Chainlink has surpassed the remainder of the industry with a significant surge over the previous week. Here’s the reasoning behind this, according to on-chain analytics.

Chainlink’s Price Has Experienced a Notable Upsurge Recently

The last few weeks have proved to be an outstanding period for LINK stakeholders, as the asset has nearly tripled in worth since early November. At the onset of this week, the cryptocurrency faced a slight dip, but the strong bullish trend has quickly returned in the past few days.

Below is a graph illustrating LINK’s performance over the recent months:

The price of the asset appears to have quickly escalated recently | Source: LINKUSDT on TradingView

From the chart, it is evident that following a rise of more than 47% from the lows earlier this week, Chainlink has successfully crossed the $28 threshold. The asset now enjoys weekly gains exceeding 22%, positioning it as the top performer among leading cryptocurrencies by market capitalization.

In terms of market capitalization, LINK currently ranks as the 12th largest in the sector, just surpassing Shiba Inu (SHIB).

The market cap of the asset is currently $17.7 billion | Source: CoinMarketCap

As highlighted in the table above, the next asset in the sights of Chainlink is Avalanche (AVAX). Its market cap remains $3.5 billion higher than that of LINK, meaning it may take some time before a flip occurs, provided the bullish momentum persists.

Regarding the factors behind the cryptocurrency’s rise, on-chain data might offer some insights.

LINK Sharks & Whales Have Been Active in Their Accumulation

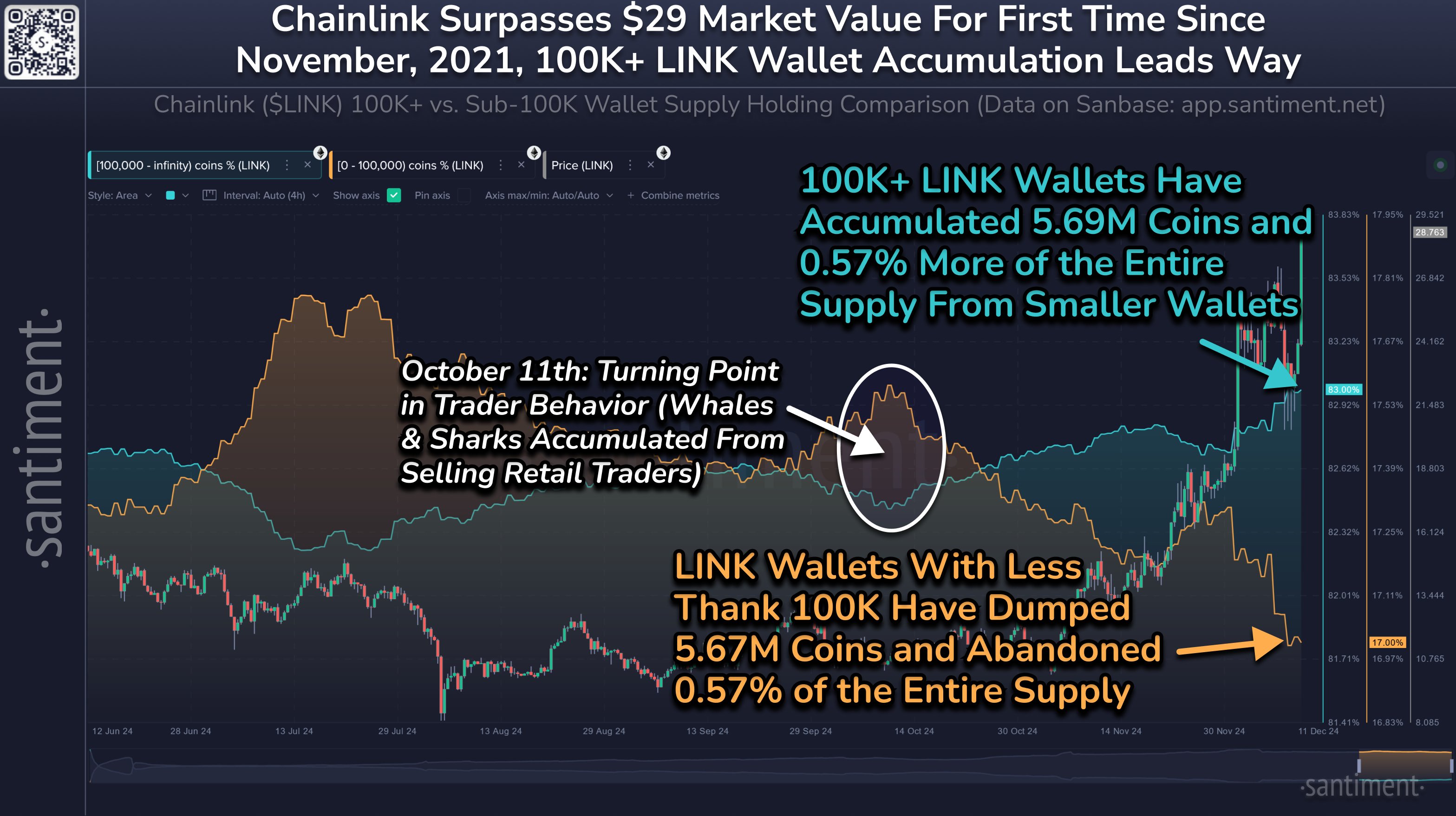

In a recent update on X, the on-chain analytics company Santiment has noted the contrasting behaviors between smaller and larger entities within the LINK network of late. The relevant indicator in this instance is the “Supply Distribution,” which measures the total amount of Chainlink held by members of specific wallet groups at present.

For this discussion, the two address ranges of interest are from 0 to 100,000 coins and 100,000+ coins. At the current exchange rate, the threshold of 100,000 coins translates to approximately $2.8 million.

Addresses holding more than this amount are categorized as significant investors in the market, commonly referred to as sharks and whales. Therefore, the Supply Distribution for this group reflects the actions of these larger investors.

Now, here’s the chart shared by the analytics firm illustrating how this indicator compares between sharks and whales versus regular investors:

The metric seems to have diverged for the two groups | Source: Santiment on X

As illustrated in the graph above, smaller Chainlink investors have been liquidating their holdings over the past couple of months, potentially due to their skepticism about LINK’s ability to rebound.

Conversely, sharks and whales have seized the opportunity, acquiring a total of 5.69 million coins from this group. As Santiment clarifies,

In the history of cryptocurrencies, significant wallets purchasing coins from hasty or anxious retail traders often leads to increases in market capitalization.

Featured image from Dall-E, Santiment.net, chart from TradingView.com