In an era where digital currencies are swiftly becoming a fundamental element of international finance, the United States finds itself at a pivotal juncture. The Trump administration has consistently highlighted its commitment to enhancing the prosperity of average Americans. From vows to restore economic vigor during the campaign to appointing innovative advisors, the White House appears set to herald a new period of financial autonomy. However, if President Trump genuinely aims to accelerate wealth generation for everyday citizens—and position the U.S. as the globe’s premier “Bitcoin Superpower”—his administration must adopt a daring, game-changing policy: abolish capital gains taxes on Bitcoin.

The Shifts of Change: Insights from Overseas

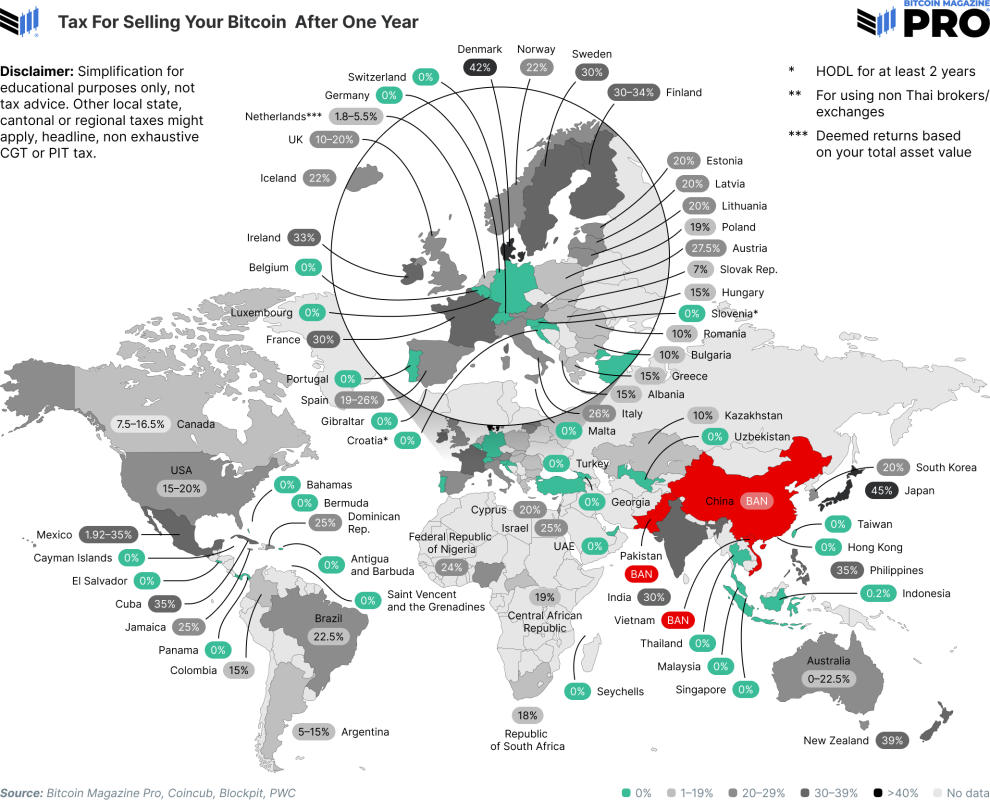

The Czech Republic recently garnered attention when its Parliament decisively voted to exempt capital gains from Bitcoin and other cryptocurrency transactions from personal income tax—provided they’re retained for over three years and satisfy specific income criteria. This is not a one-off occurrence. Nations such as Switzerland, Singapore, the United Arab Emirates, El Salvador, Hong Kong, and regions in the Caribbean have long understood that no or minimal capital gains taxation on Bitcoin can aid in fostering adoption, financial innovation, and consumer trust.

As John F. Kennedy famously remarked, “A rising tide lifts all boats.” If we apply that reasoning to economic advancement through Bitcoin, the tide is global—and it’s rising rapidly. In a landscape overflowing with international liquidity and debt, America’s economic vessel must navigate these digital waters. The policy decisions of these countries—and their citizens’ growing prosperity—send a strong message: The U.S. can and should utilize Bitcoin as a catalyst for growth, rather than encumber it with outdated tax structures.

Trump’s Own Statements: A Route to Abundance

President Trump has indicated a readiness to reconsider Bitcoin taxation. “They have them paying tax on crypto, and I don’t think that’s right,” he stated in a recent interview, resonating with the frustrations of millions of Americans who find it unreasonable to pay capital gains taxes after using Bitcoin for something as trivial as a cup of coffee. “Bitcoin is money, and you have to pay capital gains tax if you use it to buy a coffee?” he rhetorically questioned, underscoring how existing regulations hinder regular transactions. He proposed, “Maybe we eliminate taxes on crypto and substitute it with tariffs.”

This viewpoint isn’t merely rhetorical embellishment. Trump, who spoke at the Bitcoin 2024 Conference in Nashville, declared his ambition for America to become the world’s “Bitcoin Superpower.” He has also vowed to “Make Bitcoin in America,” transforming the U.S. into a leading center of Bitcoin innovation. Furthermore, he appointed former PayPal Chief Operating Officer David Sacks as his ‘White House A.I. & Crypto Czar’ on December 5—an action widely regarded as a step toward implementing progressive crypto policies.

The BITCOIN Act of 2024: A Strategic Reserve for the People

The U.S. has already made significant strides in this direction. The BITCOIN Act of 2024 mandates that all Bitcoin owned by any federal agency must be transferred to the Treasury to establish a strategic Bitcoin reserve. Over a five-year period, the Treasury is required to acquire one million Bitcoins, storing them in trust for the United States. This governmental accumulation reflects a long-term vision for integrating Bitcoin into the national financial strategy. But why halt there? Abolishing capital gains tax on Bitcoin would create a positive feedback loop between national policy and individual prosperity. As the federal government invests and retains Bitcoin, private individuals could similarly do so without enduring punitive tax responsibilities.

Supporting the Average American

For regular Americans, the cost of living and the burden of inflation were central themes of President Trump’s reelection campaign. Traditional approaches—interest rate adjustments, quantitative easing—often equate to merely rearranging deck furniture on a sinking ship when facing genuinely systemic economic challenges. Bitcoin provides a life-saving measure—dare we say, a digital Noah’s Ark—for Americans striving to preserve and enhance their wealth against the corrosive impacts of inflation. Eliminating capital gains taxes on Bitcoin would empower individuals to transact, invest, and save in a stable, finite asset without the drain of federal taxes on every incremental gain.

The ripple effect is evident: more individuals adopting Bitcoin as a store of value and means of exchange will lead to stronger demand, further fortifying the U.S. Treasury’s strategic assets. It’s a virtuous cycle, a positive feedback mechanism. As Bitcoin’s value escalates, so does the nation’s wealth base—contributing to pay down national debt, enhancing the dollar’s dominance in global trade, and genuinely making Americans wealthier and more secure.

Why America Requires Bitcoin

Bitcoin is no longer an experimental niche reserved for a select group of enthusiasts. It has matured into a mainstream, urgent priority for everyday Americans—particularly the emerging generation that will shape our nation’s future economy. This is not merely an ideological appeal; it’s a practical, evidence-backed reality. According to the Stand With Crypto Alliance, a non-profit dedicated to transparent blockchain policies, over 52 million Americans now own some form of cryptocurrency. Nearly nine out of ten Americans believe the financial system requires reform, and 45% express that they would not endorse candidates who obstruct crypto innovation. These figures reflect a broad, cross-partisan movement: Stand With Crypto’s studies show that 18% of Republicans, 22% of Democrats, and 22% of Independents hold crypto. This transcends typical tribal politics and highlights a fundamental truth—Bitcoin is now a key topic in national policy discussions, rather than an aside on a fringe agenda.

The call for America to take the lead is unmistakable. 53% of Americans desire crypto companies to be U.S.-based, ensuring that technological advancements and the wealth they produce remain on domestic soil. Among Fortune 500 executives, 73% favor U.S.-based partners for their crypto and Web3 initiatives, indicating a corporate inclination to maintain America at the forefront of global financial advancement.

Neglecting to act now invites a repetition of past blunders. America once dominated advanced manufacturing, yet 92% of sophisticated semiconductor production currently resides in Taiwan and South Korea. We cannot afford to relinquish control of the future financial domain to other regions. Bitcoin is not merely another investment category; it serves as the digital backbone of an rapidly transforming monetary system. If the U.S. wishes to safeguard its economic dominance, sustain leadership in innovation, and guarantee that everyday Americans have access to a stable, growth-oriented financial future, it must wholeheartedly embrace Bitcoin. In doing so, the nation can affirm its position as the global Bitcoin superpower—elevating our citizens, fortifying our economic foundation, and protecting our strategic interests in the digital economy of the 21st century.

America, Navigating the Path Forward

By aligning with international best practices and enacting forward-thinking policies, the U.S. can establish itself as a beacon of financial freedom and technological innovation. Abolishing capital gains tax on Bitcoin would convey to investors, entrepreneurs, and everyday citizens that America is determined to lead in the 21st century’s digital economy. It’s not just about being “Bitcoin-friendly”; it’s about equipping average Americans with the necessary tools to navigate tumultuous economic waters.

The complexities and inefficiencies of taxing every digital transaction present an unnecessary hindrance to innovation and daily life. Americans deserve superior treatment—they deserve the autonomy to trade in a digital landscape without oppressive oversight.

Ultimately, this is America’s opportunity to do what it has historically excelled at: innovate, adapt, and lead. Removing capital gains taxes on Bitcoin wouldn’t merely fulfill a campaign commitment; it would pave the way for long-term prosperity, empower citizens to secure their financial futures, and establish the United States as the world’s preeminent Bitcoin advocate. A rising tide, indeed, lifts all boats—and what better vessel to embark upon than a Bitcoin Ark, captained by a visionary administration committed to genuinely Making America Great Again?

This article is a Take. The views articulated are solely those of the author and do not necessarily mirror those of BTC Inc or Bitcoin Magazine.