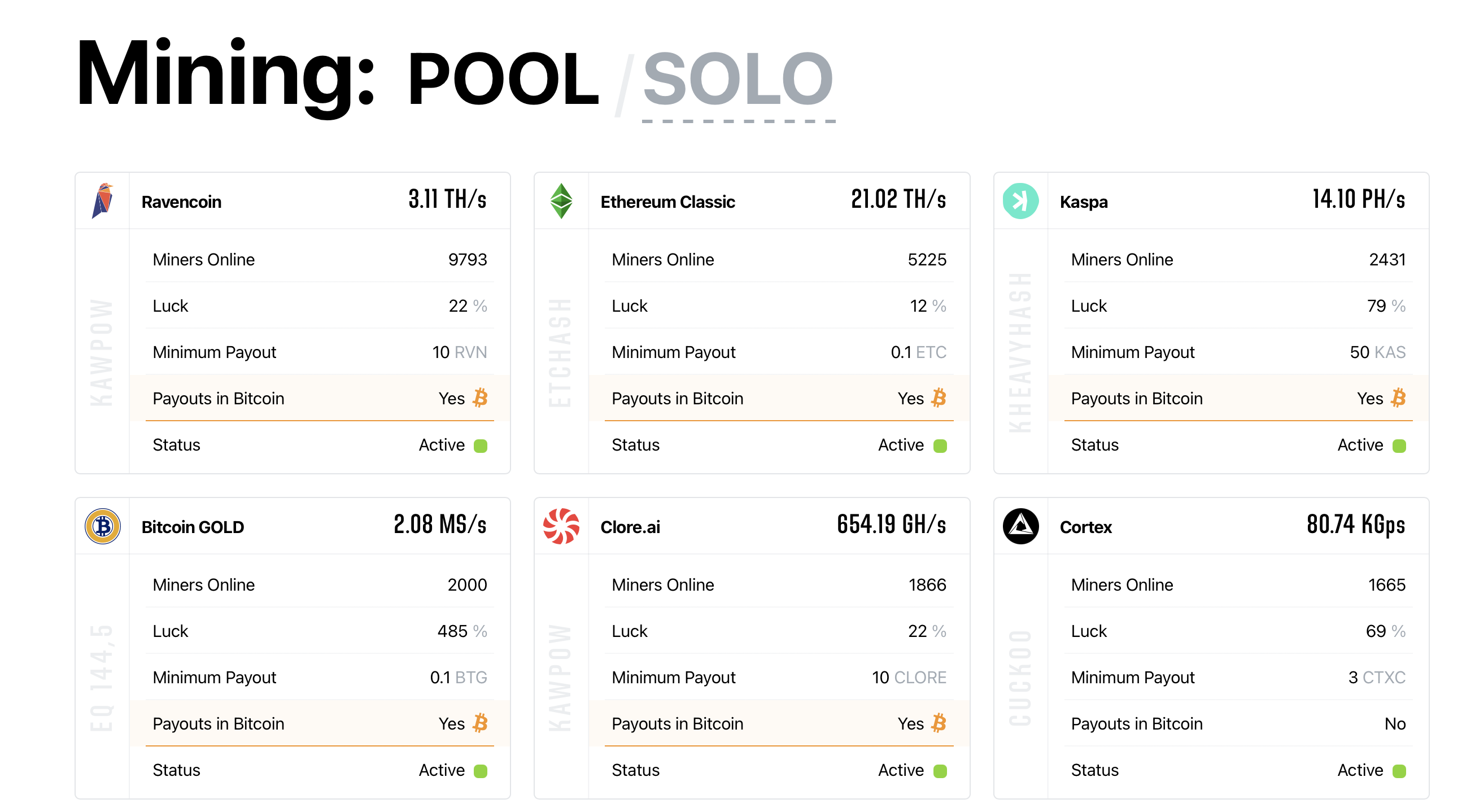

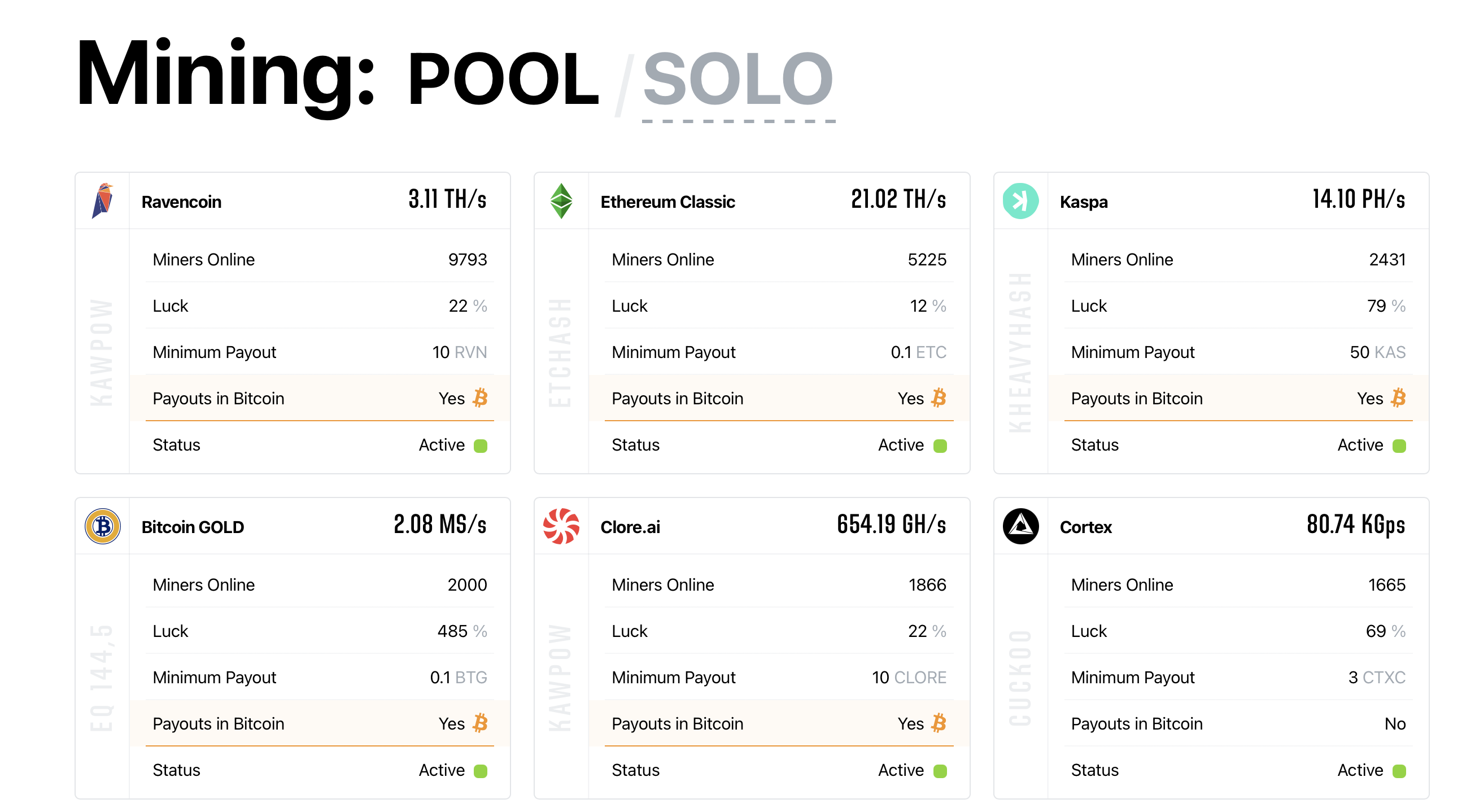

Most currencies on the 2Miners pool permit BTC payouts. You can verify this feature on their main page.

How to Begin Earning Bitcoin and Cryptocurrency in 2025

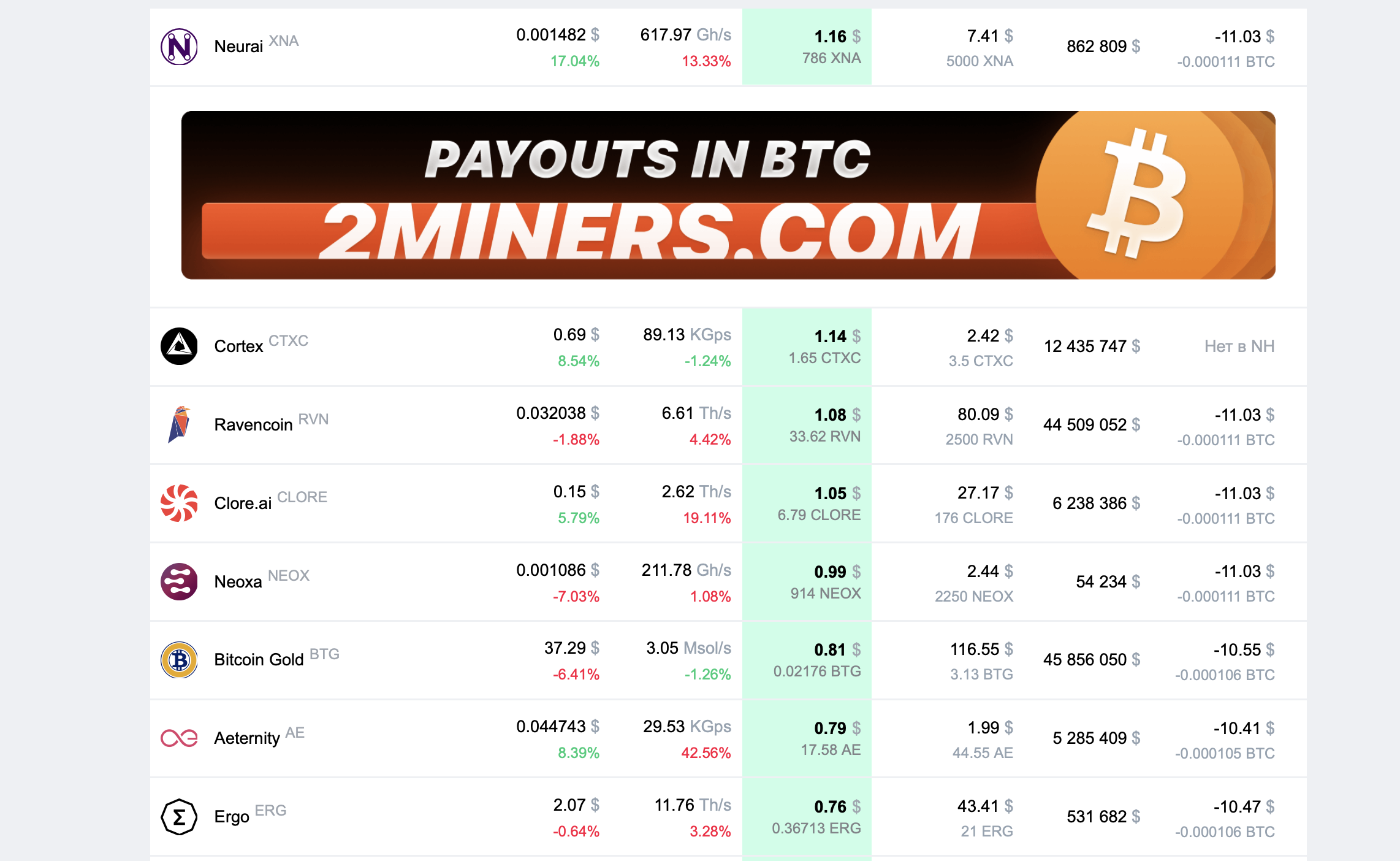

What amount can you generate in dollars through mining? Utilize the calculator with a more robust GPU, such as the Nvidia GeForce RTX 3090.

At present, this GPU generates about $1.16 daily. After deducting electricity expenses (which fluctuate according to location), you can anticipate roughly $30 monthly or $350 annually.

Is this additional income worth it? Certainly. Can Bitcoin or other cryptocurrencies surge by tens or hundreds of percentage points in months? Absolutely.

Commence mining now to take advantage of the upward trend. Keep in mind, the bull market will not endure indefinitely, so your GPU won’t have to operate for a complete year.

Now, let’s delve into the particulars.

What Has Changed in Cryptocurrency Mining Over the Years?

Ethereum used to lead the mining sector because of its usability with GPUs rather than noisy, dedicated ASICs. However, in September 2022, Ethereum made the switch to a Proof-of-Stake

“`(PoS) consensus mechanism, discarding GPU mining.

Currently, validators protect the network by staking 32 ETH in a deposit contract, operating validator clients, and executing tasks that were formerly performed by miners. Additionally, users can participate in staking pools with lesser amounts of ETH.

This transition left millions of GPUs idle, motivating their owners to mine alternative cryptocurrencies, leading to a notable drop in profitability.

In spite of these hurdles, mining has advanced, with new Proof-of-Work (PoW) ventures on the rise. These assets are traded on platforms, simplifying the conversion of mining yields into everyday necessities.

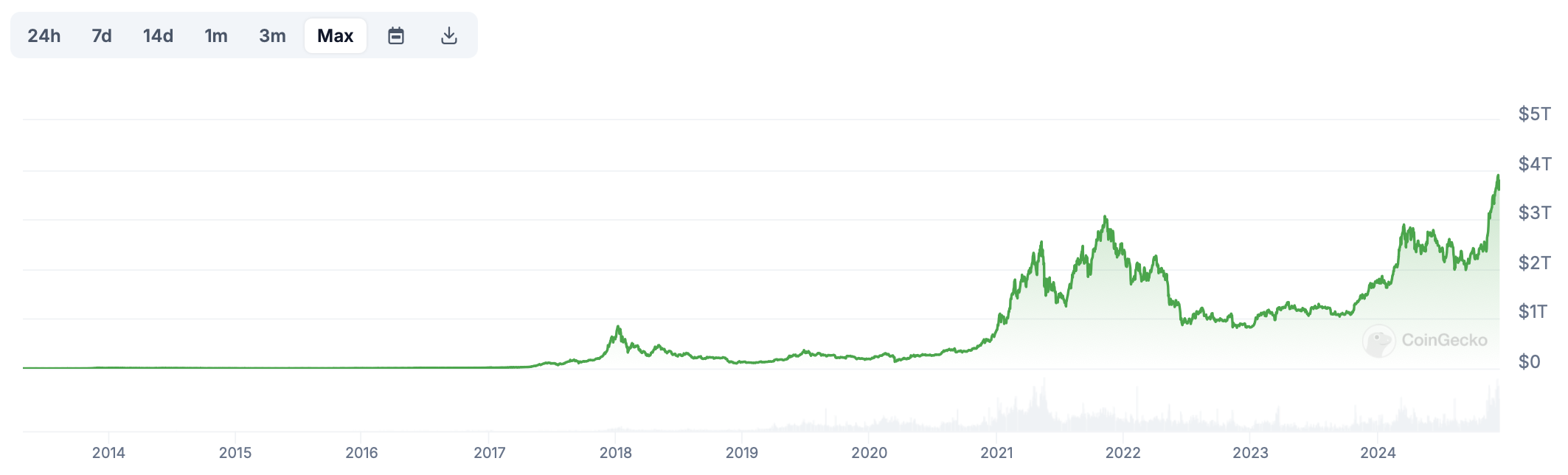

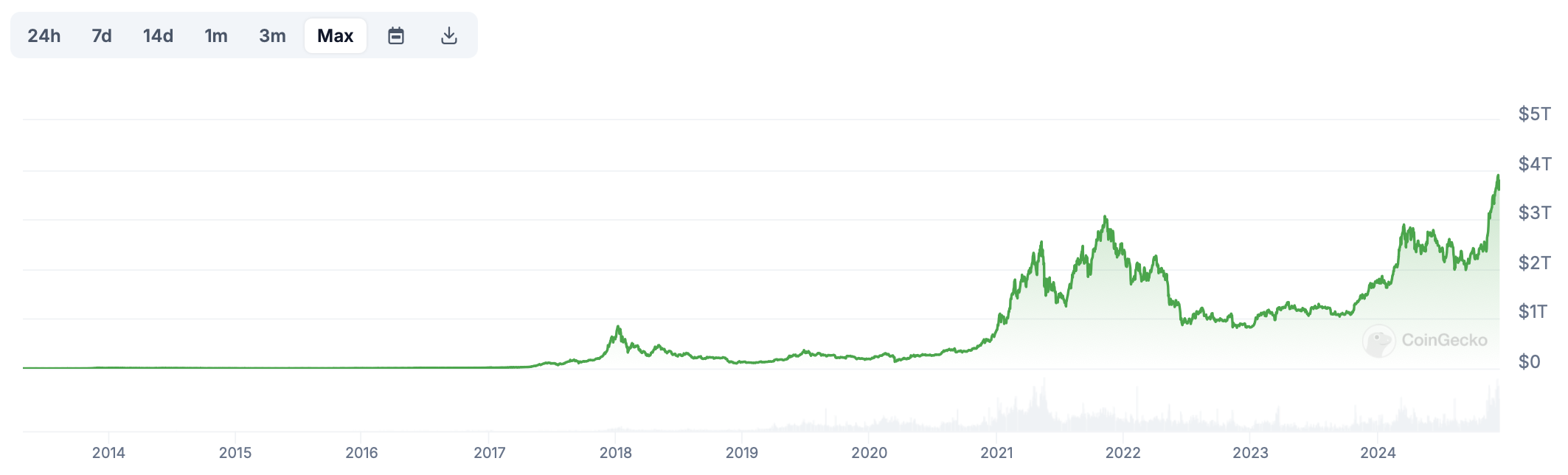

Cryptocurrencies are currently witnessing swift growth, luring in new investors. For example, the market cap for cryptocurrencies has exceeded prior all-time highs set in 2021 and continues to ascend.

What Could Be Bitcoin’s Peak Value This Cycle?

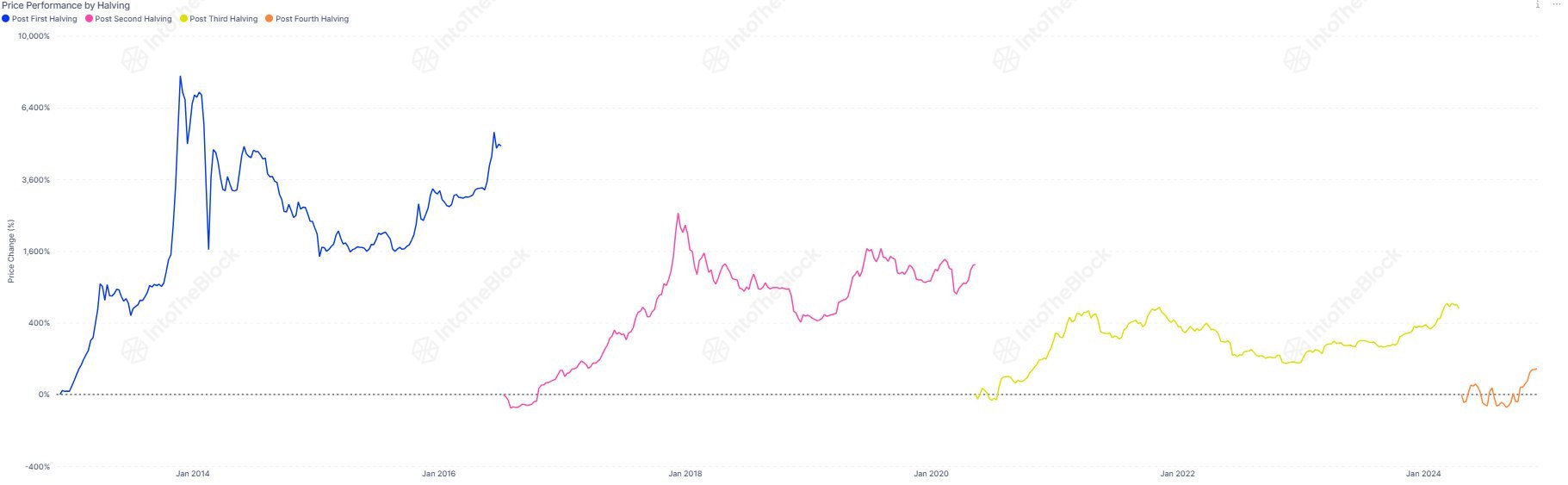

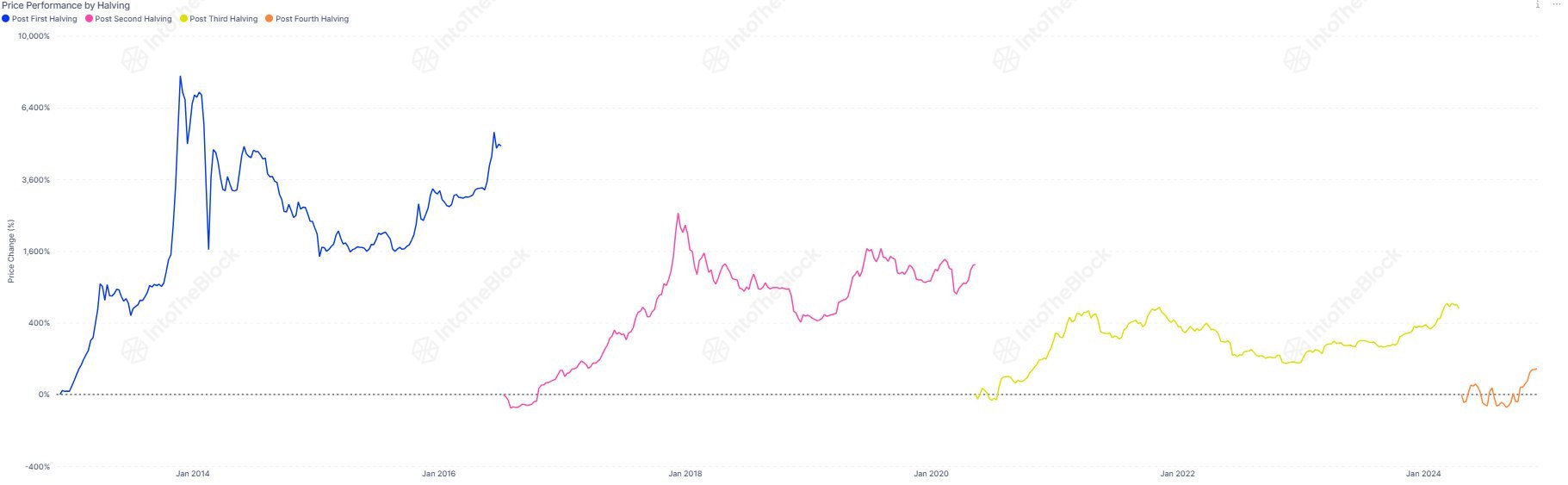

Experts at IntoTheBlock analyzed Bitcoin’s historical performance, investigating growth following halving events (block reward reductions that occur every four years):

- 2013 cycle: Bitcoin increased by 7,900%.

- 2017 cycle: Bitcoin ascended by 2,560%.

- 2021 cycle: Bitcoin climbed by 594%.

With each cycle, Bitcoin’s growth rate diminishes due to its increasing market capitalization, which now stands at $1.9 trillion. Analysts from IntoTheBlock forecast that BTC could soar by 100–200% from its April 2024 halving price, potentially hitting $130,000–$190,000 in this bullish run.

Which Coins Are Mineable in 2025?

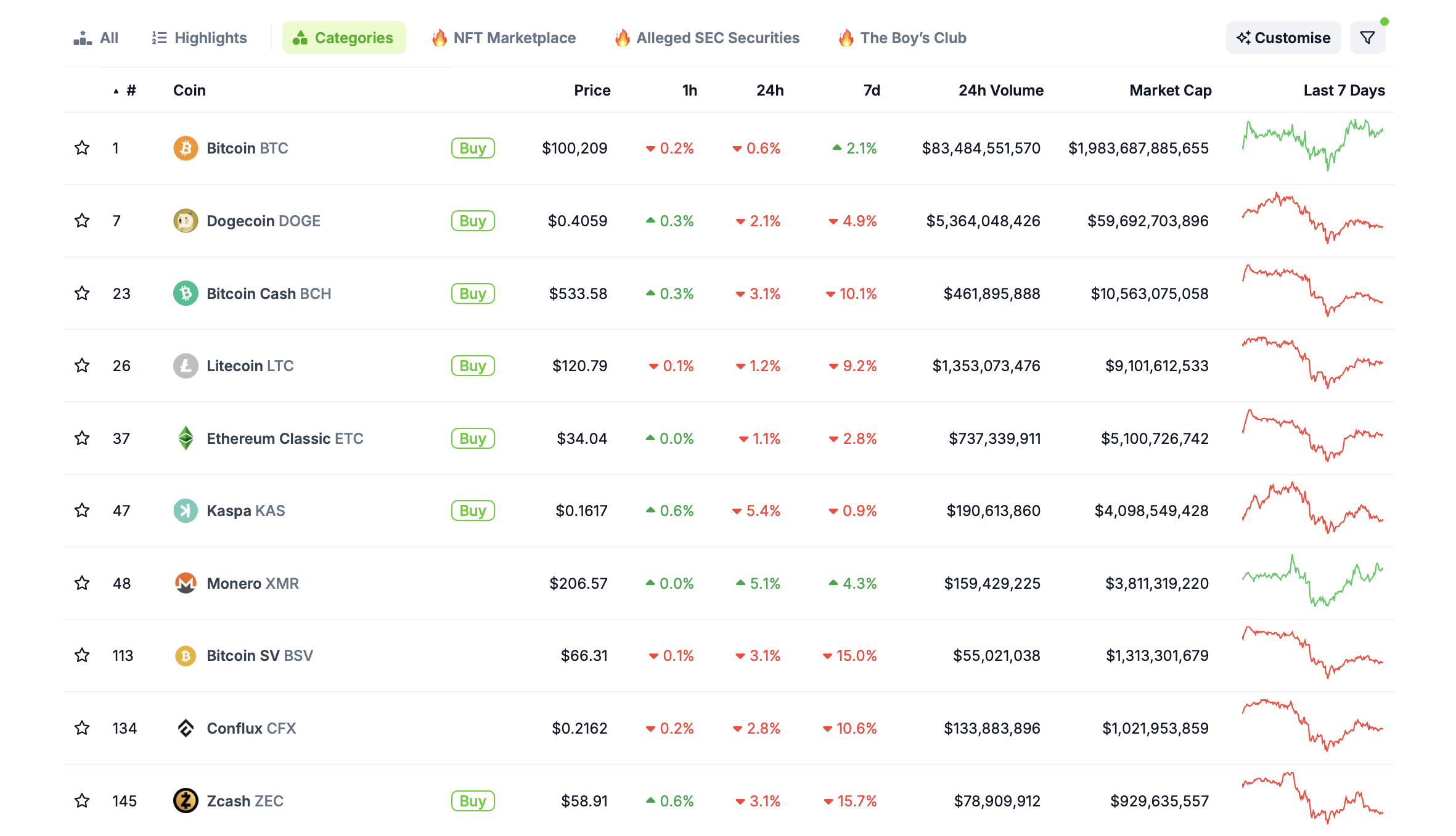

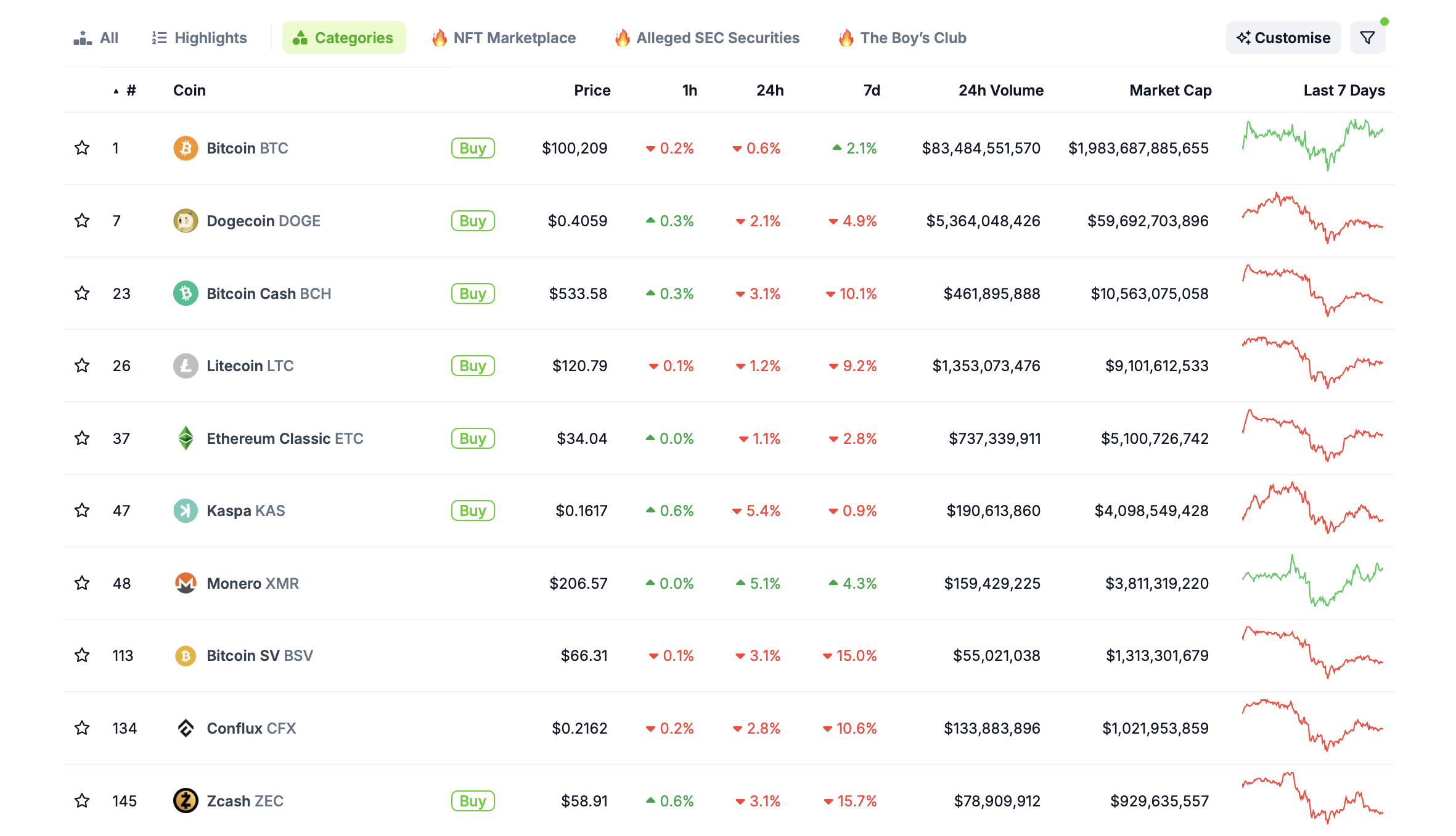

Numerous PoW coins are available for mining. Below is a list of notable selections with considerable market capitalizations, headed by Bitcoin.

Their total market capitalization amounts to $2.08 trillion, with a daily trading volume of $92 billion.

In the 2Miners pool, top contenders include Ravencoin, Ethereum Classic, Kaspa, Clore, Cortex, and others. For optimal profitability, refer to the 2CryptoCalc tool.

Ravencoin experienced an increase of 44% in a month, ETC ascended by 56%, Clore leaped 43%, and Cortex achieved a monthly growth of 239%. In contrast, Kaspa (KAS) witnessed its value multiply by 11x over the span of 18 months.

Precisely a year and a half back — June 6, 2023 — 1 KAS was priced at merely 1.4 cents. Currently, the cryptocurrency is assessed at $0.16, representing an elevenfold escalation. Furthermore, this is far below the cryptocurrency’s peak value.

Veteran participants might prefer retaining their mined alternative coins and consider selling at a later time. Abrupt price increases for coins are frequently observed in the cryptocurrency market.

Why mining continues to be a wise choice

Some individuals may believe that the time to invest in cryptocurrencies has passed, assuming their initial investment will inevitably incite a market downturn or even initiate a bearish cycle in the cryptocurrency realm.

Nonetheless, this assertion does not hold entirely true, as there are numerous reasons to anticipate the continued bull market.

Here are those reasons:

- Donald Trump secured victory in the U.S. presidential election. Throughout his campaign, he voiced support for the cryptocurrency sector and pledged to enact sensible regulations for digital assets within the nation. This would be unprecedented in the United States, leading investors to foresee broader global acceptance of cryptocurrencies.

- The leadership of the Securities and Exchange Commission (SEC) is on the verge of changing. The upcoming chairman will be Paul Atkins, recognized for his favorable view towards cryptocurrencies. It’s reasonable to predict that the SEC will terminate the unnecessary lawsuits against various blockchain firms that have troubled the sector in recent years.

- Earlier announcements indicated that Trump has appointed a candidate for the position overseeing AI and cryptocurrency policy. The position will be occupied by former PayPal COO David Sacks, who will focus on crafting the nation’s cryptocurrency regulatory framework.

- There’s ongoing discourse in the U.S. and other nations concerning the establishment of national Bitcoin reserves. For instance, a proposal put forward by Senator Cynthia Lummis suggests obtaining one million BTC to be maintained for a minimum of 20 years.

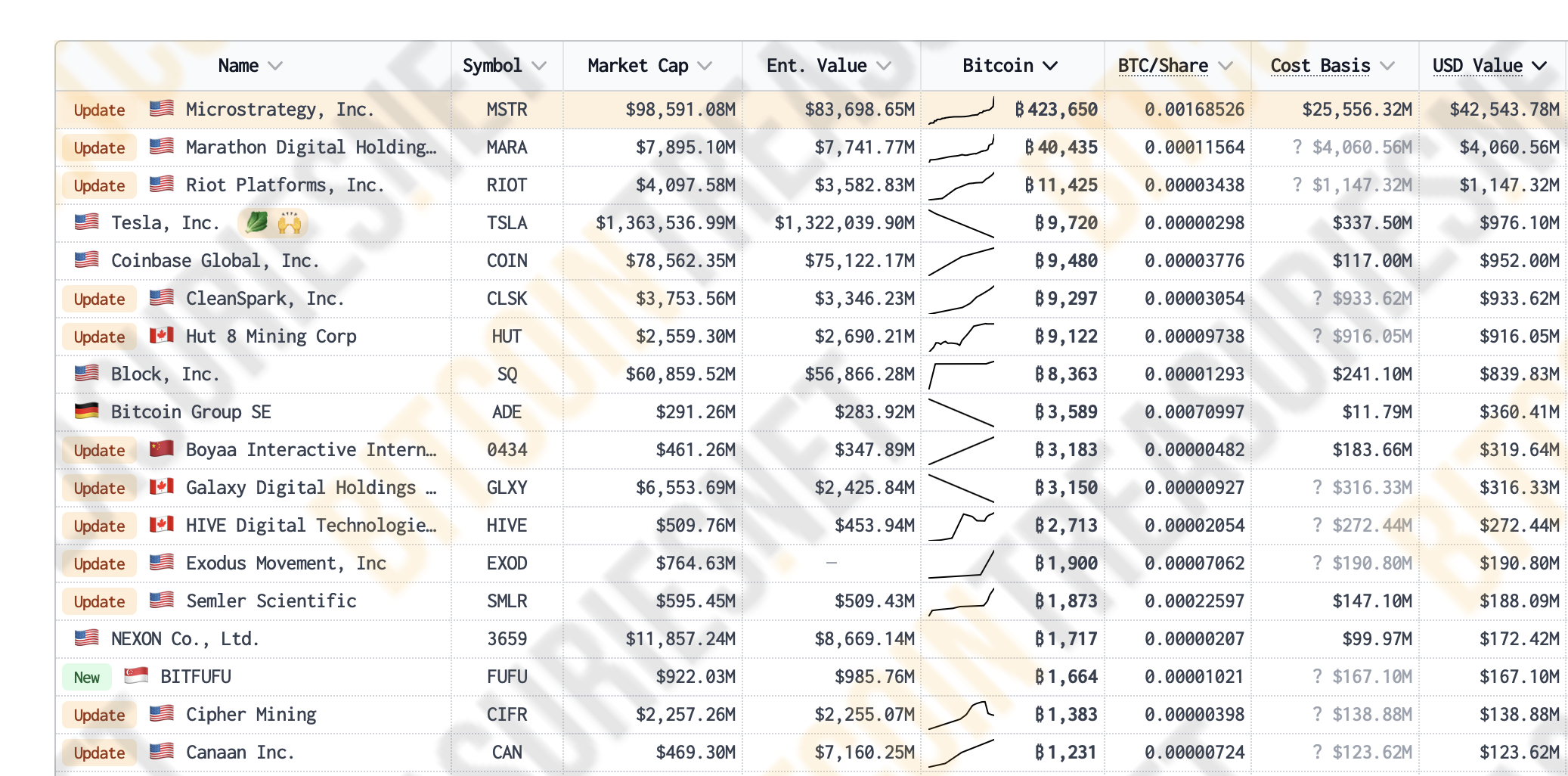

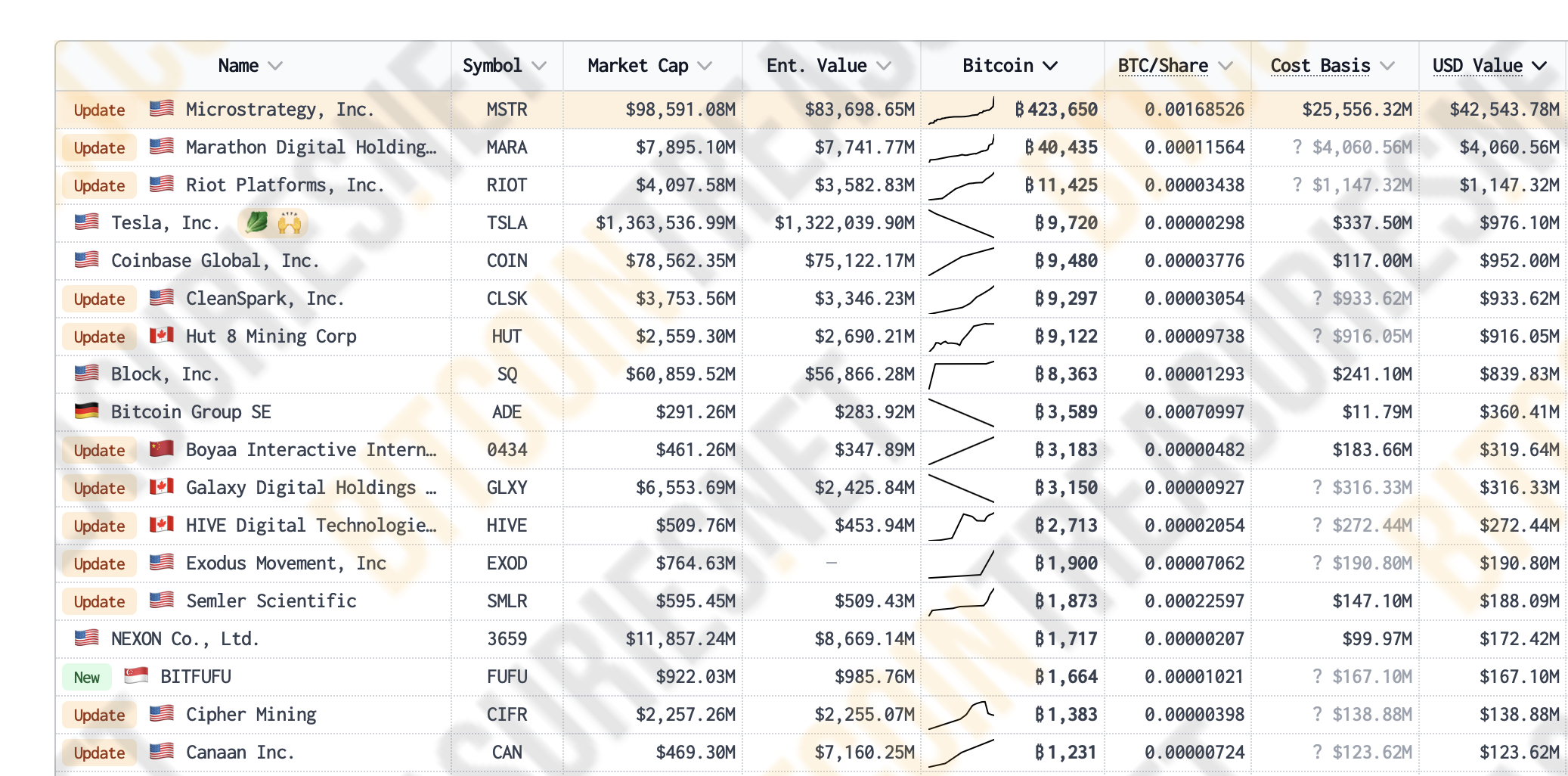

- MicroStrategy, under the leadership of Michael Saylor, persists in making large-scale investments in Bitcoin. This Monday, the firm declared the acquisition of 21,550 BTC valued at $2.1 billion. Additionally, it aims to generate a further $42 billion in the upcoming years to procure more coins.

The prevailing enthusiasm in cryptocurrency occasionally results in ludicrous price escalations. A notable instance in recent weeks has been XRP by Ripple.

This month alone, the coin has surged by 251%, increasing in value several times over. Here’s an illustration of XRP’s chart over the past year:

Gathering Bitcoin and alternative cryptocurrencies under the present circumstances appears to be a robust strategy.

Should You Transform Mining Rewards into Bitcoin?

Some cryptocurrency investors are reluctant to involve themselves with altcoins — that is, any coins aside from Bitcoin. Although altcoins can often provide greater returns, this cautious perspective is justifiable.

Initially, altcoins usually exhibit heightened volatility, which signifies their prices change significantly more often — including falling. This renders them more unpredictable. New investors might not be equipped to handle such fluctuations, making the decision to commence their crypto venture with Bitcoin a sensible option.

Furthermore, long-range investments in altcoins tend to be more hazardous compared to those in Bitcoin. Numerous altcoin endeavors struggle to endure market downturns or so-called bear markets. They experience declining investor interest, witness trading volumes diminish to mere hundreds of thousands of dollars, and ultimately, the coin could become insignificant.

Is mining still lucrative in 2025

An approach to reduce this risk is by utilizing the exceptional characteristic of the 2Miners mining pool: Bitcoin payouts. As previously stated, rewards acquired in other cryptocurrencies can be automatically swapped for BTC and dispatched to the specified wallet address.

Nonetheless, if you possess expertise in investing in various cryptocurrencies along with the ability to sell them at set price points, mining altcoins can still prove to be a feasible option.

Conclusion: Why Mining is Worth Exploring

A bullish market is the ideal moment for cryptocurrency mining. During such times, coin values are ascending, mining incurs no losses, and it even enables you to amass coins. These coins, in turn, can be auto-converted into Bitcoin.

A remarkable success narrative is MicroStrategy. This organization invested $25.5 billion in its existing holdings of 423,650 BTC, which has now appreciated to $42.5 billion. Consequently, this translates to unrealized gains of approximately $17 billion, rendering the risks faced by new miners of coins appear minimal in comparison to MicroStrategy’s audacious tactic.

Additionally, mining is comparatively straightforward and won’t exhaust your GPU. As an added benefit, you’ll secure a consistent influx of Bitcoin, which you can safely hold for several years without concern.

As always, we pledge our support for your mining endeavors. Keep informed through our X (Twitter) and Telegram miner community. Wishing you productive mining!