By Luisa Maria Jacinta C. Jocson, Correspondent

THE PHILIPPINES’ POSITION in a worldwide anti-money laundering ranking deteriorated as its standing dropped to the 49th slot out of 164 nations.

This development came as President Ferdinand R. Marcos, Jr. on Wednesday highlighted the Philippines’ “advancement towards exiting” the Financial Action Task Force’s (FATF) “gray list.”

“This is an extremely crucial issue,” Mr. Marcos remarked during a speech at the 33rd regular assembly of the Anti-Terrorism Council, according to a transcript from his office.

“I understand that it’s not widely discussed in public, but nonetheless, as a barrier to the ongoing evolution of our economy, and our position in the global arena, this, our departure from the gray list is an essential progress,” he further stated.

The Philippines aims to exit the FATF’s gray list of jurisdictions under heightened scrutiny for “dirty money” threats by February. It has remained on this gray list for over three years, since June 2021.

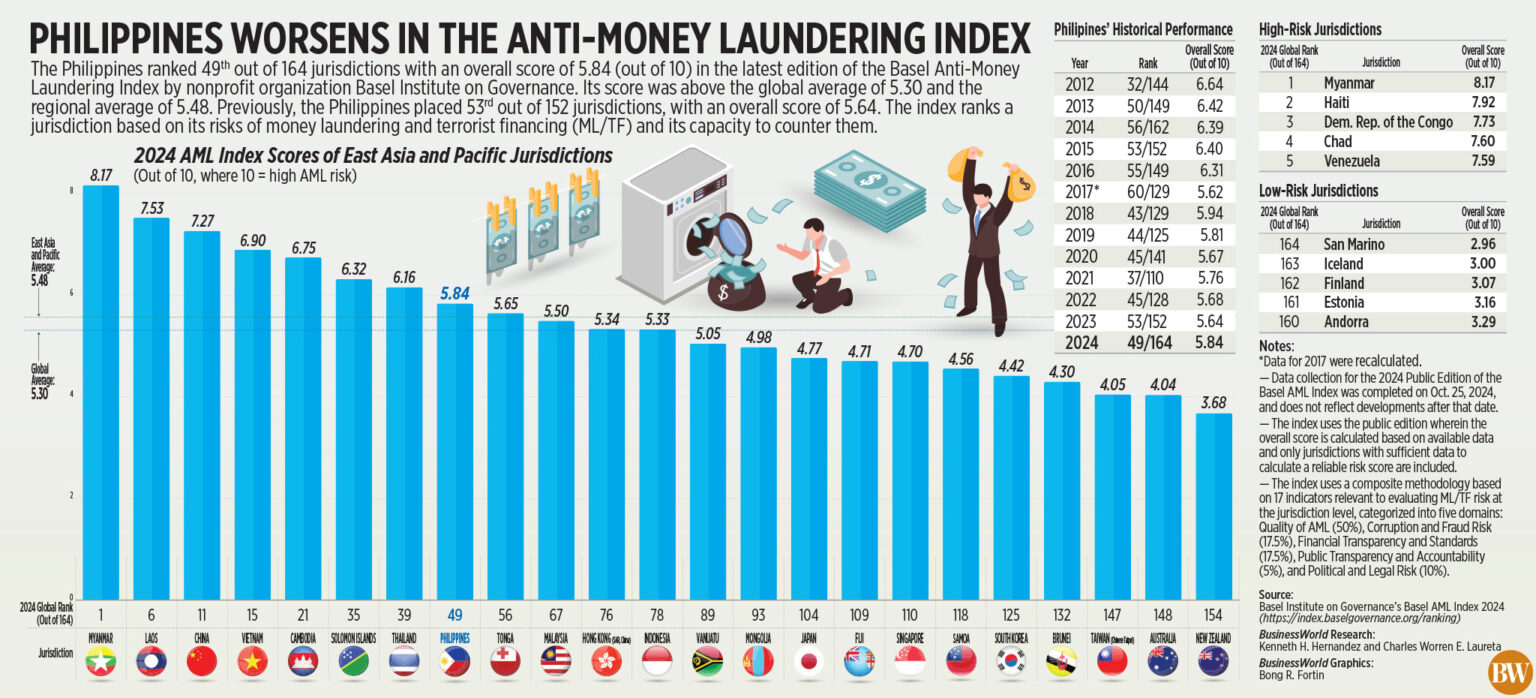

In the most recent Basel Anti-Money Laundering (AML) Index published by the Basel Institute on Governance, the Philippines achieved the 49th position with an overall score of 5.84 (out of 10). This is a decline from its previous rank of 53rd out of 152 jurisdictions, with an overall score of 5.64.

The index evaluates a jurisdiction based on its money laundering and terrorist financing risks and its capability to combat them. It utilizes a 0-10 scoring system, where a score of 10 signifies the highest risk level.

Myanmar was at the top of the Basel AML index with a score of 8.17, followed by Haiti, Democratic Republic of the Congo, Chad, and Venezuela.

The Philippines’ score was higher than the global average of 5.30.

“Concerns regarding financial transparency remain the primary vulnerability in this region, with over half of the jurisdictions recording a high risk score in the Financial Secrecy Index,” the report highlighted.

In the East Asia and the Pacific region, Myanmar held the highest score, followed by Lao PDR (6th), China (11th), Vietnam (15th), Cambodia (21st), Solomon Islands (35th) and Thailand (39th).

The weakest area in East Asia and the Pacific demonstrates shortcomings in financial transparency and standards, it noted.

It pointed out low effectiveness ratings regarding beneficial ownership transparency; the investigation, prosecution, and penalties of money laundering crimes; and efforts to prevent the proliferation of weapons of mass destruction.

“Nearly half of the jurisdictions receive high risk ratings for fraud and financial offenses,” it noted.

Conversely, the countries that received the lowest risk scores were San Marino (2.96), Iceland (3.00), Finland (3.07), Estonia (3.16), and Andorra (3.29).

Experts remarked that the Philippines still has considerable work ahead to enhance its money laundering/terrorist financing frameworks.

“It is quite ironic that despite all the discussions around the Philippines exiting the gray list, global perception suggests that issues of money laundering and associated governance challenges have deteriorated,” commented Filomeno S. Sta. Ana III, a coordinator at Action for Economic Reforms.

During its October plenary session, the FATF retained the country on its list of jurisdictions under increased surveillance for dirty money risks.

Nonetheless, the FATF indicated it had determined that the Philippines has “substantially completed” the recommended action items aimed at enhancing its anti-money laundering and counter-terrorist financing strategy.

“Philippine officials and their supporters believe that merely establishing technical standards would suffice for us to be removed from the gray list. However, what truly counts is the authentic compliance with regulations,” stated Mr. Sta Ana.

Chester B. Cabalza, founding president of International Development and Security Cooperation based in Manila, emphasized that the country must “exhibit consistency and transparency” in its efforts to exit the gray list.

“We possess legal frameworks to support and fortify our institutions. The Philippines must rigorously implement them and prosecute offenders to enhance compliance,” he added.

Antonio A. Ligon, a law and business educator at De La Salle University in Manila, remarked: “The nation needs to diligently apply the anti-money laundering regulations. It is vital to implement robust monitoring measures.”

The FATF is scheduled to perform an onsite evaluation in the Philippines to assess the progress of its action plan and implementation of reforms, which is expected to occur early next year.

However, the Basel report also pointed out that moving off the gray list is merely one milestone in a nation’s anti-money laundering endeavor.

“Being delisted is indeed a moment for celebration and optimism, but it does not signify the conclusion of the journey. FATF standards continue to evolve and strengthen, necessitating jurisdictions to perpetually enhance their efforts to keep pace.”

“Evading or graduating from the gray list represents just one phase in an ongoing quest for a robust system that effectively combats money laundering and associated risks while ensuring financial inclusion and innovation remains unimpeded,” it concluded.