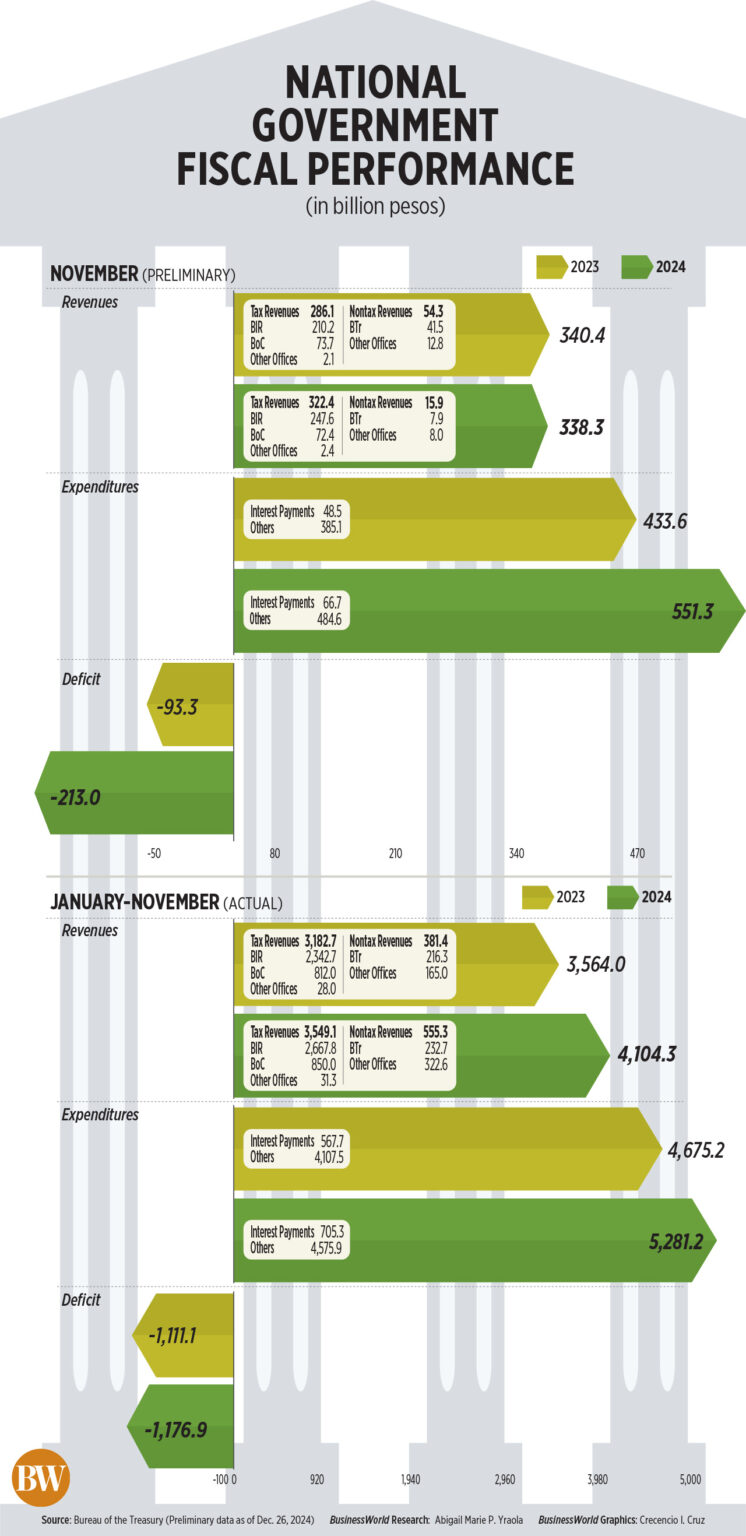

THE National Government’s (NG) fiscal shortfall expanded to P213 billion in November, as revenue intakes decreased and expenditures surged, as per Treasury statistics.

Information from the Bureau of the Treasury (BTr) indicated that the budget deficit more than tripled to P213 billion in November, up from P93.3 billion in the same month last year.

In terms of month-on-month changes, this marked a shift from the P6.3-billion surplus recorded in October.

During November, revenue intakes decreased by 0.61% to P338.3 billion compared to P340.4 billion a year earlier, owing to a 70.7% drop in nontax revenue collections.

Nontax revenues drastically fell to P15.9 billion in November from P54.3 billion in the previous year, which included a one-off P23.8-billion remittance of supplementary dividends from the Bangko Sentral ng Pilipinas (BSP).

Treasury earnings decreased by 80.86% year-over-year to P7.9 billion, while collections from other agencies dropped by 37.83% to P8 billion.

Conversely, tax revenues increased by 12.7% to P322.4 billion in November, up from P286.1 billion in the same month last year.

The Bureau of Internal Revenue (BIR) reported a year-over-year increase of 17.77% in collections to P247.6 billion in November.

“The annual positive growth in BIR collections for November 2024 is a result of the double-digit rise in revenues from income taxes, value-added tax (VAT), excise duties, and documentary stamp tax (DST). The uptick in income tax is attributed to the influx of taxpayers filing their third Quarterly Income Tax Return before or on Nov. 15 of the current tax year,” the BTr stated.

Meanwhile, the Bureau of Customs (BoC) saw a 1.69% year-over-year decline in collections, totaling P72.4 billion in November, “driven by decreased collections from import duties and excise taxes, which was offset by enhanced VAT collections.”

In contrast, NG outlays surged by 27.13% to P551.3 billion in November, compared to P433.6 billion a year prior.

“This notable growth is due to heightened capital expenditures for road and defense infrastructure projects, social protection, and education-related initiatives, as well as personnel service needs,” the BTr commented.

The swifter spending in November was also linked to the enhanced National Tax Allotment shares for local government units (LGUs), along with the disbursement of special shares from national tax proceeds.

Primary expenditures — referring to total spending minus interest payments — grew by 25.85% year-over-year to P484.6 billion in November.

Interest payments saw an increase of 37.29% to P66.7 billion in November, compared to P48.5 billion in the same month of 2023.

WIDER DEFICIT

Additionally, the budget shortfall expanded to P1.18 trillion for the January-to-November timeframe, compared to the P1.11-billion deficit from the previous year. This accounts for 79.29% of the P1.5-trillion full-year deficit ceiling.

For the 11-month span, revenue collections rose by 15.16% to P4.11 trillion, up from P3.56 trillion last year.

“Nonetheless, the year-to-date revenue of P4.11 trillion, which equates to 96.12% of the P4.3-trillion adjusted full-year program, exceeded last year’s 11-month aggregate by 15.16%,” the BTr noted.

Tax revenues increased by 11.51% to P3.55 trillion as of the end of November. BIR earnings grew by 13.88% to P2.67 trillion, constituting 93.64% of the P2.8-trillion revised plan.

Collections from the BoC marginally increased by 4.68% to P850 billion during the January-to-November period, representing 90.46% of the full-year goal of P939.7 billion.

“The positive year-to-date growth can be mainly attributed to the heightened year-over-year collections from import duties, VAT, and excise duties, driven by an increased value of non-oil imports (net of rice), PHP/USD exchange rate fluctuations, and the value and quantity of petroleum oil imports, among other factors,” the BTr explained.

Conversely, nontax revenues surged by 45.6% to P555.3 billion as of the end of November.

Revenues from the Treasury climbed by 7.57% to P232.7 billion due to “increased interest on advances from GOCCs (government-owned and -controlled corporations), guarantee fees, and the NG share from PAGCOR (Philippine Amusement and Gaming Corp.) income.”

“Moreover, the BTr’s year-to-date income has already eclipsed the revised full-year target of P187 billion for 2024 by 24.43%,” it remarked.

Earnings from other agencies soared by 95.46% to P322.6 billion in the 11-month window, surpassing the revised P262.6-billion full-year program by 22.84%.

During the January-to-November period, government spending leaped by 12.96% to P5.28 trillion, accounting for 91.78% of the modified P5.8-trillion full-year expenditure plan.

Primary spending rose by 11.4% to P4.6 trillion, while interest payments increased by 24.25% to P705.3 billion.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort stated that the November budget deficit primarily illustrated the accelerated government spending.

“This also reflected heightened debt servicing/interest costs amid increased borrowing arising from the COVID-19 (coronavirus disease 2019) pandemic… as well as continued comparatively higher interest rates domestically and internationally… and the persistently weaker peso exchange rate that raised the peso equivalent of foreign debt interest and principal payments,” he remarked.

Mr. Ricafort also highlighted that the year-on-year drop in Customs revenues in November was “partly due to reduced tariff rates on imported rice, which consequently diminished government revenues.”

President Ferdinand R. Marcos, Jr. directed that rice tariffs be lowered to 15% from a previous 35%, effective until 2028.

Customs Commissioner Bienvenido Y. Rubio had earlier projected around P16.34 billion in lost revenue during the second semester due to the lower rice tariffs.

“One strategy that could assist in reducing the NG’s budget deficit and curtail additional borrowings/overall debt for the NG would be to enhance the remittance of dividends and surplus by certain GOCCs,” Mr. Ricafort suggested.

He also indicated that further rate reductions by both the BSP and the US Federal Reserve could alleviate debt servicing costs and reduce the budget deficit.

“However, ongoing budget deficits in recent months would still necessitate more national government borrowings, thereby implying a need for additional tax and other fiscal reform actions aimed at further lowering the NG debt-to-GDP ratio below the international cap of 60%,” he added.

Filomeno S. Sta. Ana III, coordinator of Action for Economic Reforms, noted that in spite of the BIR’s “aggressive” initiatives against smuggling, the taxation effort requires enhancement.

“Nonetheless, the need for improved tax enforcement remains, yet the administration is hesitant to raise taxes, even though certain taxes are effective and widely accepted by the public, such as ‘health taxes’, taxes on alcohol, soda, ultra-processed foods, vape, and heated tobacco products, and cigarettes,” Mr. Sta. Ana noted. — Aubrey Rose A. Inosante