“`html

Founders: Jesse Shrader and Anthony Potdevin

Date Established: March 2021

Headquarters Location: Nashville, TN

Employee Count: 10

Website: https://amboss.tech/

Public or Private? Private

Jesse Shrader believes that this year will be significant for the Lightning Network.

With Bitcoin’s valuation increasing and Tether (USDT) being integrated into Lightning, Shrader speculates that an increasing number of businesses and organizations will start recognizing Lightning as a viable payment solution in the coming year.

Amboss, the company he co-founded, is ready to assist in realizing this ambition.

“We aim to leverage Bitcoin as a payment method and utilize Lightning to achieve that,” Shrader shared with Bitcoin Magazine. “Our goal is to transform Lightning into a highly efficient, high-performance network.

With a comprehensive array of tools and services developed by Shrader and the Amboss team, they are prepared to onboard the next generation of institutional users to the globe’s largest permissionless payment network — particularly now that USDT operates on Lightning.

What Amboss Offers

Amboss primarily delivers intelligent payment infrastructure for digital transactions via the Lightning Network.

“We provide insights to individuals on how to enhance the efficiency of payments within the network,” remarked Shrader.

To achieve this goal, they offer a variety of products and services.

One of their standout offerings is Amboss Space, a Lightning Network explorer that employs machine learning to assist users in retrieving information on or connecting to any node within the network.

In addition to their analytics platform, Amboss supplies customers with tools and services to enhance liquidity on Lightning.

One such service is Magma Marketplace, which allows users to buy and sell liquidity on the Lightning Network. Through Magma, users can supply liquidity — while retaining custody of their bitcoin — for yield generation.

Another offering is Hydro, an extension of Magma. This software allows users to automate their liquidity purchases, thereby increasing the likelihood of successful payments.

(Additionally, Amboss provides Reflex, a compliance suite for business clients with AML (Anti-Money Laundering) reporting responsibilities.)

Amboss’ analytical software and tools are specifically designed for high-volume transactions, which are increasingly feasible on Lightning.

“We evaluate the capability of businesses to process payments through simulations,” Shrader clarified. “We assist businesses in understanding how much of the network they can truly access when attempting a payment.”

The Status Of Lightning

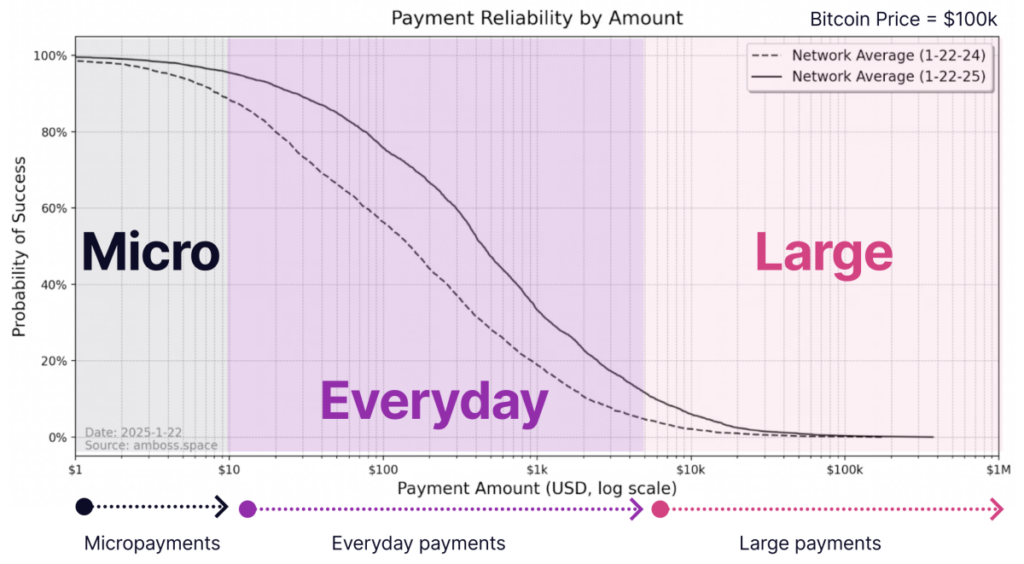

Shrader maintains an optimistic outlook regarding the expansion of Lightning. With each passing day, users are leveraging the network for transactions beyond just micropayments.

“We’ve been effectively managing everyday transactions on Lightning, which I define as payments ranging from $10 to $4,000,” stated Shrader. “We are working to further amplify the network’s capabilities, focusing on decentralization.”

Transactions exceeding $4,000 remain challenging to process. Shrader elaborated that additional capital is required to facilitate the processing of larger payments effectively.

Nonetheless, he also mentioned that the recent surge in bitcoin’s value has eased the processing of higher payments.

“What we’ve observed recently is an increase in the Bitcoin price, which has enhanced the capacity for settlement across all Lightning channels,” Shrader explained. “Since the channels are denominated in bitcoin, it’s akin to having larger pipes.”

While Shrader is hopeful about these larger pipes enabling greater throughput, he also believes that the introduction of Tether (USDT) to Lightning will draw even more liquidity into the network.

Tether (USDT) On Lightning

At the conclusion of last month, Lightning Labs announced its plans to introduce USDT to Bitcoin and the Lightning Network through the Taproot Assets protocol.

This upgrade facilitates Bitcoin service providers in seamlessly integrating and accepting USDT, which Shrader believes will be advantageous for Lightning.

“One undeniable fact is that Tether has found product market fit,” noted Shrader.

“Last year, it facilitated $10 trillion in transactions, surpassing Visa and MasterCard,” he continued.

“It is abundantly clear that there is a demand for U.S. dollars.”

Shrader, being practical, acknowledged that many staunch Bitcoin advocates have reservations about USDT operating on Bitcoin and Lightning, and he empathizes with them, as he values bitcoin’s sound money characteristics.

However, he believes that the advantages of incorporating USDT on Lightning significantly outweigh the disadvantages, especially since many still have yet to grasp what bitcoin is or accept its volatility.

“Many haven’t yet embraced the orange pill and recognized the benefits of bitcoin,” he clarified.

“I see bitcoin as a remarkable tool, and I aspire to share that with as many individuals as possible. Nevertheless, there are numerous issues with conventional payment systems, and Bitcoin provides a highly secure, auditable framework, which is something I want to offer to the world on a grand scale,” he further stated.

“While bitcoin’s price performance benefits me, many people fear volatility. If one possesses an asset with minimal volatility like USDT, now operating on very secure, trustless networks, that represents a significant advantage.”

The Challenge That USDT On Lightning Addresses

Shrader recounted how the first Bitcoin-related event hosted by MicroStrategy was titled “Lightning for Corporations.” During the event, businesses were encouraged to start compensating employees in bitcoin over Lightning — not fully grasping the challenges this decision would later present.

“What employers discovered was that the numerous 1099s required for employee submissions were a burden,” said Shrader. “Additionally, they faced considerable regulatory challenges as well.”

Shrader indicated that paying employees in USDT over Lightning not only alleviates accounting and regulatory burdens but also mitigates some of the counterparty risk connected with utilizing banks — a situation that Shrader is well aware of.

“Our payroll used to be processed through Silicon Valley Bank,” Shrader noted.

“At one instance, the payroll provider reached out to me requesting that I resend my mid-month payroll after I had already attempted to pay the staff. This incident resulted in a loss of half a month’s operational runway. All this occurred due to the insolvency of Silicon Valley Bank,” he concluded.

“Thus, if I can eliminate the counterparty risk inherent in the financial system by transitioning to Bitcoin and Lightning, it places me in a far better position.”

[Author’s note: Some counterparty risk still remains while utilizing USDT, as trust is required that Tether possesses actual U.S. dollars to support the tokenized versions it issues.]

The Risks

Shrader acknowledged certain risks associated with USDT on Bitcoin and Lightning, but did not appear overly concerned about them.

“There are some MEV risks when trading assets that are not a blockchain’s native asset on-chain,” noted Shrader. “However, Bitcoin already has Ordinal

“`inscriptions that generate alternative assets, thus that issue is already present.”

He also didn’t appear troubled when I mentioned the possibility of a Bitcoin fork leading to the USDT on one of the chains losing its value, nor did he perceive a significant threat from major economic entities in the Bitcoin network, such as Coinbase, which manages the bitcoin for the U.S. spot bitcoin ETFs, choosing to endorse a “Tether fork” of Bitcoin, which might also encompass other enhancements that could negatively impact Bitcoin in the future.

“Consensus within Bitcoin is not dictated by the custody of bitcoin, thus while a crucial enterprise like Coinbase may back diverse alterations or efforts, that doesn’t assure that protocol modifications would be implemented,” Shrader stated.

Rather than concentrating on the dangers linked with USDT on Bitcoin, Shrader is taking a different approach.

“What is likely more fascinating are the prospects that it unlocks where you possess real arbitrage capabilities on Bitcoin itself,” noted Shrader.

“Since each node can transact in both USDT and bitcoin, there is also the capability to swap between them inherently on Lightning, you can send bitcoin out of one Lightning channel and receive USDT in another of your Lightning channels,” he further explained.

“This can be as straightforward as creating a USDT invoice and settling it with BTC, instantly realigning holdings.”

2025: The Year Of Lightning

In Shrader’s concluding remarks from my conversation with him, he revealed two final critical reasons why 2025 will be known as the year of Lightning.

The first is that possessing bitcoin is no longer necessary to utilize Lightning.

“Up until this point, if individuals or businesses aimed to move to Lightning, they needed to possess bitcoin initially — and that’s a significant obstacle,” Shrader elaborated. (Shrader mentioned in reply to a subsequent inquiry that, outside of the U.S., acquiring USDT is relatively simple and commonplace.)

“The bitcoin-exclusive market for payment processing is minimal. However, this year we have eliminated that barrier, and consumers can transact with another asset — USDT. There is already a substantial market for that,” he added.

(Shrader also pointed out that while USDT is operating on Lightning networks, bitcoin still gains, as the USDT is converted into bitcoin as it moves through Lightning. He remarked that “all that bitcoin circulating on Lightning makes it more beneficial to operate a Lightning node.”)

Furthermore, Shrader observed that Lightning users will only incur a small fraction of what they were paying in transaction fees using conventional financial systems.

“We’re providing liquidity at less than 0.5%,” stated Shrader.

“As a user of extensive payment card networks, I’m paying 4% for all that payment processing, and the funds don’t arrive for days to weeks following the payment being made,” he continued.

“With Lightning, your payment processing costs diminish by nearly 10 times.”

Considering Shrader’s arguments, it’s tough to believe that 2025 won’t represent a significant period for Lightning.