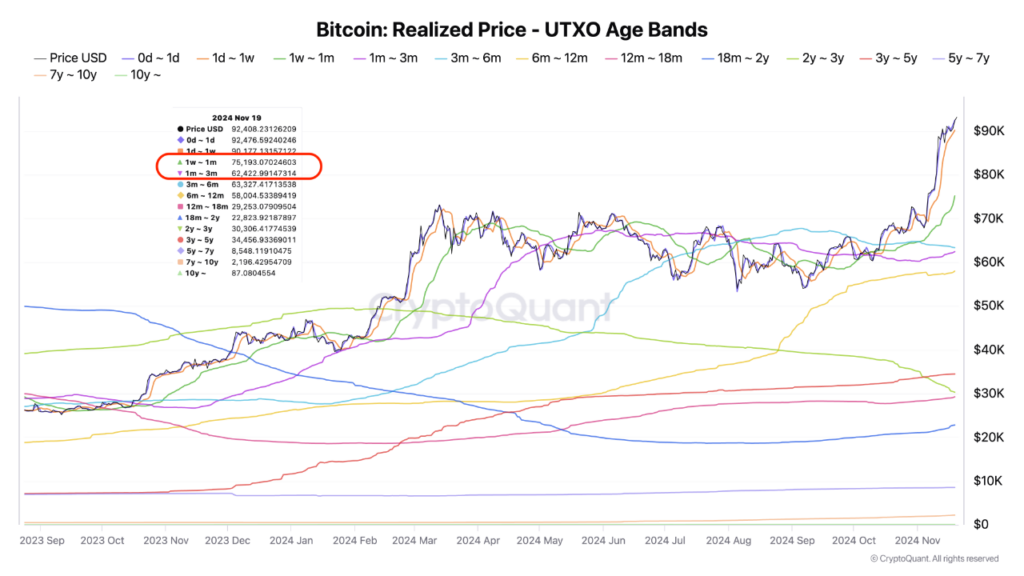

A recent examination by CryptoQuant analyst tugbachain illuminates a crucial element of Bitcoin market dynamics — the UTXO Realized Price Age Distribution.

This metric plays a vital part in comprehending the holding behaviors of various investor factions and the market’s reaction to price changes. The realized price, derived from the Realized Cap divided by the overall supply, is essential for pinpointing cost bases among longtime holders and recent purchasers.

As noted by tugbachain, the realized price thresholds for one-month and three-month durations frequently act as pivotal zones during corrections in a bull market.

These thresholds offer a perspective through which market sentiment, especially among smaller investors, can be examined, providing insights into the fundamental dynamics that motivate buying and selling activities.

Vital Support Levels For BTC

The analyst pinpoints two particular realized price points—$75,100 and $62,400—as significant cost bases for smaller investors. These points are important as they function as support areas during times of market turbulence.

tugbachain highlighted that historically, when Bitcoin’s price approaches these points, it often triggers purchasing reactions, underscoring the psychological and financial impact of these price levels on minor investors.

The CryptoQuant analyst further indicates that these support levels not only reveal the behaviors of smaller investors but also how their actions may be swayed, or even controlled, in a bullish market. During bullish cycles, it’s typical for market behaviors to exacerbate fear among smaller investors, often leading to panic selling.

tugbachain concluded with the observation:

Keeping a close watch on these levels can yield valuable insights for making well-informed investment choices.

Bitcoin Market Performance

In the meantime, Bitcoin has just achieved a new all-time high (ATH). To date, BTC’s apex stands at $94,784. However, at the moment of writing, the asset has slightly retreated from this peak with a current trading value of $94,523, though it remains up by 3.1% over the past day.

While the asset has experienced consistent upward momentum in recent weeks, CryptoQuant has shared an intriguing analysis on whether it is the right moment to sell or still hold BTC in a recent post on its official X account. Referencing major key metrics, CryptoQuant highlighted BTC’s MVRV ratio.

As per the on-chain data provider’s platform, historically, an MVRV ratio exceeding 3.7 indicates that Bitcoin has reached a market peak. Fortunately, the most recent data reveals BTC’s MVRV still remains below this threshold at a value of 2.62 as of November 19.

Bitcoin Hits ATH: Is It Time to Sell or Hold?

MVRV > 3.7 has historically marked market peaks.

Explore these 4 additional key metrics to improve understanding of market timing and make more informed decisions.

Details below

pic.twitter.com/ewavOhofBR

— CryptoQuant.com (@cryptoquant_com) November 19, 2024

Featured image generated with DALL-E, Chart from TradingView