The Bitcoin marketplace has historically exhibited cyclical fluctuations and growth driven by adoption, prompting investors to look for tools that enhance their comprehension and anticipation of these cycles. One such resource is the Golden Ratio Multiplier—a Bitcoin-centric indicator crafted by Philip Swift, Managing Director of Bitcoin Magazine Pro. This article explores the complexities of the indicator and examines the latest Chart of the Day, which presents a data-driven perspective on Bitcoin’s pricing pathway.

The #Bitcoin Golden Ratio Multiplier 1.6x level, presently at ~$100,000, has again functioned as resistance for #BTC price activity! 🐻

If we can surge past this level, then ~$127,000 becomes our next major milestone! 🎯 pic.twitter.com/RCRKYFDAZt

— Bitcoin Magazine Pro (@BitcoinMagPro) December 10, 2024

Click here to access the live Golden Ratio Multiplier chart on Bitcoin Magazine Pro at no cost.

Comprehending the Golden Ratio Multiplier

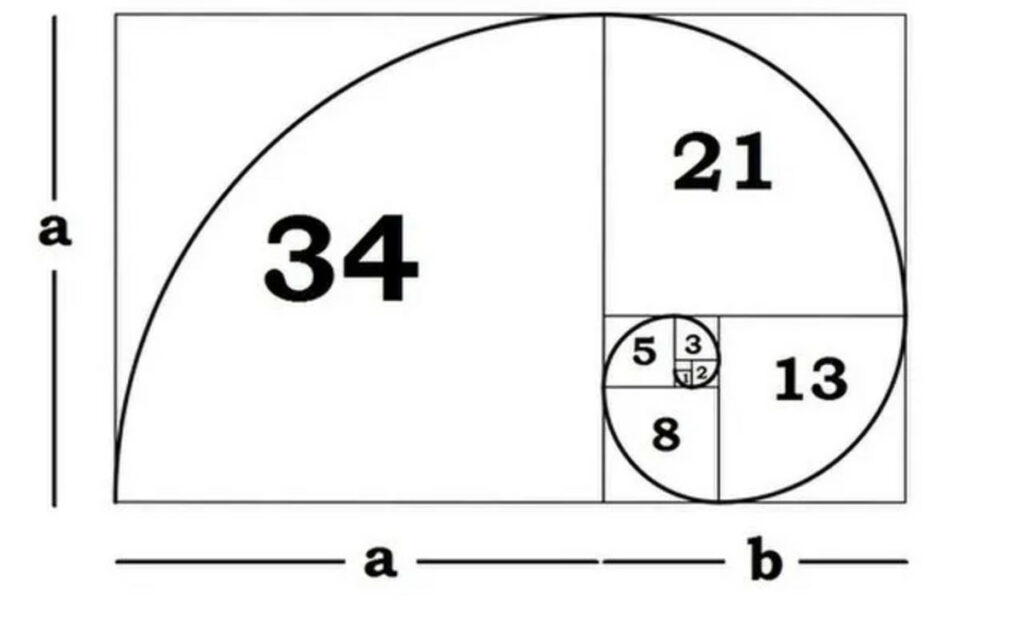

The Golden Ratio Multiplier acts as a charting mechanism that evaluates Bitcoin’s long-term adoption trend and market cycles. At its essence, the indicator employs multiples of the 350-day moving average (350DMA) to identify regions of critical price resistance or peaks in market cycles. These multiples are grounded in two key mathematical concepts:

- The Golden Ratio (1.6)

- The Fibonacci Sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, etc.)

The Golden Ratio and Fibonacci sequence have continually demonstrated significance in natural phenomena, finance, and trading, making them suitable for modeling Bitcoin’s logarithmic price progression over time. Historically, Bitcoin’s price peaks within cycles and significant market cycle highs correspond with Fibonacci-based multiples of the 350DMA. This establishes the Golden Ratio Multiplier as an essential resource for spotting instances of price resistance as Bitcoin’s adoption continues to evolve.

Mechanics of the Indicator

The chart represents Bitcoin’s price against essential Fibonacci multiples of the 350DMA, such as 1.6x (the golden ratio), 2x, and 3x. These thresholds have effectively indicated:

- Intracycle peaks: Moments when Bitcoin’s price faces short-term resistance within a market cycle.

- Significant cycle peaks: Long-term market summits that denote the cessation of a bull phase.

The diminishing Fibonacci sequence multiples indicate Bitcoin’s evolving market. As adoption increases and Bitcoin’s market capitalization escalates, its price volatility and rapid growth naturally lessen. As a result, the upper Fibonacci multiples (e.g., 21x) become less pertinent in the current market, while lower multiples such as 2x and 3x gain importance for analysis.

Analysis of the Chart of the Day: $100,000 Resistance

The Chart of the Day, shared on Bitcoin Magazine Pro’s X profile, emphasizes Bitcoin’s ongoing interaction with the 1.6x multiple of the 350DMA, which hovers around $100,000. As illustrated in the chart, this point has repeatedly served as a strong resistance area for Bitcoin’s pricing.

Significant Insights from the Chart

- Historical Relevance of the 1.6x Level: This threshold has acted as a vital resistance point in previous cycles, and its current position as a psychological landmark ($100,000) further emphasizes its significance.

- Breakout Potential: Should Bitcoin succeed in rallying above the 1.6x level, the next pivotal target becomes the 2x multiple, nearing $127,000. This is in alignment with the Golden Ratio Multiplier’s long-term forecast of diminishing Fibonacci-level peaks.

Importance of the $100,000 Milestone

The $100,000 threshold signifies not only a significant Fibonacci multiple but also a crucial psychological obstacle within the market. Surmounting this level could rejuvenate bullish momentum, attracting new investors and possibly initiating a parabolic price movement towards the $127,000 resistance.

What Distinguishes This Indicator?

The Golden Ratio Multiplier is notable for incorporating Bitcoin’s adoption trajectory into its calculations. As a tool designed for Bitcoin’s early adoption period, it considers the logarithmic character of Bitcoin’s price development. By pinpointing price points that align with natural adoption trends, the indicator provides:

- Clarity on Market Phases: Assists investors in identifying intracycle peaks and cycle summits.

- Risk Management Insights: Offers a framework for understanding when the market might be overstretched and where investors could contemplate revising their strategies.

As adoption advances, the Fibonacci multiples will continue to decline, indicating the indicator’s effectiveness may lessen once Bitcoin achieves widespread acceptance.

Consequences for Investors

For investors, the Golden Ratio Multiplier yields practical insights into where Bitcoin’s price may confront resistance or undergo consolidation. The data indicates:

- Short-Term Perspective: The $100,000 benchmark represents a crucial resistance. Should Bitcoin struggle to breach this limit, a phase of consolidation could be imminent.

- Medium-Term Outlook: A successful breach of $100,000 may set the stage for a surge towards $127,000, the 2x multiple. Historically, such breaches have coincided with substantial volume and renewed investor enthusiasm.

- Long-Term Vision: While the Golden Ratio Multiplier remains effective for analyzing Bitcoin’s adoption phase, its predictive capability may diminish as Bitcoin transitions into a stable asset category.

Final Thoughts

The Golden Ratio Multiplier, developed by Philip Swift in 2019, has consistently proven its worth as a forecasting tool for Bitcoin’s price shifts. By examining Fibonacci multiples of the 350DMA, the indicator provides a framework for comprehending Bitcoin’s long-term price trajectory and pinpointing essential resistance points.

The Chart of the Day illustrates that Bitcoin is once again assessing the $100,000 resistance level. A fruitful rally past this hindrance could open pathways toward $127,000, presenting considerable opportunities for investors who grasp the underlying dynamics.

To investigate live data and remain updated on the latest evaluations, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes solely and should not be construed as financial advice. Always conduct your own research prior to making investment choices.